Measurabl, which helps companies in the real estate industry measure their environmental, social and governance impacts, raised $93 million in an oversubscribed Series D funding round.

Energy Impact Partners and Sway Ventures co-led the round for San Diego-based Measurabl. Moderne Ventures, WVV, Suffolk Construction, Broadscale, Camber Creek, Salesforce Ventures1, Building Ventures, Constellation Technology Ventures, Concrete Ventures, RET Ventures, Colliers and Lincoln Property Co. also participated.

Measurabl has now raised $172.6 million total, per Crunchbase.

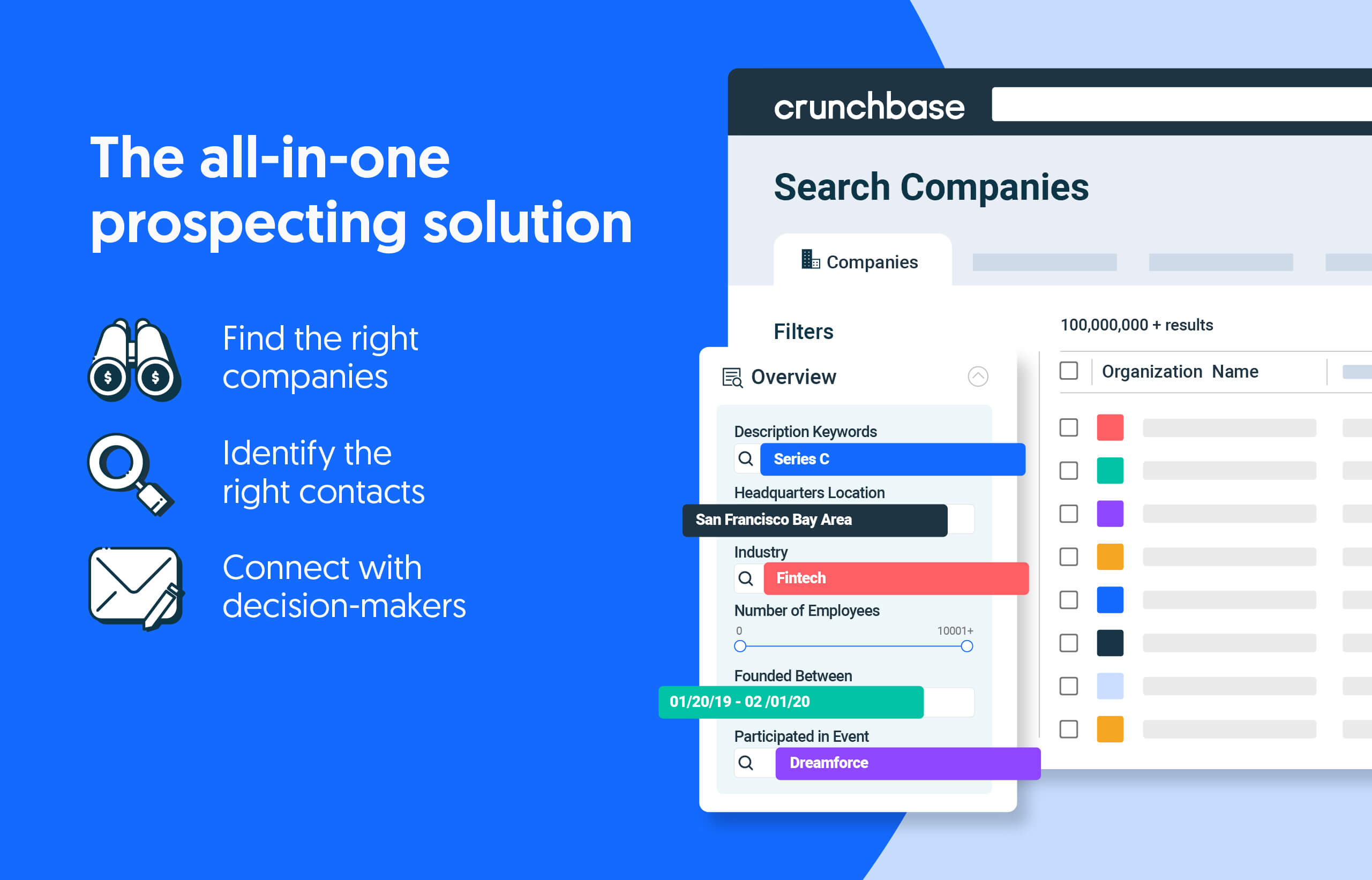

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

The startup was co-founded in 2013 by CTO Lance Onken and CEO Matt Ellis, the former director of sustainability at commercial real estate brokerage giant CBRE. The company claims it’s the most widely used ESG platform for the real estate industry, with 37% of top asset managers using its platform to measure and manage the impact of $2 trillion worth of properties.

The company acquired a couple other startups in 2022 to help it build out its platform. It bought Hatch Data, a building energy and carbon management platform, as well as WegoWise, a platform for building managers to track energy and utility usage, that had raised $4.9 million per Crunchbase.

“The antidote to greenwashing is objective measurement and transparency,” Ellis said in a statement announcing Measurabl’s new raise. “This funding allows us to further enhance our market-leading ESG technologies, expand to new geographies, and ensure the real estate industry has the investment-grade data necessary to transition to a sustainable, profitable future for all.”

Sustainability draws huge VC dollars

ESG refers broadly to a set of criteria that evaluate the sustainability and ethical impacts of a company or investment, looking at factors including carbon emissions, labor practices, animal welfare, workplace diversity and inclusion efforts, supply chain transparency, executive compensation, and board composition. By one estimate, ESG accounts for $1 out of every $8 in U.S. assets under professional management.

Billions of venture dollars have also gone to startups in the sustainability industry: $7.3 billion globally last year, just shy of the $7.4 billion they raised in 2021, Crunchbase data shows. Those figures are particularly significant, given that overall venture spending fell 35% globally last year from 2021’s record highs.

Startups that describe themselves as ESG-related specifically raised $480.9 million in venture backing globally last year, per Crunchbase, a huge leap compared to $95.2 million in 2021.

Venture investors’ continued interest in ESG startups also comes despite new pressures on corporate sustainability efforts, which some prominent Republicans have criticized as politicized investing that leads to lower returns for the sake of virtue signaling.

Related Crunchbase Pro queries

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

When we look at the declines in tech valuations, it’s tempting to turn to prior down markets for guidance on how a recovery might play out.

It’s not easy wrapping your head around what Boston-based Lightmatter does exactly, but investors get it and the new funds have reportedly tripled…

Tech’s biggest software developers, chipmakers and hyperscalers have paid attention — and money — to AI for years, per Crunchbase data.

U.S. seed startups have been the least affected by the venture funding downturn, but these companies are competing in a more crowded field than ever.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://news.crunchbase.com/clean-tech-and-energy/venture-funding-environment-sustainability-measurabl/