Fast forward to 2140, when all 21 bitcoins are in circulation, what will happen to the network? Will miners continue to secure the network when the reward goes away?

The Bitcoin network was created around the principle of controlled supply —only a specific number of Bitcoins are minted each year until the total number of coins reaches 21 million.

The Bitcoin network consists of nodes run by individuals, miners, businesses, and developers.

Miners run nodes on the Bitcoin network that broadcast new blocks, verify and add them to the blockchain. Without miners, transactions would not get added to the blockchain.

Every ten minutes, the Bitcoin miner that solves the cryptographic puzzle receives a reward —a fixed number of Bitcoins for their work called the “block reward.” Currently, the “winning” miner receives 6.25 BTC. The block reward decreases every four years and it will take another 120 years before the last Bitcoin is mined because of the halving process.

Miners also receive a transaction fee, but transaction fees pale in comparison to block rewards. Transaction fees make up as little as 6.5% of a miner’s revenue.

Miners currently receive around 900 BTC (~$18 million) a day in block rewards, so securing the network is a big business.

In 2021, Bitcoin miners made more than $15 billion in revenue. But this year has been a different story with several headwinds miners has to deal with —declining prices, increasing energy costs, and increasing network difficulty.

Last year Bitcoin’s price soared and created a lot of exuberance in the Bitcoin mining community, with numerous mining companies embarking on a buying spree to get more mining equipment, largely financed by debt. This year has been the exact opposite. We’ve seen the price of Bitcoin decline and network difficulty rise. Both these factors have worsened mining economic conditions, reducing cash flow and putting miners in a tighter financial position —trying to make debt payments. At the same time, we’ve seen rising energy prices which made it even more challenging for miners and their operating margins. Also, they had to deal with other issues related to regulations and more scrutiny as it relates to ESG.

Shares of crypto miners Marathon Digital Holdings Inc., Riot Blockchain Inc., and Core Scientific Inc. are all down 55% or more this year. Publicly traded miners were forced to sell some of their mining rigs and Bitcoin holdings to avoid running out of cash —miners unloaded about 240,000 bitcoin at fire sale prices in May and June, according to Arcane Research.

To top it all, on September 8, the Biden administration released a report calling for industry standards to limit cryptocurrencies’ environmental footprint.

Still, Bitcoin miners are building more capacity regardless of all the problems they are facing and are at the forefront of innovative permutations of data centers, such as immersion cooling. Energy prices have probably been the biggest headwind they’ve had to deal with because of the rising prices of natural gas since the start of the war in Ukraine.

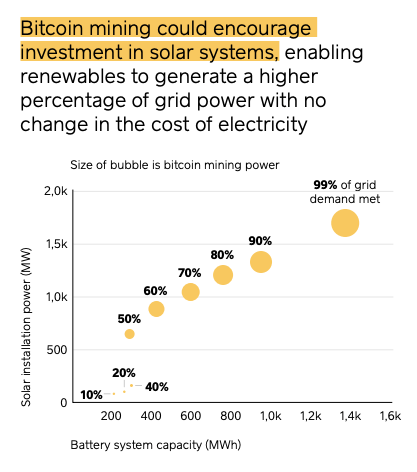

But rising energy prices may lead to cheaper electricity for miners —especially for those who are willing to adapt to the changing conditions.

Bitcoin mining is unique because it can be placed right at the source where energy is produced. This is one of the reasons we are seeing gas flaring becoming more popular as an energy source for Bitcoin mining. Miners are taking something that exists today which causes tons of methane emissions into the atmosphere, far worse than CO2, and using it for bitcoin mining. Bitcoin provides a natural economic incentive to use these emissions.

Others are putting to work the inefficiencies in electrical production and electrical grids and another unique feature of Bitcoin mining —that it can be turned off on demand at any point in time, without a negative impact on the users of the Bitcoin network. Unlike households, hospitals, and other industries, turning off bitcoin mining equipment is not a big problem. There are economic tradeoffs when turning off Bitcoin mining, but it does not hurt Bitcoin per se. For example, if you turn off the power to a factory that produces cars, then you’re not building cars anymore. Or if you turned off people’s heaters in the winter, the consequences would be dramatic.

In the case of Bitcoin mining, the real question for the miners is if turning off the mining equipment is an economically viable business. But there are a lot of conditions where it can be.

For example, in the US, and other places around the world miners are signing agreements with the energy providers, allowing the energy providers to turn off mining unilaterally during certain times when demand peaks. While miners use a lot of power they are completely predictable and stable —a miner always uses the same amount of power— so operators can plan their capacity. If they run into a shortage, because of spikes in electricity usage, mining operations are simply shut down. When mining is turned off miners lose revenue, but miners in these deals get preferential pricing for their energy so it’s an economic win for the miner, but also the community.

For gird operators, Bitcoin miners are godsent.

Bitcoin miners are unique energy buyers because they offer a highly flexible and easily interruptible load, provide a payout in a globally liquid cryptocurrency, and are location-independent. The only infrastructure they need, besides the mining equipment, is an internet connection.

These qualities constitute an extraordinary buyer of last resort that can be turned on or off at a moment’s notice anywhere in the world. Miners could enable energy providers to deploy substantially more solar and wind generation capacity. As a result, energy providers have a higher base load of their power usage, which allows them to have higher revenues and use the additional revenue to increase their capacity in renewable energy sources, without straining the network even more, as it’s already under strain.

Bitcoin mining consumes a lot of electricity, but steel, aluminum, gold, and zinc mining are by far a lot bigger energy hogs. Just about everything we use in our lives needs energy —electric vehicles, refrigerators, data centers, and other hallmarks of human progress.

The problem with Bitcoin is not how much energy it consumes, but how we view it —whether we consider it to be useful or not. Why is everyone so worried about an industry that consumes approximately 0.55 percent of global electricity production?

There is a group of people that are actively trying to create negative headlines about Bitcoin because they have competing cryptocurrencies or initiatives that would be bolstered if Bitcoin were criticized. Unfortunately, these headlines have influenced a large group of people that think Bitcoin is not environmentally friendly, so they don’t appreciate or take the time to understand the value that bitcoin can bring to them, their communities, and the world.

But if Bitcoin mining is handled with the right regulatory and commercial approach, it could lead to positive opportunities for governments and utilities, accelerating renewable energy growth.

Bitcoin mining has the potential to revolutionize the way we approach electricity generation by changing the energy industry’s incentive structure. This is what’s going to allow miners to stay in business and continue to secure the network even beyond 2140 when they are no longer awarded the block reward.

by Ilias Louis Hatzis is the founder and CEO of Kryptonio wallet.

Subscribe by email to join the other Fintech leaders who read our research daily to stay ahead of the curve. Check out our advisory services (how we pay for this free original research.