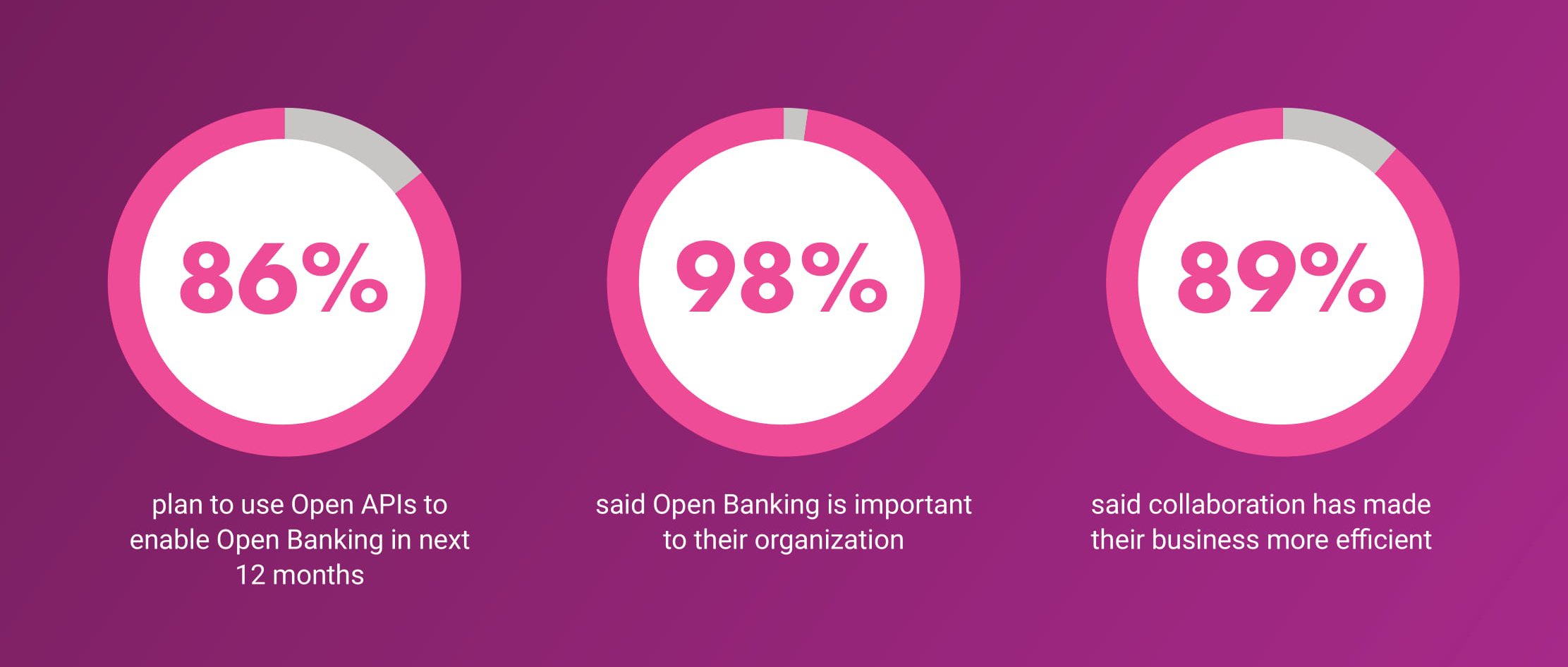

A survey launched this week by Finastra revealed that close to 100% of financial institutions in Singapore and Hong Kong think Open Banking is important, with two thirds in Singapore calling it a “must have”. Open Banking has not only taken root, banks are already seeing the green shoots of progress. In fact, Finastra’s survey found that 95% of banks in Hong Kong have already found collaboration to be a key driver of success, while nine out of 10 in Singapore said it has already made their business more efficient.

image credit: Finastra

So what does this tell us? In short, it highlights recognition that banks cannot provide the digital services or experiences that customers want operating from within walled gardens will not allow them to. Incumbents are facing a steady pipeline of new digital players coming to market across the region, so they are looking towards fintech collaboration as a way to compete.

These are positive findings, but the statistics do not mean the work is done. Opening up is an ongoing process and those who do it better will be the ones that thrive, especially as the move towards digital services is being accelerated by the COVID-19 crisis. For banks and their customers to benefit from Open Banking’s true potential, they must open up their culture and their vision, as well as their technology.

Open culture

Openness and collaboration is a shift from the traditional norm for many banks, and something which may be more willingly embraced by some parts of the business than others. Organizations, therefore, need to build openness into their DNA. Siloes should be broken down so that teams across disciplines and functions can work together towards the same goal. Divergent thinking should be rewarded, and new ideas pursued and incubated through practices like 90-day sprints. If they fail, it’s ok – fail fast and move on to the next thing.

We are now seeing innovation sprints and customer-specific hackathons that encourage participation from the entire ecosystem: customers, suppliers, partners and developers. This outside-in approach generates wider opportunities such as partnerships, joint propositions, co-development, and an ecosystem mindset, in which the goal is sustained, combined success, not success in isolation.

Support for this type of working needs to come from the top and have visible commitment from the C-suite. Successfully creating an open culture leads to a collaborative mindset, which, in turn, creates curiosity and bravery to look outside for innovation and advantage.

Open Vision

An extension of developing an open culture is vision.

Millennials and Generation Z are important market segments for incumbent banks, particularly because they are the most likely to switch to a digital challenger. It is therefore important to understand that these populations hold different values to the generations before them, placing greater importance on factors like a purpose, ethics and sustainability.

It’s not enough to be a follower in the market and try to replicate others’ success in product lines or approaches; banks must seek out new ways to innovate that have a wider positive social and economic impact.

There is no trade-off between individual success and global sustainability. And banks can play both partner and collaborator in this open ecosystem. The majority of innovation happens outside of an organization’s walls, so leveraging external innovation found within the wider network can bring about not only new products and services, but new partnerships that, together, can address the wider societal agenda and drive powerful change.

Open Technology

Open technology has the power to bring everything together. Open application programming interfaces (APIs) allow banks to plug third party solutions into their systems with ease, enabling them to react to customer needs by bringing in new services or functionality quickly. Over the next 12 months, around 90% of financial institutions in both Hong Kong and Singapore say they plan to use open APIs to enable Open Banking in this way.

Banking collaboration will also benefit from the trend towards platformification. We have already seen business models transform in areas like transport and ecommerce, where platforms like Gojek and Alibaba connect service providers with consumers. Finastra is advancing this trend in financial services with FusionFabric.Cloud, our open developer platform and marketplace. Developers can integrate existing apps or develop new ones within the platform, whilst financial institutions are able to explore the apps available and find the innovation they are looking for. By championing innovation through collaboration, platforms like this will change the way banking software is built and distributed.

There is unprecedented opportunity to bring about change in financial services through digital transformation and new ways of working. The results of our survey show that this is already underway, but it is up to financial institutions to decide how far they will go. There will be those that embrace openness fully – culture, vision and technology – and those that will not. Those that do not ignore open culture and vision may never reap the full potential of Open Banking, for themselves or their customers.