Databricks revealed some sensational growth this week, as they did last year. Exiting this quarter to $2.4 billion annual run rate, the company’s revenue growth is accelerated year-over-year by 10 percentage points.

| Quarter | Q2 2023 | Q2 2024 |

|---|---|---|

| Quarterly Revenue, $m | 375 | 600 |

| Revenue Growth | 50% | 60% |

| Customers | 10,000 | |

| Gross Margin | 85% | 80% |

| Net Dollar Retention | 140% | |

| Data Warehouse Revenue, $m | 100 | 400 |

| Average Annual Customer Value | 37,500 |

Net dollar retention is a major driver of growth at 140%, which is top decile. The table above shows the other data points that we’ve collected through their press releases in the last two years.

The fastest growing product category mentioned is the data warehouse revenue : 300% growth, now at $400m annually, nearing 20% of revenue.

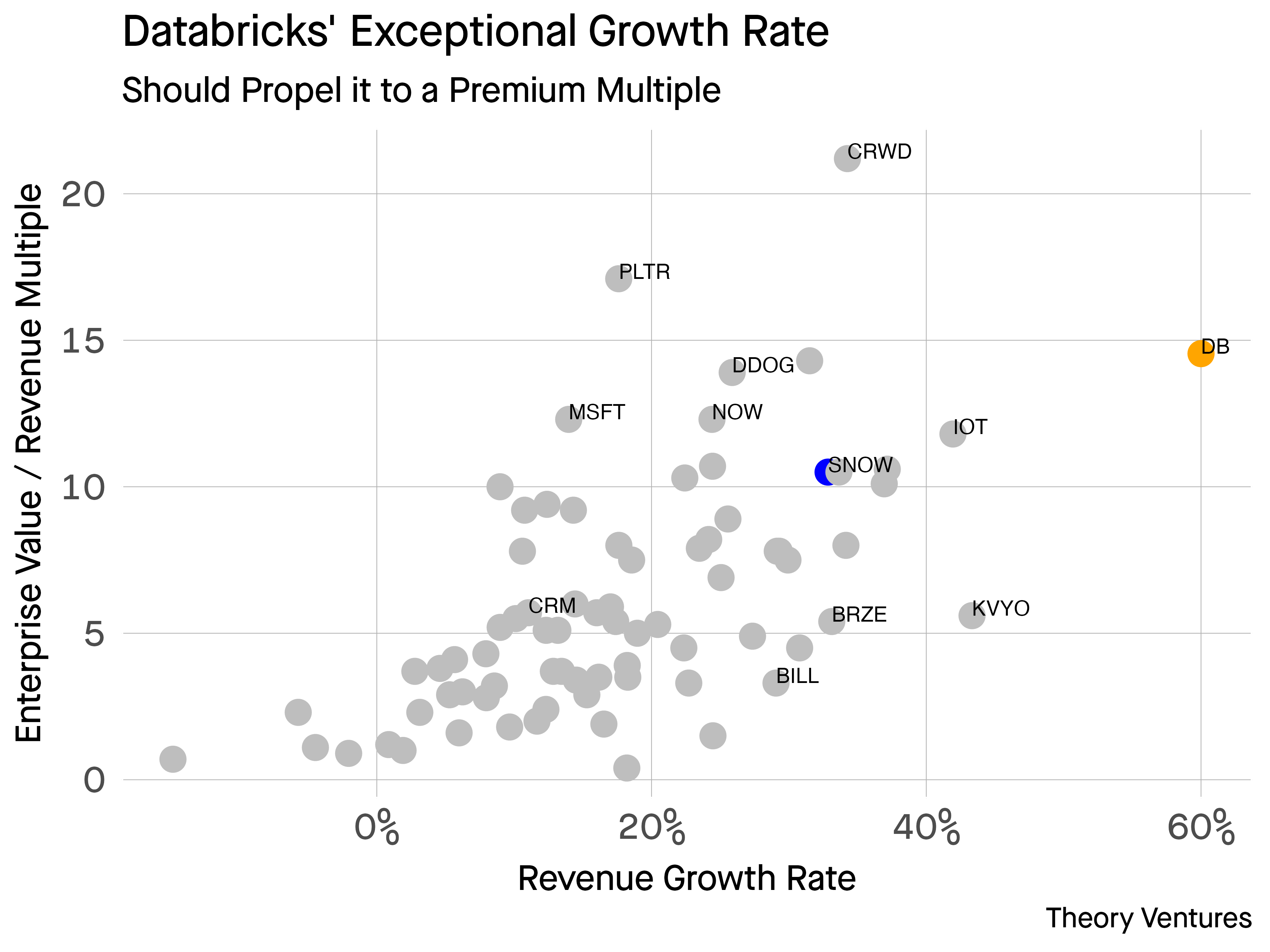

With these modest data points, we can build a basic linear regression model for what the company is worth. This model is rough with an R^2 of approximately 0.45.

click on the image to enlarge

Assuming Databricks continues to grow at roughly 50%, that implies the company in the public markets would be worth approximately $54b. However, the company will likely trade at a premium to this. It is one of the few companies that provides significant exposure to AI software in the public markets.

| Company | Snowflake | Databricks |

|---|---|---|

| TTM Revenue, $B | 3.0 | 2.4 |

| Revenue Growth Rate | 33% | 60% |

| Estimated Multiple | 12 | 14.5 |

Compared to Snowflake, Databricks is growing nearly twice as quickly. Without additional data, it’s difficult to comment on the relative sales efficiency or profitability.

Databricks’ growth rate is yet another example of the rapid demand for AI infrastructure & the systems needed to power it.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.tomtunguz.com/databricks-growth-2024/