- This week, the 10-year yield has risen by over 30 basis points (bps).

- The yen is trading very close to the significant 150 per dollar mark.

- Futures are now pricing in less than a one-in-three chance of another rate hike this year.

On Friday, the dollar was on the verge of reaching the closely monitored 150 level, painting a bullish picture for the USD/JPY price analysis. The dollar got support from a rapid increase in the US 10-year Treasury yield. It briefly touched 5% overnight, a level not seen since 2007.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Notably, the 10-year yield, currently at 4.9456%, has risen by over 30 basis points (bps) this week. This surge is attributed to growing expectations that the Fed will hold rates high for longer. Moreover, there are concerns about the US fiscal situation.

Consequently, there has been a lot of downward pressure on the yen. The exchange rate was 149.85 per dollar, close to the 150 per dollar mark. Some traders speculated that this level might trigger intervention by Japanese authorities, as it did last year.

Elsewhere, Powell emphasized that the US economy’s strength and persistent tight labor markets might necessitate tighter borrowing conditions. However, he noted that rising market interest rates could reduce the need for the central bank to take action.

As Powell spoke, investors increasingly placed their bets on the idea that the Federal Reserve has completed interest rate hikes. Meanwhile, futures are now pricing less than a one-in-three chance of another rate hike this year. This is down from around 40% before his speech.

USD/JPY key events today

Markets do not expect any key economic releases today, which might lead to a quiet trading session for USD/JPY.

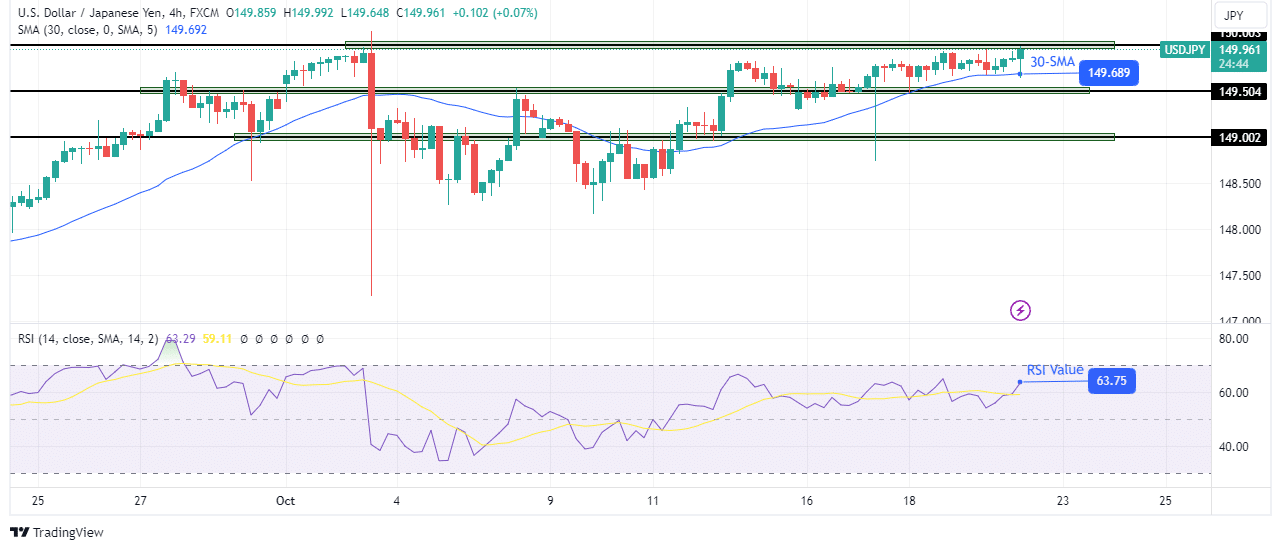

USD/JPY technical price analysis: Bulls lock horns with crucial 150.00 resistance level.

The USD/JPY bulls are retesting the key 150.00 resistance level. However, the bullish move weakened as the price got closer to the resistance. Bulls have stayed close to the 30-SMA while the RSI moves sideways in bullish territory. This indicates a weakening trend.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The last time the price touched the 150.00 resistance, bears emerged with an engulfing candle to reverse the trend. Therefore, this might happen again, especially since bulls have weakened. If bears resurface, the price will break below the 30-SMA and the 149.50 support level. Such a move would then allow bears to retest the 149.00 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-price-analysis-inching-closer-to-pivotal-150-yen-level/