Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 18 June 2024

Close to apply: 05 July 2024

Balloting: 11 July 2024

Listing date: 22 July 2024

Close to apply: 05 July 2024

Balloting: 11 July 2024

Listing date: 22 July 2024

Share Capital

Market cap: RM225.547 mil

Total Shares: 1.025 bil shares

Market cap: RM225.547 mil

Total Shares: 1.025 bil shares

Industry CARG

Sales Value of Fabricated Metal Products 2019-2023 : 2.7%

Sales Value of Metal Roofing Sheets: 5.4%

Sales Value of Trusses: -7.1%

Sales Value of Equipment for Scaffolding, Shuttering, Propping and Pit-propping of Iron or Steel: -18.4%

Sales Value of the Manufacturing Industry 2019-2023 (Constructions, manufacturing) : -.1.9% & 6.7%

Industry competitors comparison (net profit%)

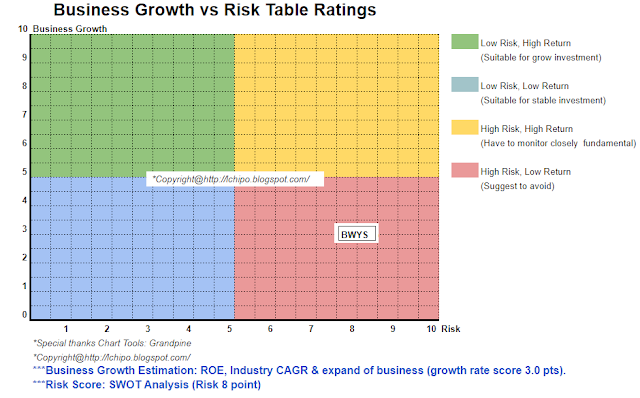

1. BWYS Group: 7.2% (PE12.94)

2. Ajiya Bhd: 18.3% (recent PE in losses)

3. SKB Shutters Corporation Berhad: 13.4% (PE6.05)

4. Astino Bhd: 4.6% (PE8.29)

5. Others: -9.9% to 19.7%

Business (FYE 2023)

Manufacturing of sheet metal products and supply of scaffoldings

Revenue segments

1. Manufacture of sheet metal products: 73%

2. Supply of scaffoldings : 24.9%

3. Trading of steel materials and steel related products: 2.1%

Manufacturing of sheet metal products and supply of scaffoldings

Revenue segments

1. Manufacture of sheet metal products: 73%

2. Supply of scaffoldings : 24.9%

3. Trading of steel materials and steel related products: 2.1%

Fundamental

1.Market: Ace Market

2.Price: RM0.22

3.Forecast P/E: 12.94 (FYE2023, EPS RM0.017)

4.ROE(Pro forma II): 8.5%

5.ROE: 11.34% (FYE2023), 19.81%(FYE2022), 23.37%(FYE2021), 3.97%(FYE2020)

6.Net asset: 0.02

7.Total debt to current asset: 0.78 (Debt: 178.098mil, Non-Current Asset: 158.122mil, Current asset: 227.568mil)

8.Dividend policy: no formal dividend policy.

9. Shariah status: Yes

1.Market: Ace Market

2.Price: RM0.22

3.Forecast P/E: 12.94 (FYE2023, EPS RM0.017)

4.ROE(Pro forma II): 8.5%

5.ROE: 11.34% (FYE2023), 19.81%(FYE2022), 23.37%(FYE2021), 3.97%(FYE2020)

6.Net asset: 0.02

7.Total debt to current asset: 0.78 (Debt: 178.098mil, Non-Current Asset: 158.122mil, Current asset: 227.568mil)

8.Dividend policy: no formal dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

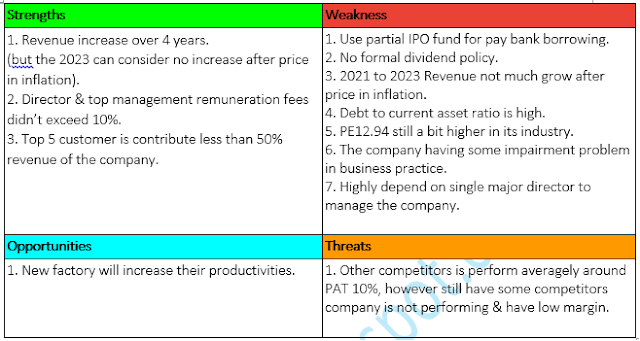

2023 (FYE 31Dec): RM246.078 mil (Eps: 0.0170), PAT: 7.2%

2022 (FYE 31Dec): RM236.231 mil (Eps: 0.0230), PAT: 10.0%

2021 (FYE 31Dec): RM222.435 mil (Eps: 0.0240),PAT: 11.2%

2020 (FYE 31Dec): RM130.864 mil (Eps: 0.0030),PAT: 2.5%

2023 (FYE 31Dec): RM246.078 mil (Eps: 0.0170), PAT: 7.2%

2022 (FYE 31Dec): RM236.231 mil (Eps: 0.0230), PAT: 10.0%

2021 (FYE 31Dec): RM222.435 mil (Eps: 0.0240),PAT: 11.2%

2020 (FYE 31Dec): RM130.864 mil (Eps: 0.0030),PAT: 2.5%

Impairment Losses

1. 2020: 1.8% (RM0.6mil)

2. 2021: 7.6% (RM2.9 mil)

3. 2022: 2.7% (RM1.1 mil)

4. 2023: 2.4% (RM1.3mil)

1. 2020: 1.8% (RM0.6mil)

2. 2021: 7.6% (RM2.9 mil)

3. 2022: 2.7% (RM1.1 mil)

4. 2023: 2.4% (RM1.3mil)

Major customer (FYE2023)

1. Inspec Engineering Systems Sdn Bhd : 4.7%

2. United Material Handling Inc: 4.1%

3. Yes Group: 1.9%

4. SKS Builders Trading Sdn Bhd: 1.7%

5. China Communication Construction (ECRL) Sdn Bhd: 1.5%

***total 13.9%

1. Inspec Engineering Systems Sdn Bhd : 4.7%

2. United Material Handling Inc: 4.1%

3. Yes Group: 1.9%

4. SKS Builders Trading Sdn Bhd: 1.7%

5. China Communication Construction (ECRL) Sdn Bhd: 1.5%

***total 13.9%

Major Sharesholders

1. Kang Beng Hai: 65.20% (direct)

1. Kang Beng Hai: 65.20% (direct)

Directors & Key Management Remuneration for FYE2024

(from Revenue & other income 2023)

Total director remuneration: RM2.325 mil

key management remuneration: RM1.30 mil – RM1.45mil

total (max): RM3.775 mil or 7.45%

(from Revenue & other income 2023)

Total director remuneration: RM2.325 mil

key management remuneration: RM1.30 mil – RM1.45mil

total (max): RM3.775 mil or 7.45%

Use of funds (MYR)

1. Construction of New Penang Factory: 22.840 mil, 40.4%

2. Purchase of new machinery and equipment: 7.716 mil, 13.7%

3. Implementation of new ERP system, production and inventory management systems: 10.831 mil, 19.2%

4. Repayment of bank borrowings: 4 mil, 7.1%

5. Working Capital: 5.5 mil, 9.8%

6. Estimated listing expenses: 5.5 mil, 9.8%

1. Construction of New Penang Factory: 22.840 mil, 40.4%

2. Purchase of new machinery and equipment: 7.716 mil, 13.7%

3. Implementation of new ERP system, production and inventory management systems: 10.831 mil, 19.2%

4. Repayment of bank borrowings: 4 mil, 7.1%

5. Working Capital: 5.5 mil, 9.8%

6. Estimated listing expenses: 5.5 mil, 9.8%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is high risk investment, as debt level is quite high & it will effected business PAT performance.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://lchipo.blogspot.com/2024/06/bwys-group-berhad.html