Last month in April, news went out that Yuga Labs, creators of the at-once mega-popular Bored Ape Yacht Club NFT, was undergoing restructuring. What followed was a round of layoffs as CEO Greg Solano — who uses the nickname Gargamel — bluntly stated that the company had “lost its way.”

That statement came just weeks after Bored and Hungry, a burger place that let customers order food with their cryptocurrency, shuttered its Long Beach location just two years after opening. Branded around the owner’s BAYC token, the ape-themed restaurant was touted as the first-ever “crypto fast food joint” — its closing bolstering the notion that the farcical BAYC-mania that gripped the country during the NFT boom of 2021 was finally on its last legs.

But when Bored and Hungry first opened, there were lines around the corner, signaling vindication to the apes, and propping up the sense that their investment into these NFTs, and in the community, were legit — both culturally and financially. To those on the outside, this was another example of just how dumb NFTs were becoming. During the NFT boom from 2021-2022, you couldn’t escape Yuga Labs’ ugly, anthropomorphized monkeys. Released in 2021 by Solano and Wylie Aronow (known as Gordon Goner), Bored Ape Yacht Club — a collection of 10,000 NFTs of edgy-looking primates — was one of the most successful web-3 Ethereum-based tokens to come out of the NFT frenzy.

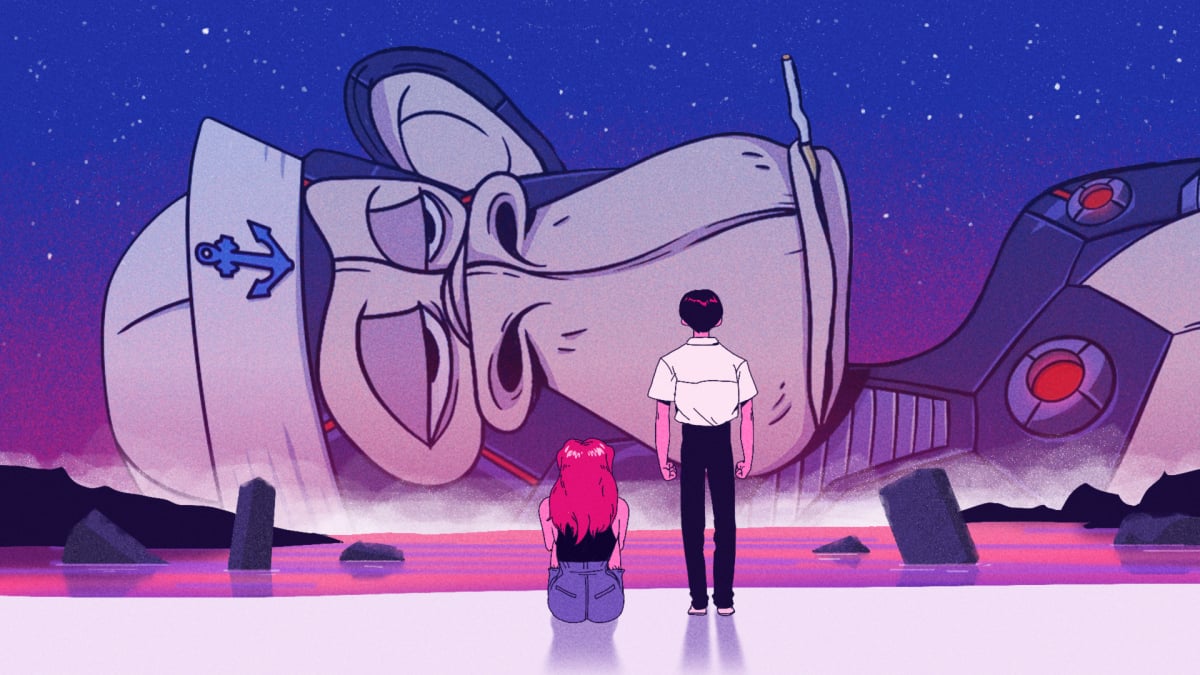

It was hawked on late-night shows, featured in giant ads in Times Square, and almost every celebrity in the mainstream was “buying one.” There were talks of movies and TV deals, with Seth Green at one point working on a series based around his personal Bored Ape. Yuga Labs even started teasing a huge videogame within the Metaverse called Otherside. For many, it was a weird time to be alive, like aliens had taken over the world — how could these ugly apes capture the zeitgeist so fast?

“Beyond the things they had control over, they had good timing,” said Dan Olson, a documentarian and Youtuber best known for his channel Folding Ideas. “The guys at Yuga are savvy marketers with real social connections that let them get their product in front of real celebrities and other behind-the-scenes folks…and used that access with their initial crypto-audience success to further astroturf BAYC as a thing that normal people thought they needed to care about.”

It’s hard to overstate just how popular these little apes had become, but they were mainstream — a status symbol for the rich and the blueprint for success in the burgeoning NFT marketplace. Traditional buyers were buying apes for thousands, believing them to be legitimate forms of financial investment. At one point, Yuga Labs had managed to raise $450M in 2022, leading to a company evaluation of $4bn. To some, BAYC was the coolest name in tech.

Yuga Labs and its investors were seemingly on top of the world — until they weren’t. By 2023, the NFT bubble had burst, which negatively affected the perception of the industry as a speculative and volatile market. The downfall was marked by a steep decline in sales and a loss of public interest. As the hype subsided, many investors found themselves holding assets that had plummeted in value, leading to widespread financial losses and even a class action lawsuit against Yuga. The planned movies were shelved, the massive Metaverse game has long been teased but is still unreleased, and the Seth Green show legally can’t be made.

This fall was further compounded by regulatory scrutiny and skepticism from TradFi sectors, which questioned the sustainability and utility of NFTs beyond their initial novelty. Consequently, BAYC’s floor price on OpenSea hit an all-time low — down 90 percent from its all-time high.

That might feel like the last remnants of this phenomenon turning to dust, but you shouldn’t dance on the graves of these apes just yet.

How Bored Apes blew up in the first place

To be clear, the art of Bored Ape Yacht Club was never the selling point. Not that it wasn’t important, but nobody had ever said that these apes made great art pieces.

“It’s immediately identifiable and polished enough that it pops even in contrast to other NFT projects that are doing the same thing,” Olson told Mashable. “BAYC, Humanz, and other ‘success stories’ do at least have artwork that looks like someone at some point spent some meaningful investment of their finite mortal lifespan working on [it], which does manage to stand out in contrast to imitators that were literally assembled in an afternoon.”

In his documentary Line Goes Up — The Problem with NFTs, Olson describes an average NFT buyer as flush with money, lacking business acumen, socially isolated, and chronically online. A primarily male audience that’s equivalent to housewives who fall victim to Multi-Level Marketing schemes — groups of people who spend a lot of time alone at home and who feel marginalized from traditional avenues of wealth.

The culture of buying digital art has also changed significantly in the past decade. In the early 2010s, niche corners of the internet saw 4chan and Reddit users buying Pepe the Frog memes. For example, Feels Good Man had a totally wild scene from 2020 showing a man spending $39,000 on a Homer Simpson Pepe ’cause he “thought it was funny.”

The initial craze started when digital artist Beeple sold his NFT collection during a Christie Auction House sale for $69 million. However, many of the newsworthy NFT purchases were of internet memes sold by the minor internet celebrities immortalized in them. “Overly Attached Girlfriend,” “Disaster Girl,” and “Nyan Cat” sold for hundreds of thousands of dollars.

#Bored #Apes #investigation

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cryptoinfonet.com/nft-news/are-bored-apes-still-relevant-in-2024-a-deep-dive/