- Markets are more optimistic that the BoJ will end negative rates in March.

- Most economists expect the Bank of Japan to end negative interest rates in April.

- US job openings in January declined, indicating weakness in the labor market.

The USD/JPY outlook points south due to mounting expectations that the Bank of Japan will hike interest rates in March. Markets are optimistic that conditions are lining up for the Bank of Japan to end negative rates at this month’s meeting. Notably, there is a big chance the upcoming annual wage negotiations will lead to pay increases. As a result, policymakers are more willing to consider rate hikes.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Meanwhile, most economists expect the central bank to end negative interest rates in April. Such a move would finally support the yen, which has weakened due to interest rate differentials. The BoJ remained dovish when most major central banks were hiking rates to tame inflation. As a result, Japan’s currency weakened significantly, constantly needing intervention for support. However, the narrative is slowly shifting. While other central banks, like the Fed, are considering cuts, the BoJ is on the verge of starting its hiking cycle.

Meanwhile, the dollar weakened on growing confidence that the Fed would cut interest rates. Fed Chair Jerome Powell was slightly dovish when he said that rate cuts would be appropriate later in the year.

Elsewhere, data from the US revealed a decline in job openings in January, indicating weakness in the labor market. A weaker labor market reduces the chance that inflation will flare up, allowing the Fed to consider rate cuts.

USD/JPY key events today

- US initial jobless claims

- Powell’s testimony to Congress

USD/JPY technical outlook: Price plummets following breakout from consolidation

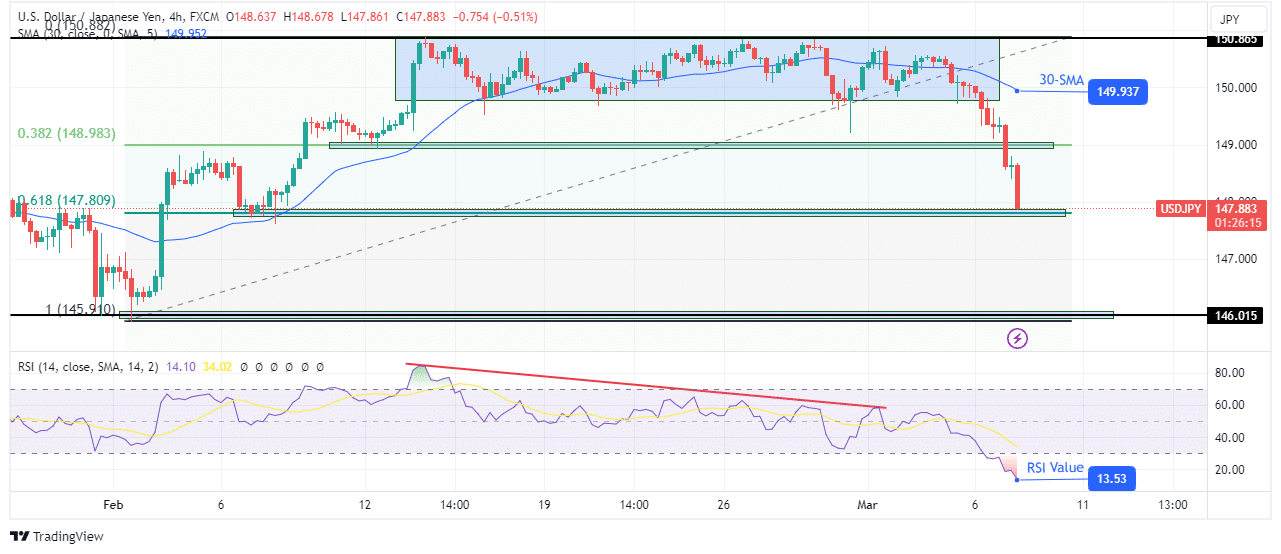

On the technical side, USD/JPY has fallen sharply after breaking out of consolidation. As a result, the price has hit its targets at the 0.382 and 0.618 Fib retracement levels. The price now sits well below the 30-SMA, with the RSI deep in the oversold region. Therefore, the bearish bias is strong.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

However, the price might need to pause after such a steep decline before continuing lower. A pullback could retest the 30-SMA as resistance before bouncing lower. Still, the price will likely soon break below the 0.618 Fib. In such a case, it might decline further to retest the 146.01 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/03/07/usd-jpy-outlook-yen-soars-on-boj-rate-hike-speculation/