Rising interest rates are fattening banks profits with Bank of America seeing a jump of 24% in its net interest income to $14 billion. That’s the spread or difference between what they charge borrowers in interest, and give to savers.

JP Morgan surprised analysts with a 51% jump in net interest incomes, bringing in $57 billion and $10 billion in profits for the quarter overall.

Citigroup saw its net interest income jump 18% to $12.6 billion, with overall profits of $3.5 billion.

Wells Fargo saw its net interest income jump 36% to $12.1 billion, making an overall profit of $3.5 billion.

Goldman Sachs, which is more focused on investment banking, saw its net interest income rise 31%, but only to $2 billion, on an overall net revenue of $12 billion for the quarter, and $37 billion year to date.

Overall, America’s biggest banks have made $97 billion on just interest payments this summer, up significantly in a year that has seen interest rates spike up and up.

The bank that has benefited the most, JP Morgan, had its CEO Jamie Dimon egg on the Fed chair Jerome Powell by stating back in January:

“My view is a pretty good chance there will be more than four [rate hikes]. It could be six or seven.”

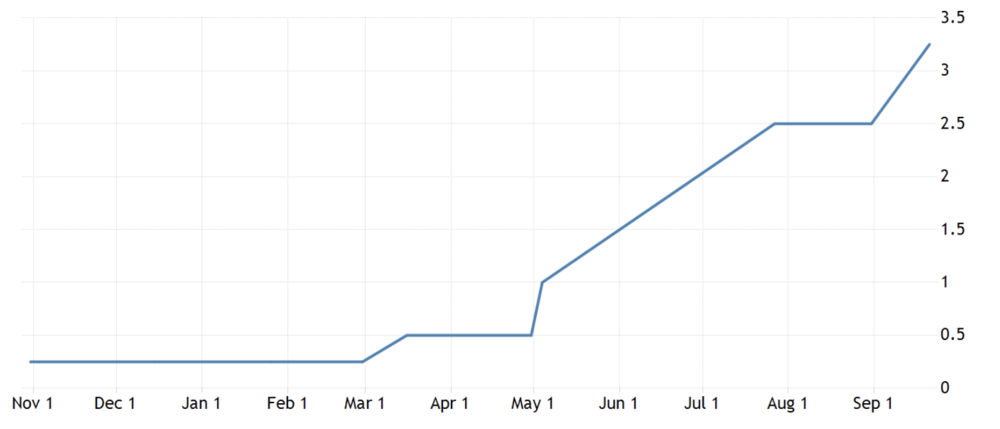

Believe it or not, that’s exactly what happened, with interest rates going vertical soon after and more importantly, with interest rates hiked six times so far. A seventh hike is expected in November.

The vast majority of the board of the Fed committee that sets interest rates are representatives of commercial banks, like JP Morgan.

They hold a vote on the matter, raising questions of a significant conflict of interest as banks would like such interest rates to be as high as possible.

That’s because interest rates are how they make profits from lending. Some of it are meant to go to savers, but only a small amount has trickled down so far with banks pocketing most of the earnings from interest rate hikes.

Some suggest such interest rises will continue to 5%, which means the American public will pay banks as much as $200 billion a quarter on money they print from nothing, and that’s just for profits, making it the biggest private tax on the public.

The expected interest rate hike in two weeks, in addition, will be the most puzzling so far as inflation has been on a downtrend since June, and gas has crashed.

Yet markets still think they will have another crisis hike of 0.75%, raising further this private tax on the public, and the costs from credit card borrowing to business borrowing.

Other ways of potentially addressing inflation have not so far been considered. That includes raising capital requirements for banks, putting quotas on lending, or many other tools that don’t involve fattening banks profits.

But it is bankers that get to vote on what to do, and of course they’re voting for profits and a hike on the private tax by the commercial money printers.