Payments Survey Results | Aug 25, 2023

Image: Unsplash/Blake Wisz

Image: Unsplash/Blake WiszCiti’s latest survey unveils the transformative trends in the payments landscape, highlighting fintechs’ rising dominance and the pivotal challenges and opportunities awaiting traditional banks.

- In today’s dynamic financial landscape, deciphering the trajectory of payment trends is paramount for both businesses and financial institutions. Citi’s Treasury & Trade Solutions embarked on a mission to demystify this realm by launching an in-depth “Future of Payments” study, shedding light on the challenges and opportunities in the payments industry.

- The survey engaged over 100 financial institution clients, aiming to delve deep into the disruptions caused by fintechs and challenger banks. Dawid Janas and Will Artingstall, the visionary leaders behind Citi’s “Enable Banks” Growth Mission, teamed up with Katie Dilaj to provide a fresh perspective on the survey’s outcomes.

Fintechs Are Eating Some Lunch

- The driving force behind this study is fueled by shifting consumer demands, rapid technological breakthroughs, and a renewed regulatory emphasis on innovation and consumer rights.

- Elements like open banking, and the introduction of innovative messaging protocols are at the forefront of this revolution. A standout insight from the study was the inroads fintechs are making into traditional market shares.

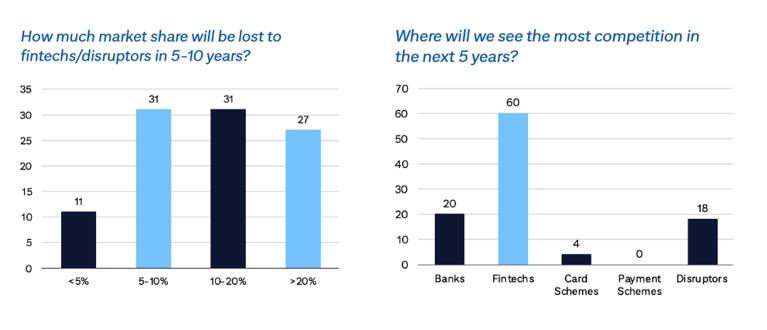

- A significant revelation from the survey was the market share loss to fintechs:

- Two out of every five bank clients reported a loss of at least 5% of their market share to fintechs.

- Further, a whopping 89% anticipate a further loss of 5-10% market share in the upcoming 5-10 years. This trend is especially pronounced in the realm of cross-border payments.

- When it comes to competition, fintechs, with their advanced frontend technology and superior client experience, are emerging as formidable adversaries. In fact, 59% of bank clients view fintechs as the most significant threat to their market share.

The Road Ahead for Traditional Banks

- Yet, the journey ahead for traditional banks is layered with complexities. They stand at a crossroads, deliberating between enhancing user interfaces and fortifying their core systems.

- The survey illuminated this dilemma, with a majority voicing the urgency to rejuvenate frontend interfaces and bolster core infrastructures. In the quest for superior client interactions, APIs (Application Programming Interfaces) are hailed as the torchbearers.

- While their current adoption might be in its nascent stages due to conflicting investment interests, the momentum is gathering pace. A commendable 80% of bank clients are already harnessing the power of APIs, signaling a paradigm shift towards interconnected banking experiences.

In wrapping up, the world of payments is on the cusp of a new era. As technology gallops forward and fintechs rise to prominence, legacy banks must recalibrate their strategies. By tuning into client aspirations, channeling investments wisely, and nurturing partnerships, they can chart a course through the challenges and harness the boundless opportunities awaiting them.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://ncfacanada.org/key-insights-and-trends-from-citis-payments-survey/