Solana (SOL) has impressed many of its investors with its price growth thus far this year and the protocol just broke new history as the total daily transaction count soared to its highest level.

Solana Bucks Daily Transaction Trend

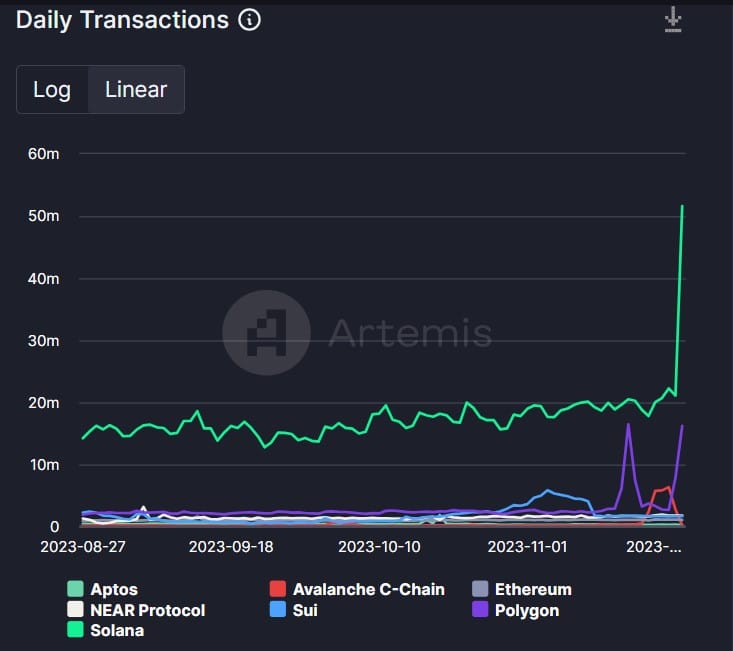

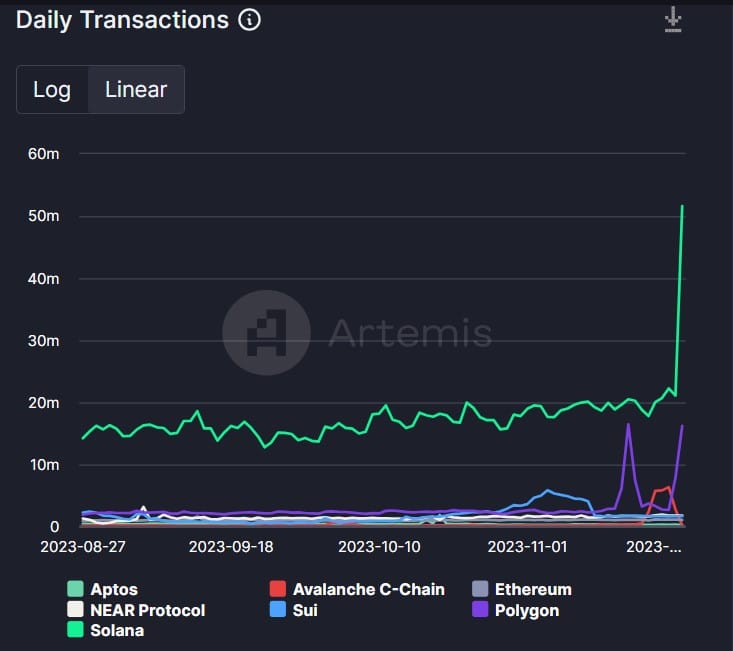

According to data from crypto data intelligence platform, Artemis, Solana soared to its highest daily transaction count of 51.63 million for the year. This impressive historic transaction milestone came as a significant deviation from the general trend as this specific metric has only flirted around the 20 million benchmark since at least late August.

<!–

adClient.showBannerAd({

adUnitId: “34683725-0f88-4d49-ac24-81fc2fb7de8b”,

containerId: “my-banner-ad”

});

–>

Based on different fundamental news emanating from the Solana protocol, buyers have attempted to push this transaction threshold beyond the 20 million mark. One of these attempts was recorded on September 13 when Solana (SOL) recorded about 18.58 million total daily transactions.

An emphatic run was recorded on October 23 when total daily transactions jumped to 19.93 million. While these transactions are not comparable to the new high recorded, they far outshine those of competing protocols like Ethereum (ETH), Polygon (MATIC), Aptos (APT), and Near Protocol.

Recommended Articles

On November 23 when Solana’s daily transaction count hit 21.1 million, Ethereum’s transaction count according to Artemis came in at 1.12 million while that of Polygon was pegged at 7.87 million. Other competing chains like Aptos and NEAR saw their transaction count touch 302.83K and 1.77 million respectively.

Solana Price Reaction

<!– Before_Last_2_Para_desk_728x90 [async]

if (!window.AdButler){(function(){var s = document.createElement(“script”); s.async = true; s.type = “text/javascript”;s.src = ‘https://servedbyadbutler.com/app.js’;var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n);}());}

var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || [];

var abkw = window.abkw || ”;

var plc653687 = window.plc653687 || 0;

document.write(”);

AdButler.ads.push({handler: function(opt){ AdButler.register(180936, 653687, [728,90], ‘placement_653687_’+opt.place, opt); }, opt: { place: plc653687++, keywords: abkw, domain: ‘servedbyadbutler.com’, click:’CLICK_MACRO_PLACEHOLDER’ }});

–>

By a very large margin, Solana (SOL) is one of the best-performing altcoins in the market today as the broader crypto world is experiencing deep consolidations across the board. At the time of writing, the coin has soared by 2.93% to $59.28 bringing the weekly surge to 1.53%.

The massive transaction count recorded has contributed to the 6% boost in SOL’s trading volume bringing the value traded to $1,215,394,579, the fifth largest of all cryptocurrencies.

Solana’s started the year on a very bad note stemming from the collapse of FTX Derivatives Exchange last November. FTX, had a sizable exposure to Solana, dampening investor sentiment earlier in the year as to what the future holds for the protocol.

After a series of liquidations involving SOL and unrelenting efforts from Solana developers and the community, the coin returned to its pre-FTX price level earlier this month and the growing daily count is proof the network health is being restored across the board.

<!–

–>

<!–

–>

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://coingape.com/solana-sol-makes-history-with-about-51m-surge-in-daily-transactions/