Cryptocurrencies have become a prominent topic of discussion and a significant part of the modern financial landscape. In this article, we’ll delve into the fascinating history of cryptocurrencies, exploring their origins, how they can be mined, their challenges, and future prospects. By understanding the evolution of cryptocurrencies, everyone can gain valuable insights into this digital revolution.

Brief Cryptocurrency History

Cryptocurrencies have a rich and intriguing history that traces back to the inception of Bitcoin in 2009. Created by an enigmatic figure known as Satoshi Nakamoto, Bitcoin introduced the concept of a decentralized digital currency. This groundbreaking innovation laid the foundation for developing numerous other cryptocurrencies, called altcoins, such as Litecoin, Ripple, and Ethereum, each with its unique features and applications. As cryptocurrencies gained traction and demonstrated their potential to revolutionize the financial landscape, the world began to take notice. These digital assets offered individuals a new way to store value and conduct peer-to-peer transactions, circumventing the need for intermediaries like banks.

What Is Crypto?

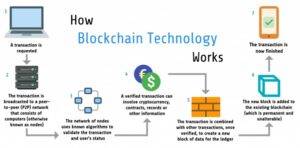

Cryptocurrencies are digital or virtual currencies that utilize cryptography to ensure secure transactions. Unlike conventional currencies issued by central banks, cryptocurrencies function on decentralized networks known as blockchains. Digital assets offer users a way to store value and conduct peer-to-peer transactions without intermediaries.

Displayed below is a diagram outlining “The mechanics of Bitcoin mining.”

What Is Mining?

Crypto mining is the process by which new coins are created and transactions are verified on a blockchain network. As a reward for their computational work, miners get newly minted coins.

Below is a diagram of “How Bitcoin mining works.”

When Did Crypto Mining Start?

Crypto mining traces its origins back to the launch of Bitcoin in 2009. It was during this time that the concept of mining was introduced to validate transactions and secure the Bitcoin network. Since then, mining has become an integral part of various cryptocurrencies, supporting their decentralized nature.

How to Get Crypto?

There are several ways to get cryptocurrencies. Some individuals acquire them through mining, while others participate in cryptocurrency trading or receive them as payment for goods and services. Additionally, individuals can obtain crypto by participating in certain blockchain-based projects, such as token airdrops, or by staking their existing holdings.

Another innovative way to get real cryptocurrencies is through RollerCoin, an online crypto mining simulator. Crypto enthusiasts can engage with the game and have the chance to mine actual cryptocurrency. RollerCoin utilizes the concept of crypto mining as the foundation of its gameplay. Traditionally, crypto mining involves complex algorithms and blockchain processes, requiring costly technology. However, in the game, players can mine real cryptocurrencies without the need for specialized equipment.

In RollerCoin, players have the opportunity to mine different cryptocurrencies, including but not limited to BTC, Doge, and ETH. These cryptocurrencies can be mined based on the player’s mining power within the game. Additionally, there is a native currency called RollerToken, which serves as the in-game currency. Players can use RollerTokens to make in-game purchases, boosting their mining power and enhancing their winnings. By participating in RollerCoin, players can gain practical insights into the world of crypto mining while mining real cryptocurrencies. Mining cryptocurrencies has become a tangible possibility, thanks to innovative platforms like RollerCoin.

Regulatory Challenges and Market Volatility

Regulations

The emergence of cryptocurrencies posed regulatory challenges for governments worldwide. Governments have responded differently, with some embracing cryptocurrencies and blockchain technology while others have adopted a more cautious or restrictive approach. Regulatory efforts aim to address concerns related to money laundering, tax evasion, investor protection, and overall market stability.

Cryptocurrency Scams

As the popularity of cryptocurrencies grew, so did the prevalence of scams and frauds. Unscrupulous individuals and organizations took advantage of the nascent industry to deceive unsuspecting investors. Examples of scams include Ponzi schemes, fake initial coin offerings (ICOs), and phishing attacks. It is crucial for individuals to exercise caution and conduct thorough research before engaging in any cryptocurrency-related activities.

Crypto Saw Over Trading Year

In certain years, the cryptocurrency market experienced significant over-trading, characterized by a surge in trading activity and high market volatility. During these periods, the value of cryptocurrencies fluctuated wildly, attracting both experienced traders and speculative investors. While these years provided opportunities for substantial gains, they also carried higher risks due to the volatility of the market.

The chart below reflects the overall cryptocurrency 24-hour trade volume from January 1, 2023, to June 15, 2023

Image Source: Statista

The Future of Cryptocurrencies

Advancements and Challenges

The future of cryptocurrencies holds exciting possibilities driven by ongoing technological advancements. Improvements in blockchain technology, such as faster transaction processing and enhanced scalability, aim to address the limitations of current cryptocurrency networks. Solutions like layer 2 protocols and sharding have the potential to revolutionize the industry and enable greater adoption.

Integration of Cryptocurrencies into Daily Life

Cryptocurrencies have the potential to integrate into various aspects of our daily lives. We expect to see increased acceptance of cryptocurrencies as a means of payment by retailers, service providers, and online platforms. The development of user-friendly wallets and payment gateways will facilitate easier and more widespread usage of cryptocurrencies for everyday transactions.

Potential Regulation and Global Adoption

As cryptocurrencies continue to gain traction, governments worldwide are actively exploring regulatory frameworks to govern their use and ensure consumer protection. We anticipate potential regulatory developments that aim to strike a balance between innovation and safeguarding the interests of participants in the cryptocurrency ecosystem. Furthermore, the global adoption of cryptocurrencies is likely to expand as more individuals, businesses, and institutions recognize their benefits and embrace their use.

Summing up

The history of cryptocurrencies is a captivating journey that started with the advent of Bitcoin and has since transformed the financial landscape. From understanding the concept of crypto and how it can be mined to the challenges of market volatility and regulatory responses, it is essential to stay informed about this digital revolution. As we look to the future, technological advancements, integration into daily life, and potential regulatory developments will shape the trajectory of cryptocurrencies, making them a significant force in the years to come.

Today, cryptocurrencies continue to evolve, with advancements in technology leading to the emergence of new concepts, such as decentralized finance (DeFi) and non-fungible tokens (NFTs). The journey of cryptocurrencies is marked by a combination of technological innovation, market volatility, and a transformative impact on the financial world, making it an exciting and ever-evolving field worth exploring.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.fintechnews.org/history-of-cryptocurrencies-everything-that-you-should-know/