Bitcoin prices are volatile, recently dropping from the peak of over $73,000 in March to the current spot levels. Analysts are turning to historical data for insights with mounting selling pressure and some investors being concerned about potential short-term losses. This historical analysis is crucial in determining whether we’ve reached a market top or if this is just a temporary pause before the trend resumes.

Will The Depth Of This Correction Depend On This?

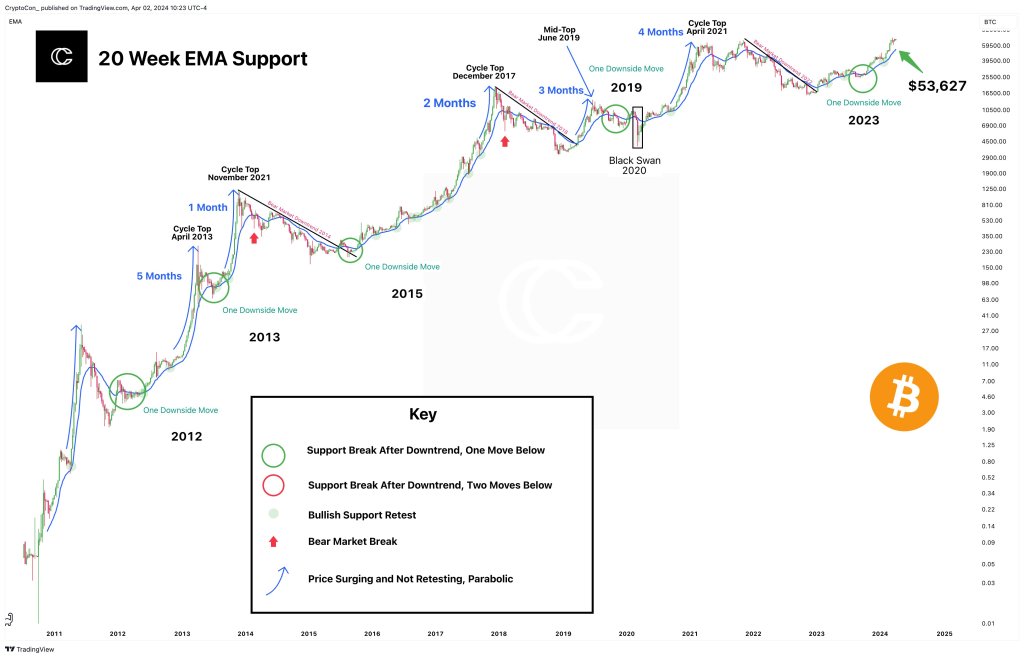

In een bericht op X, een analist zei the depth of the current correction will largely depend on whether Bitcoin is “parabolic” or not. Whenever an asset registers “parabolic” prices, it means valuation has increased sharply, and, at some level, analysts think it is unsustainable.

In that case, prices tend to cool off later, but after key resistance levels and even all-time highs have been broken. If this is the case, then the current cool-off could suggest the formation of a potential “first cycle top” at the March 2024 all-time high of $73,800.

This formation will be similar to those seen in April 2013 and 2021.

However, in another scenario, traders should expect a different arrangement, assuming the recent price growth wasn’t unsustainable or parabolic. Assuming this is the case, Bitcoin will likely continue bleeding and revisit established support levels.

The analyst predicts a possible correction to as low as the $53,600 support in the coming sessions. This retracement, the analyst continues, will allow the formation of a “smoother curve like 2016 – 2017.”

The Influence Of Bitcoin Halving

Aside from this assessment, another analyst is roping in the concept of the Bitcoin pre-halving cycle. Usually, and looking at historical formations, prices tend to collapse leading up to the halvering event, which is set for the third week of April.

In een bericht op X, de analist zei the current rejection and the failure of bulls to push prices higher suggest that the coin might consolidate between $60,000 and $70,000 in the coming weeks.

Bitcoin continues under pressure and will likely register even more losses in the days ahead. Based on the daily chart formation, BTC prices are trending below the middle BB. Notably, it is finding strong rejection from the $71,700 zone.

Even though the uptrend remains, buyers will only be in control should prices rise, reversing current losses, preferably with increasing participation levels.

Feature afbeelding van DALLE, grafiek van TradingView

Disclaimer: het artikel is uitsluitend bedoeld voor educatieve doeleinden. Het vertegenwoordigt niet de mening van NewsBTC over het kopen, verkopen of aanhouden van beleggingen en uiteraard brengt beleggen risico's met zich mee. U wordt geadviseerd om uw eigen onderzoek uit te voeren voordat u beleggingsbeslissingen neemt. Gebruik de informatie op deze website geheel op eigen risico.

- Door SEO aangedreven content en PR-distributie. Word vandaag nog versterkt.

- PlatoData.Network Verticale generatieve AI. Versterk jezelf. Toegang hier.

- PlatoAiStream. Web3-intelligentie. Kennis versterkt. Toegang hier.

- PlatoESG. carbon, CleanTech, Energie, Milieu, Zonne, Afvalbeheer. Toegang hier.

- Plato Gezondheid. Intelligentie op het gebied van biotech en klinische proeven. Toegang hier.

- Bron: https://www.newsbtc.com/bitcoin-news/bitcoin-at-crossroads-ahead-of-halving-will-btc-fall-to-53600/