Tag: emergence

Oil rally wanes, gold edges higher

What I learned from the Soil Carbon Challenge

This nonprofit organization, the Soil Carbon Coalition, was inspired in part by Allan Yeomans's 2005 book, Priority One: Together we can beat global warming, which Abe Collins and I had been reading. Yeomans suggested that increased soil carbon could make a difference for climate. In 2007 Joel Brown of the NRCS gave a talk in Albuquerque in which he said that according to the published literature, good management by land stewards did not result in soil carbon increase, and that it was too difficult to measure anyhow. With that, I resolved to begin measuring soil carbon change on ranches and farms that were consciously aiming at greater soil health.

I had done plenty of reporting on land stewardship and plenty of rangeland monitoring. I studied research-grade, repeatable soil sampling and analysis methods and combined them with some rangeland transect methods I had learned from Charley Orchard of Land EKG. In 2011 I bought an old schoolbus, made it into living quarters, and for most of the next decade I traveled North America slowly, putting in hundreds of baseline transects and carbon measuring sites mainly on ranching operations that had some association with holistic planned grazing. I resampled over a hundred at intervals of 3-8 years. The question I was asking was: Where, when, and with whose management, was soil carbon changing over intervals of several years? I called this project the Soil Carbon Challenge.

A lot of data accumulated. What did it show, what did it mean?

In order for there to be meaning or learning, there needs to be a context, a purpose. My purpose in embarking on this project, the question behind the question, was 1) to see if measuring soil carbon change over time could provide relevant feedback or guidance to land stewards who were interested in soil health, and 2) to see what soil carbon change, if it were significant and widespread, might imply for climate policy that was narrowly focused on more technical rather than biological solutions. Everywhere I traveled, water was the main issue for people, whether it was floods or drought. I measured soil carbon because it was central to the flow of sunlight energy through soils, critically influential for soil function, and easier to measure change than measuring soil water. At no point did I advocate for the commodification of soil carbon into credit or offset schemes.

The soil carbon change data that I got on resampling baseline plots was noisy and variable, especially in the top layers (0-10 cm depth). There were some pockets of consistent change, such as a group of graziers in southeast Saskatchewan showing substantial increases, even down to the 40 cm depth that I often sampled to. But the majority of change data that I collected did not offer solid support to the hypothesis that holistic planned grazing or no-till, for example, in a few years would increase soil carbon in every circumstance or locale, or that soil carbon would faithfully reflect changes in forage production, soil cover, or diversity.

Many of the people on whose ranches I sampled did not know what to do with the data or results, or simply interpreted the data as a judgment: a high or increasing level of soil carbon indicated good management, and low or decreasing was bad. Measured soil carbon change, especially at one or two points, was not meaningful, useful, or in some cases timely feedback, and may not have contributed much to their learning and decision making as I had hoped it might. For the most part the ranches I sampled on were widely scattered, and there was little interaction between them or mutual support, little opportunity for discussion or the development of a shared intelligence or a community of practice. The "competition" framing or context that I suggested in 2010 did not help. The effort tended toward an information pipeline rather than a platform that enabled people to take responsibility for their own learning. For a while I posted the data on this website, but that did little to foster discussion or interpretation, or encourage people to add learning to judgment.

Nor did the noisiness and variability of the data I collected offer solid support for soil carbon increase as a strategy for reducing atmospheric carbon dioxide and easing climate change--a strategy that was growing increasingly popular, with many people and organizations advocating for it, and which has resulted in new programs, policies, and markets to try and reward ranchers and farmers for increases (usually modeled rather than measured) in soil carbon.

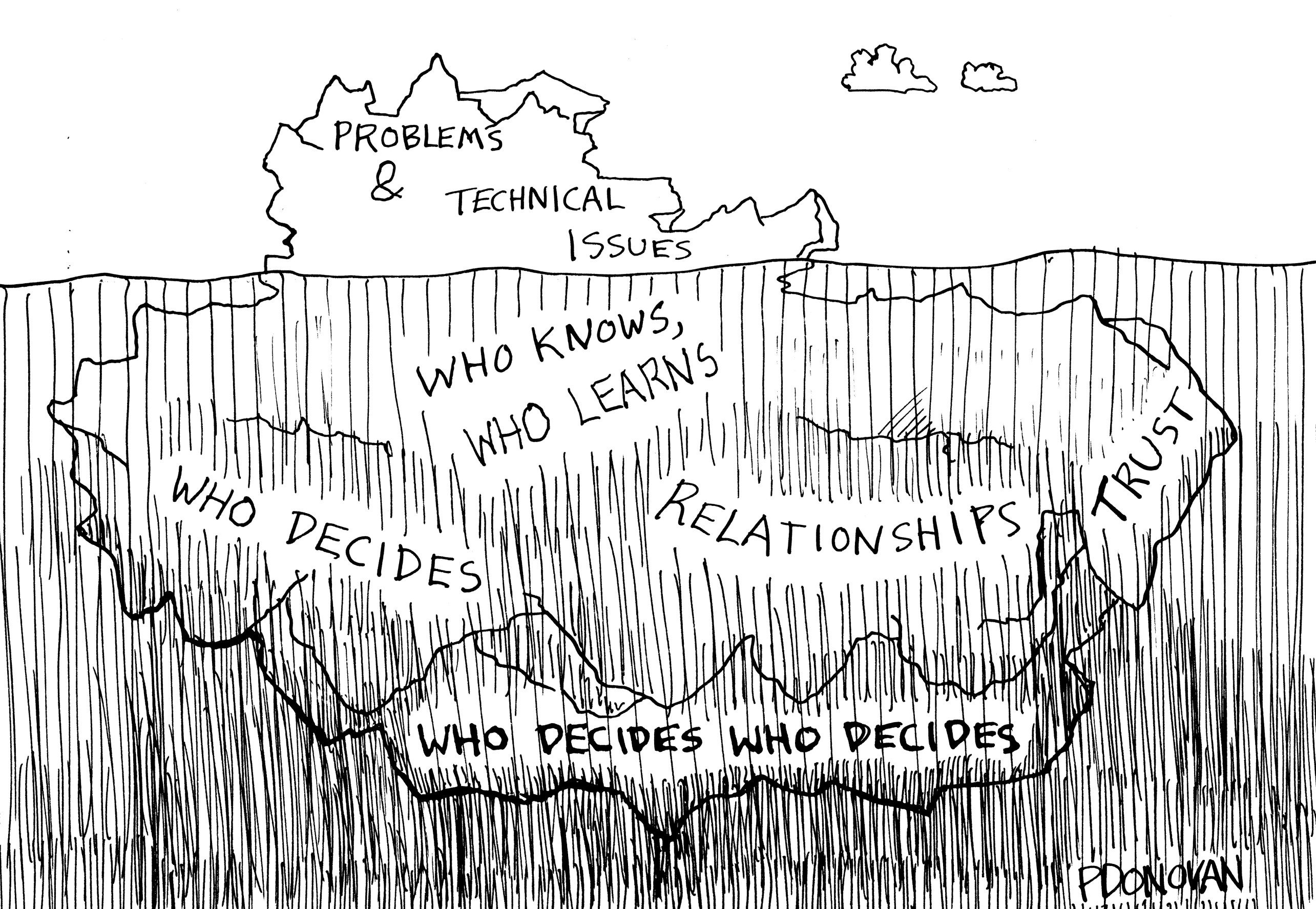

So the Soil Carbon Challenge was at least a partial failure, in that it took aim at the problems and technical issues at the tip of the iceberg, and fostered judgment more than learning and new questions. I did take some lessons from this decade of travel, conversations, workshops, transects and soil sampling, sample processing and analysis, data entry, and associated reading and research into the history of the discovery of the carbon cycle, water cycle, and climate issues. Some of these lessons resonated with what I had learned, and then forgotten, in the trainings I took in holistic management and consensus building in the 1990s.

Like many attempts at "solutioneering" the problems of soil health and climate, the Soil Carbon Challenge focused on the tip or immediately visible portion of the "iceberg," and was not designed around the center of gravity: human or people issues, paradigms and power, relationships and trust.

What I learned (or saw from a new perspective, or rediscovered):

1. Energy is a context for all life

and energy flow, from sunlight, is a pattern that connects all knowledge and activity. However, energy is an abstraction: we can only know it, sense it, or measure it by its results, the work it does, the changes it creates. Our planet is an open system largely run by sunlight energy. As I wrote here, "We are riding an enormous, incredibly complex, fractal eddying flow of sunlight energy used in many ways by interrelated communities of self-motivated living organisms whose metabolisms, behaviors, and relationships are increasingly influenced by our own." And, as Selman Waksman, Aldo Leopold, and others realized, soil is a major hub for sunlight energy flow.

2. Learning networks

are a context for the emergence of a community of practice, of a shared intelligence. These are social groupings where people share what they are learning, and are able to witness or share in the learning of others, and so gain an enriched perspective, with dialogue. It helps if these are participatory, ongoing, local, and include evidence as well as new questions. Some degree if trust is needed in order for judgments to ripen into learning, and listening is a key ingredient. Over the past year or so I have developed soilhealth.app as a way of supporting learning networks around soil health and sunlight energy flow, and am seeking partnerships on that project.

It's not that measuring soil carbon is a bad or useless thing, but a good context or purpose is needed. We learn from differences. Here are 4 suggestions for learning, about different kinds of differences, all of which may surprise and spark your curiosity:

- To learn more about flows of sunlight energy, get an infrared heat gun ($15 and up) that measures or estimates radiant heat, and begin playing with it, pointing it at various stages of sky, soil, plants, and other surfaces and objects.

- Use infiltration rings to gauge how well water infiltrates into various soil surfaces. Remember that soil moisture held in soil pores represents a huge capture of free sunlight energy.

- Record change over time in some kind of indicator, quantity, or measurement you are interested in or curious about. Precipitation or infiltration for example. For ranchers, animal days of grazing on a particular pasture for example, or pounds of gain. Repeatable observations need some kind of recording system.

- Share your observations and learning with others in a learning network. As two eyes helps you see depth, so do multiple perspectives enrich and deepen your learning.

The relationship between retail services and identified goods on trademark applications

China Takes Next Steps in Retiring Physical Cash

Letter From Shanghai No 811 – Digital RMB only This week we feature another guest post from John Browning, founding partner of Hong Kong commodity and financial futures broker BANDS Financial. It’s the latest in his ongoing reporting on the development by the People’s Bank of China (PBOC) of e-CNY, its digital yuan*. We last wrote about it here. On Sunday (01-09-2022), I read a long article published on Yahoo Finance discussing the outlook for the use of cash, which seemed not to mention China at all in its discussion of the emergence of central bank digital currencies. I don’t

The post China Takes Next Steps in Retiring Physical Cash first appeared on FinTech Rising.

Hacking Esports and Gaming with Brand Activations

This article outlines the neuroscience behind effective activations that inspire customer action(s) and/or loyalty in the gaming community. Here is what you should know: The estimated 474 million esports fans are a subset of 2.9 billion people who spent an estimated $175.8 billion on games in 2021. Effective activations ‘hack’ cognitive processes in the brain to influence positive customer actions. AT&T and Wasserman executed a branded experience on Twitch that demonstrates the key pillars and rules […]

The post Hacking Esports and Gaming with Brand Activations appeared first on Esports Group.

Fuel for Thought: Auto demand levels remain depressed on chip famine alongside race between vaccine & variants; 2022 Light Vehicle demand set to post...

Automotive Monthly Newsletter and Podcast

Auto demand levels remain depressed on chip famine alongside race

between vaccine & variants; 2022 Light Vehicle demand set to

post 82.4 million (+3.7%)

Semiconductor shortages and wider supply chain disruptions expected to linger until 2023

IHS Markit forecasts new light vehicle sales of nearly 82.4 million globally in 2022, up 3.7%. IHS Markit projects the industry will finish out 2021 with nearly 79.4 million light vehicles sold, and industry demand levels will continue to be restrained next year as the semiconductor supply chain remains challenged. Tentative demand recovery will continue across most regions, assuming the ongoing availability of effective vaccines and apart from any major impacts from the Omicron variant.

Full year 2021 sales are expected to be up just 2.9% from the levels achieved in 2020. IHS Markit remains cautious on recovery prospects, as the global auto industry grapples with this "perfect storm" of unprecedented circumstances. Depressed vehicle output levels are expected to impact vehicle lead times for some time, pressuring depleted inventories and delaying fulfillment of prevailing order levels.

"The path of the pandemic remains an important driver of the 2022 auto demand cycle, especially the "race" between vaccine and variants. Concerns remain as winter arrives for Northern Hemisphere nations, and the emergence of the Omicron variant represents a worrying development," said Colin Couchman, executive director, global light vehicle forecasting, IHS Markit.

Most regions face limited recovery prospects on supply chain challenges and potential further COVID-19 flare-ups

The European auto industry looks set for a bleak mid-winter as widening virus concerns combine with ongoing supply chain woes, with concerns for German-based production. The 2021 Western and Central European demand forecast foresees 13.9 million units, just scraping into growth territory, up 0.2% y/y. 2022 demand is set at 15.0m units (+7.8%), according to IHS Markit.

"European car consumers are expected to hunker down for a second winter of COVID-19, but the new year might struggle to deliver meaningful improvement to new car sales levels," said Couchman.

Looking at 2022, US sales volumes are expected to reach nearly 15.5 million units, up an estimated 2.6% from the projected 2021 level of approximately 15.1 million units. "For 2022, the pace of sales is expected to quicken in the second half of the year. Given current inventory conditions, it's difficult to project significant demand recovery in the first half of 2022. But we expect to exit 2022 with a pace of sales more recognizable to pre-COVID levels, setting the stage for better volume outlooks into 2023 and 2024," according to Chris Hopson, manager, North American light vehicle sales forecast, IHS Markit.

In Mainland China—for 2021, IHS Markit analysts foresee the market down by 1% y/y, to 23.4 million units, as supply chain shortages choke off market growth. Near-term risks are balanced, and 2022 is currently set at 24.2 million (+3.3% y/y), with more meaningful recovery expected for 2023—back above pre-crisis levels to 26.9 million, up by 11.3% y/y.

Production expected to recover slowly through 2022

Global light vehicle production in 2021 is expected to finish at 75.5 million units, a paltry 1.2% improvement over 2020 levels.

For 2022, IHS Markit forecasts a rebound in light vehicle production of 9.0 percent, to 82.3 million units. The outlook will continue to be characterized by the availability of automotive-grade chips, at least until 2023. The balance of incremental capacity gains within the semiconductor sector, heightened 'chips-per-vehicle' requirements and robust non-automotive chip demand all feature in this assessment.

"Overall, while manufacturing operations in most regions are expected to improve, capacity constraints within the semiconductor supply chain remain the single most influential feature of the forecast. As the semiconductor tide recedes, will this expose further risks to the auto recovery? Threats elsewhere within the supply chain could become more apparent as chip supplies improve, notably, logistics, worker related issues, and key raw materials shortages," said Mark Fulthorpe, executive director of light vehicle production forecasts at IHS Markit.

In Greater China, IHS Markit forecasts modest growth for 2022 of 1.6 percent, to 24.3 million units. Europe is expected to produce 18.5 million units in 2022, up from an estimated 15.7 million this year. For the North American region, momentum is improving heading into 2022, though our outlook based on current forecasts remains at nearly 15.2 million units; this reflects growth of just over 2.2 million units year over year. A more normalized supply chain is forecast to support vehicle output levels of 90.6 million units for 2023, a further 10% y/y increase, and comfortably above pre-pandemic output levels of 2019.

Electrification remains a growing dynamic—2021 has seen an "arms race" of ambition as OEMs declare electrification targets for coming 5-15 years

Recent months have witnessed an unprecedented flurry of OEM announcements on electrification ambitions for the coming 5-15 years. Electric vehicles are fast evolving from a compliance side hustle into fully fledged core offerings for many OEMs. At COP26 earlier this year, policymakers and regulators also shared their visions for a greener future, including the US, the EU and the UK. Transformational change is firmly on the agenda and making sense of this arms race of ambition represents an ongoing challenge.

Dive Deeper:

Webinar | Supply Chain Crisis - What's Ahead for 2022. Watch Now

Accelerate your data innovation with IHS Markit's Data Lake. Learn more

What is Web 3.0 and Why it Has Insane Potential

Web 3.0 is a buzzword that has been floating around the depths of the internet in recent years and is a term that is often used synonymously with Blockchain technology. I remember when I had first started seeing and hearing, “Web 3.0,” tossed around in various publications and articles, I didn’t fully grasp or comprehend […]

The post What is Web 3.0 and Why it Has Insane Potential appeared first on Coin Bureau.

Social Experience Platform Topia Launches Verified NFTs, Profiles, and Receives Follow-on Investment from Thirty Five Ventures

Topia, the leading platform for creating social experiences with decentralized spatial chat inside fully customizable virtual worlds, announced feature launches and key new investment. Kevin Durant and Rich Kleiman's Thirty Five Ventures join Topia investors Alexis Ohanians' Seven Seven Six and Bonfire Ventures.

As an industry first, Topia has expanded its creator ecosystem with the launch of their verified NFT system. With this system, ERC-721 NFT owners can verify and place their on-chain assets inside Topia worlds and collaboratively create NFT galleries. Topia's peer-to-peer webrtc streams are decentralized, allowing secure end-to-end encrypted browser-based chat. In addition to the new verified NFT system, Topia also introduced member profiles, enabling unique usernames and greater relationship building within Topia worlds.

With the new gallery feature, NFTs can be displayed publicly in a Topia world where friends, family, colleagues, and the general public can be invited to view and discuss them. Topia is maintaining a publicly available verified NFT gallery in topia.io/nft and holding a public launch event with a series of talks on December 14 in topia.io/pixel.

“The emergence of NFTs represents a major milestone for Web3, decentralized technology, and the interoperable creator economy. Until now, it has been challenging to showcase NFTs in real-time social experiences online. We wanted to replicate the ability to socialize around art, as you would in our home, at a gallery, or museum,” said Topia CEO and co-founder Daniel Liebeskind. “Decentralized databases are great for creators, who get to add assets to a shared public backend and leave it up to platforms like Topia to build interoperable frontends that increase the value of their creations. Since founding Topia two years ago, we've been on a mission to empower the creation of social experiences for real-time connection and play. Verified NFTs and owner profiles represent our commitment to the growing interoperable metaverse and enable Topia world builders to create hybrid on-chain, off-chain social experiences that showcase NFTs and are accessible to everyone.”

How Verified NFTs work in Topia -- A new menu option allows Topia users to connect Ethereum accounts to their Topia account. All of the user's ERC-721 NFTs will be populated into their asset library and can be placed within Topia's worlds. Similar to original art in the physical world, an NFT can only exist in one place at a time across the entire Topia universe. Hovering over a placed NFT will reveal a “verified NFT” badge that confirms its on-chain identity and its owner's Topia profile. Placed NFTs can also be added to a user's profile to highlight worlds.About Topia

Since launching in April of 2020, Topia has grown to see hundreds of user-hosted events every week. Topia's scalable architecture can handle events ranging from a few friends to thousands of concurrent guests coming together. The free-to-use platform has co-hosted virtual Burning Man twice and attracted a diverse range of users from families, students, and schools, to companies, music and arts festivals, and Fortune 500 companies. Large companies and confluencers have been hiring agencies to build out branded Topia worlds for their employees and fans to foster creativity and collaboration.

topia.ioThe Green DeFi platform Energyfi is about to launched on mainnet

Quick Take

- Energyfi is designing green and cost-effective Decentralized Finance by providing a comprehensive set of DeFi features on Energy Web, Avax, Near and Bsc, all while accelerating their adoption.

- Energyfi raised $200,000.00 in a private token sale.

- The Green DeFi platform Energyfi is about to be launched on mainnet with the release of EnergyPad, it's ILO platform.

The Green DeFi platform Energyfi is about to launched on mainnet

The Green DeFi platform Energyfi is about to launched on mainnet

Decentralized finance in brief

Decentralized Finance (commonly referred to as DeFi) is a blockchain-based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial instruments, and instead utilizes smart contracts on blockchains, the most common being Ethereum.

Introducing Energyfi

Newly, Decentralized Finance faces two major problems: high transaction costs and a huge carbon footprint on the environment due to excessive energy consumption (especially on Ethereum).

Energyfi is addressing these issues by designing a comprehensive set of DeFi features on Energy Web Chain, Avalanche, Near and Binance Smart Chain, which will accelerate their adoption at the same time. Indeed, to move towards mass adoption, a blockchain needs more users, and to have more users, it needs more dApps. In order to foster the emergence of decentralised applications (dApps) and to support developers who wish to build on these networks, a fast and reliable all-in-one platform like Energyfi is crucial. Both a cornerstone and a catalyst, Energyfi aims to lead the industry towards: decentralisation, transparency, environmental awareness and cross-chain interoperability. These core values can be seen in the main features of Energyfi.

Energyfi's Features

The Energyfi platform includes a wide range of features, all designed to enable the adoption of green networks and the emergence of environmentally friendly decentralised finance.

This includes:

- Launchpad (permissionless fundraising platform)

- Dex (decentralised exchange platform where you can easily buy and sell your crypto-currencies on the network of your choice)

- Staking/Farming (savings product)

- Lending (lend and borrow crypto-currencies.

Energyfi Token (EFI)

EFI token will have multiple use cases such as governance and platform utility. Holding EFI token will also be necessary in order to use some of the Energyfi services. Also, to promote EFI token holders, a frictionless yield and burn mechanism is included.

This will respectively provide a passive income and fight against inflation.

Energyfi raised $200,000 in a private sale and the public sale will be scheduled

The token private sale round was supported by several investors including INBlock ventures, Blu Ocean capital and whitelisted private investors.

$200,000.00 were raised during the private sale and a public sale will be organised in the near future on EnergyPad, the Energyfi launchpad.

Website: https://www.energyfi.io

Telegram: https://t.me/Energyfi_official

Expensive Gaming Chair – Choose The Best One – IoT Worm

Winning Esports Marketing with Cultural Branding part 3

This is the final entry in a three part series. Click here to download the entire guide (PDF). Your brand can achieve icon status in esports and gaming through cultural branding. Where gamers value your product for what it means to their identity first, followed by its functional benefits. Cultural branding differs from the three main models prevalent in conventional marketing today – emotional, mindshare and viral (see […]

The post Winning Esports Marketing with Cultural Branding part 3 appeared first on Esports Group.