European Crowdfunding | Feb 13, 2024

Insights from the 2023 European Crowdfunding Market Report

LenderKit, CrowdSpace, and the UiA Crowdfunding Research Center collaborated on the development and publishing of the latest 2023 European Crowdfunding Market Report (an 132 page PDF endeavour) providing a comprehensive look at the inter-workings and latest developments of Crowdfunding markets in Europe. The source data was collected by administering a survey to crowdfunding platforms from April to August, 2023.

Overview

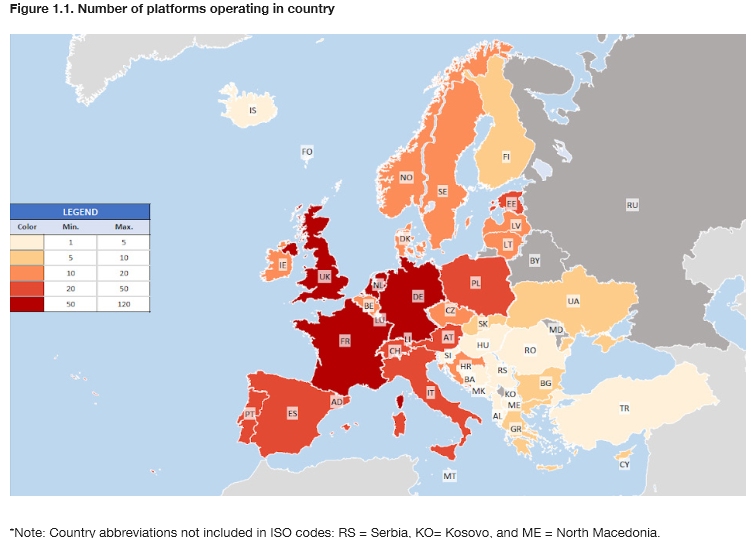

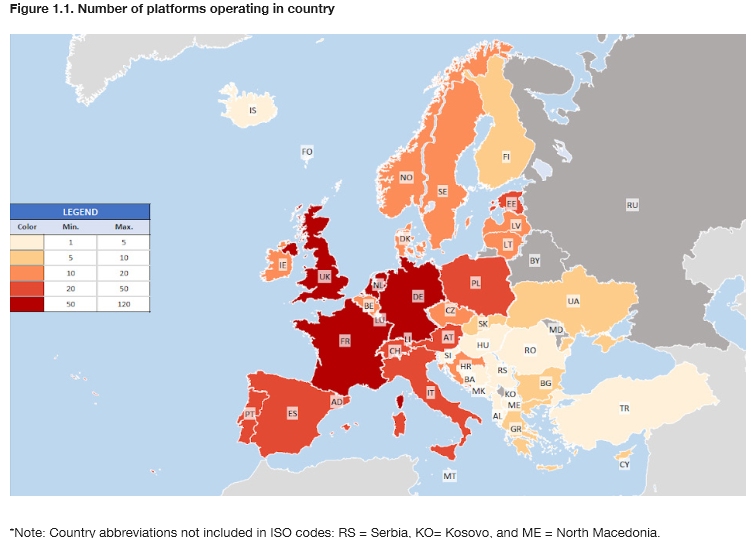

- Europe’s crowdfunding market has seen robust growth, hosting 594 platforms that extend their reach across multiple countries, resulting in a broad and dynamic environment for crowdfunding activities across the continent.

- Germany, the UK (independent of the EU), and France are highlighted as the countries with the highest number of crowdfunding platforms, indicating their significant roles in the European crowdfunding ecosystem. Also, the Baltic states (Estonia, Latvia, and Lithuania) exhibit an exceptional density of platforms per capita, signifying an intense crowdfunding activity that ‘punch above their weight’.

See: European Crowdfunding Platforms Licensed Under ECSPR

- The annual average volume of funds raised per platform increased from 16 million EUR in 2021 to 19 million EUR in 2022, for a 17% increase. Specifically, lending platforms experienced growth from 19 million EUR to 24 million EUR, showcasing their rising prominence. Conversely, equity-based and non-investment platforms maintained consistent volumes year over year, with equity at approximately 15 million EUR and non-investment at around 9 million EUR.

- Regionally, Eastern Europe led the charge in growth rates, with a 13% increase in average volumes, from 11.3 million EUR in 2021 to 12.9 million EUR in 2022. Northern European platforms reported the highest average volumes at 27 million EUR in 2022, significantly outpacing other regions and indicating a robust market. The Netherlands, Norway, and Denmark were identified as leading markets based on the Crowdfunding Market Readiness Index (CMRI – read report for more info), which evaluates six indicators of market development.

- Education. Education. Education. The perception of insufficient public knowledge about crowdfunding is widespread, with 70% of European equity platforms and 67% of lending platforms expressing this concern. This sentiment is echoed across all regions, highlighting a continental challenge in crowdfunding education and engagement. The need for more education is consistent globally, as crowdfunding sectors require educational funding support from government and innovation stakeholders to increase knowledge and credibility among prospective users and market participants.

See: A Guide to Real Estate Investing through Crowdfunding in the US and Canada

- Most platforms use third-party payment service providers, indicating a reliance on external financial infrastructure for transaction processing. Planned technological enhancements include mobile applications, secondary markets, and auto-investing features, signifying an ongoing evolution towards more user-friendly and diversified service offerings.

- Limited but growing interest blockchain-based asset tokenization and secondary trading. Platforms are also considering process automation for various operational aspects, suggesting a trend towards efficiency and innovation.

Image: Figure 1.1 – 2023 European Crowdfunding Market Report

Image: Figure 1.1 – 2023 European Crowdfunding Market ReportPlatform Trends and Insights

- Most Crowdfunding platforms surveyed have been operational for 8-9 years. This suggests a stable foundation for the industry, although there’s a noted decrease in the establishment of new platforms in subsequent years, indicating a potential saturation or consolidation phase.

- A significant majority of platforms (over 80% in both 2021 and 2022) primarily serve their home country markets. However, platforms based in Eastern Europe exhibit a higher tendency towards international outreach compared to those in Southern Europe, showcasing diverse strategic priorities and market penetration approaches. The flow of international funds shows variation across models, with lending platforms experiencing a notable portion of international investment. The trend highlights Northern Europe as a major beneficiary of international funds, emphasizing its attractiveness to global investors.

See: Seedrs to Offer Investors Venture Capital Trusts

- 60% of platforms operate a single crowdfunding model, yet there’s a notable trend towards combining models for diversification. Additionally, a significant number of platforms report collaborative relationships with traditional financial institutions (TFIs), highlighting a bridge between traditional finance and crowdfunding sectors.

- Platforms are licensed for equity (81.6%) and debt (65.5%), with only 27.6% operating non-investment platforms.

Backers and Investors

- The total number of backers across Europe slightly decreased by 1.91% between 2021 and 2022, with an estimated 3.6 million individuals participating in crowdfunding activities. This reduction is considered minor, attributed to the economic uncertainties following the COVID-19 pandemic.

- A decline of 18.7% in the number of equity investors, whereas the number of lenders in lending models increased by 29.6%. Non-investment models saw a 4.5% reduction in backers.

- Most platforms reported serving less than 500 backers, indicating a concentration of smaller investor pools across many platforms. However, there was growth in the segment of platforms serving 10K-50K backers, from 12.0% in 2021 to 16.4% in 2022, suggesting an expansion in the reach of some platforms.

- Backers’ ages vary by model and region, with younger investors (aged 26-35) dominating in Northern Europe, especially in equity and lending models. Older backers (aged 46 and above) are more prevalent in non-investment crowdfunding across Western, Southern, and Northern Europe.

See: UK Changes to HNW Rules Will Impede Access to Capital

- Women dominate as backers in non-investment models (52%-60% across regions) but are a minority in investment models, constituting 18%-27% in equity and 7%-27% in lending. This reflects broader trends of gender differences in financial risk-taking and investment.

Outlook

Continued collaboration between traditional financial institutions and crowdfunding platforms, along with a focus on technological innovation and public education, will be key to unlocking the full potential of crowdfunding in Europe.

Download the 132 page PDF report –> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/current-state-of-crowdfunding-in-europe-2023-market-report/