The world is rapidly shifting towards clean renewable energy solutions, driven by their immense potential to mitigate climate change and achieve global net zero targets. Surprisingly, private equity firms are at the forefront of this trend, investing heavily in solar, wind, biomass, and other renewables.

These firms are drawn not only by the social and humanitarian benefits but also by the economic advantages of renewables, which include low-cost power, reduced reliance on imported fuels, and a more secure, reliable energy supply.

Private Capital Takes Charge in Renewable Energy Investments

Private capital is experiencing a surge in acquiring renewable energy developers, increasingly favoring equity-based take-private deals for leveraged buyouts due to high interest rates and rising electricity demand.

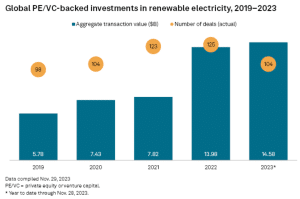

The statistics underscore this movement. In 2023, private equity and venture capital transactions in the global renewable energy sector nearly reached $15 billion. This is the highest total in the past five years, according to S&P Global Market Intelligence data.

Moreover, funds raised for renewable energy projects in recent years are approaching 25 times the value of fossil fuel asset fundraising, per another industry report. This significant financial commitment highlights the growing recognition of the economic viability and long-term benefits of renewable energy investments.

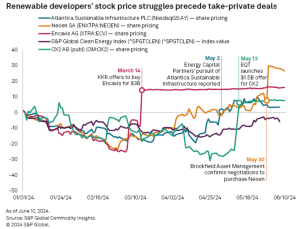

Key investors such as KKR & Co. Inc., Brookfield Asset Management Ltd., EQT AB, and Energy Capital Partners LLC have actively bid for listed renewable platforms this year, aiming to accelerate the companies’ installed capacity in the coming years.

After a period of limited dealmaking activity, asset managers and infrastructure funds are now leveraging their project development skills as they grow more comfortable with the renewable energy sector. Brookfield Renewable Partners, for instance, has a strong track record of acquiring developers with significant pipelines in the US.

Peter Zhu, managing director at Macquarie Group Ltd.’s Green Investment Group, highlighted that the current higher interest rate environment has adjusted equity returns for renewables favorably, creating an attractive investment window for leading renewable platforms.

Last month, private equity firm EQT offered offered to acquire Swedish renewable energy company OX2 for $1.5 billion. The goal is to enhance EQT’s renewable energy portfolio and boost OX2’s growth in the energy sector.

This shift indicates a strategic pivot in private capital investment, focusing on the long-term potential and growth capabilities of renewable energy developers.

Challenges and Opportunities in Renewable Energy Valuations

The renewable energy sector has faced substantial challenges in recent years, including project delays, trade restrictions, supply chain disruptions, and rising interest rates, affecting both US and European developers. These obstacles have negatively impacted the valuation of publicly traded renewable energy companies.

- For instance, within Bloomberg Intelligence’s renewables peer group—which includes Brookfield target Neoen SA and KKR target Encavis AG—the enterprise-value-to-capacity multiple has declined from 1.5x in January 2023 to 1.1x.

A notable example is Sweden’s OX2 AB, whose stock price dropped by 24% in 2024 before EQT AB made a $1.5 billion offer on May 13.

According to experts, the current market conditions have made the valuations of these publicly traded renewable power developers more attractive for investors. They highlighted that the previous combination of rapid growth in renewable power and low interest rates created opportunities for private capital to acquire renewable developers at more favorable prices.

Data centers are a significant driver of growth in the renewable energy sector. KKR’s $3 billion bid for Germany’s Encavis includes a commitment to increase the company’s installed capacity to 7 GW by the end of 2027, up from the previous target of 5.8 GW.

Similarly, Brookfield has expressed intentions to “accelerate [Neoen’s] growth,” reflecting a broader trend among investment giants to enhance the capabilities of renewable energy developers they acquire.

The Nordic market, particularly suited for data centers, is poised for growth due to the substantial power demands associated with data center development.

Brookfield recently entered into a global 10.5-GW framework agreement with Microsoft, a deal nearly 8x larger than the largest single corporate PPA, underscoring the immense demand from hyperscale datacenters and industrial facilities.

Fueling the Exponential Growth in Energy Transition Deals

Energy transition deals involving private equity have surged dramatically over the past five years, with total deal value increasing by 7,300%. In the U.S., private equity-backed energy transition deals grew from less than $500 million in 2018 to more than $25.9 billion in 2023.

In comparison, traditional private equity energy deals only increased by 53%, from $20.9 billion in 2018 to $32.0 billion in 2023. Although still behind, private equity deal flow in the energy transition sector nearly caught up with traditional energy deals over this period.

Non-private equity investors still dominate energy transition deal flow, but their growth, while robust, was less dramatic. The total value of these deals rose by 379%, from $8.9 billion in 2018 to $42.7 billion in 2023.

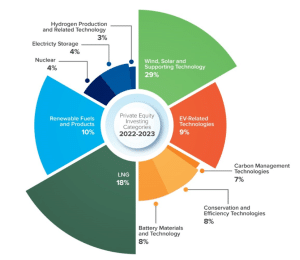

As for how capital is being deployed, data suggests private equity investing in energy transition is very broad in scope. Remarkably, most of the funds in 2022 and 2023 went to wind, solar, and supporting technologies ($12.8 billion).

The significant increase in private equity investments in the energy transition sector could drive these efforts forward.

Private equity firms are increasingly investing in the renewable energy sector, driven by both economic and environmental benefits. Despite challenges like project delays and rising interest rates, the potential for growth in renewable energy remains strong. This surge in private capital is critical for accelerating the global transition to clean energy.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/private-equity-buys-in-renewable-energy-big-time-almost-15b/