As an asset, Bitcoin may be increasingly anti-fragile as well. When Silicon Valley Bank collapsed on March 10, 2023, fears of contagion sent stocks down by over -1% the next trading day, but bitcoin rose by 20%. This “safe haven” price response was a new phenomenon for bitcoin, and time will tell if it persists. But bitcoin is outperforming all other asset classes over the last 1, 3, 5, and 10 years, periods that include many stresses.

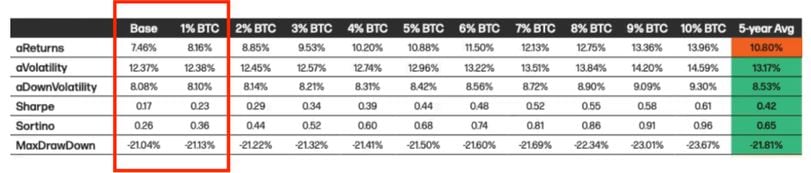

Research from Galaxy shows that a 1% allocation to bitcoin in a 55% S&P 500 / 35% Bloomberg U.S. Agg / 10% Bloomberg Commodity portfolio over 5 years from August 2018 – August 2023 would have resulted in higher returns and better risk adjusted returns, with virtually no impact on volatility or max drawdown:

Last week, Fidelity added bitcoin to its diversified ETF portfolios in Canada, with a 1% allocation for the Conservative ETF and a 3% allocation for the Growth ETF. With many bitcoin ETFs now available in the US, such as the low cost Franklin Templeton EZBC or iShares IBIT, it is easy for US investors to follow suit.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fintechnews.org/how-bitcoin-benefits-from-global-stresses/