Rajiv Jain’s GQG Partners buys Rs 411 crore shares in JSW Energy

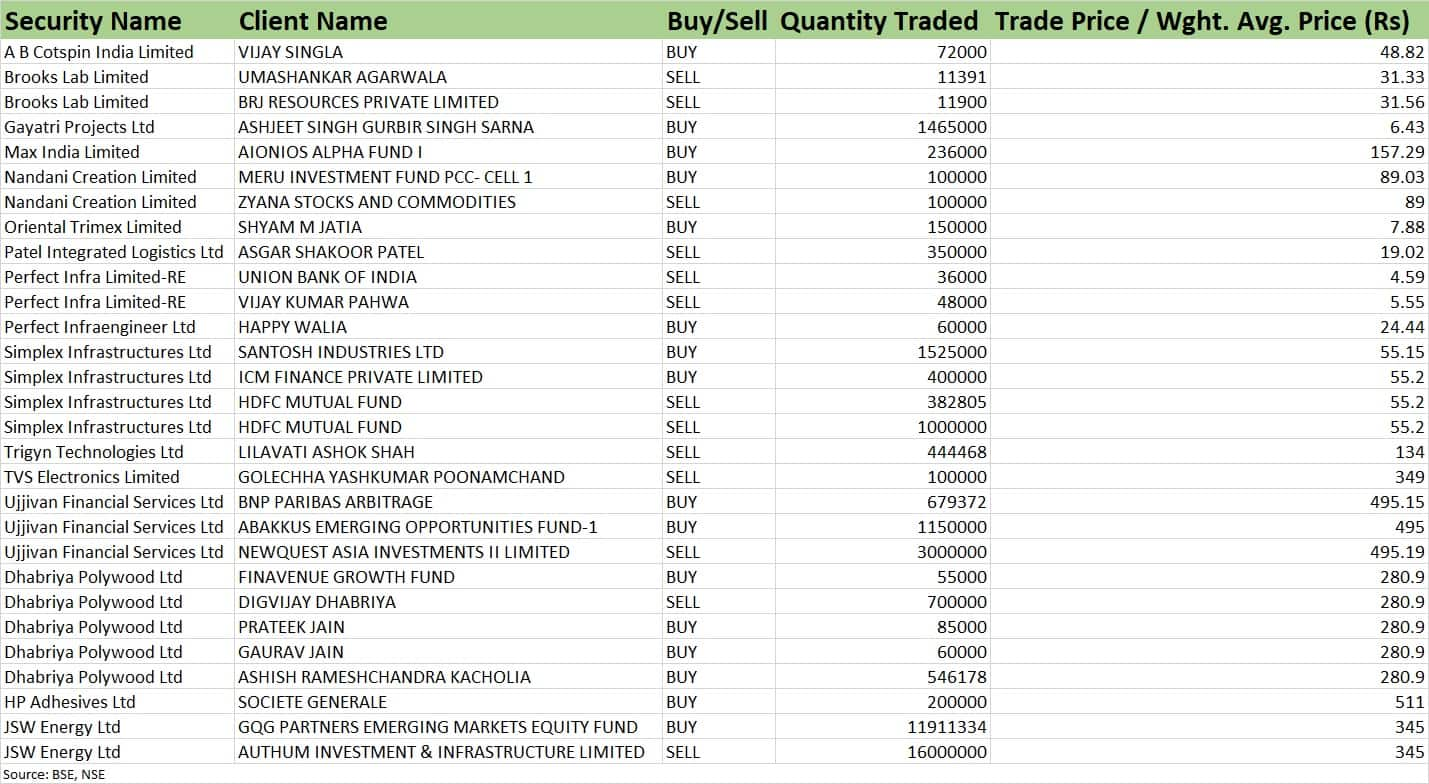

Rajiv Jain’s Fort Lauderdale-based asset management firm GQG Partners has bought nearly Rs 411 crore worth shares in power producer JSW Energy, via open market transactions, on August 14.

As per bulk deals data available with exchanges, the US-based GQG Partners Emerging Markets Equity Fund has bought 1.19 crore equity shares, which is equivalent to 0.72 percent stake in the power producer, at an average price of Rs 345 per share. The stake buy was worth Rs 410.94 crore.

However, Authum Investment & Infrastructure was the seller in this deal, offloading 1.6 crore equity shares or 0.97 percent stake at same average price. As of June 2023, Authum Investment held 2.01 percent stake in the company.

JSW Energy shares gained 1.52 percent to close at Rs 374.25 on the NSE.

Ujjivan Financial Services was also in focus, falling 2.3 percent to Rs 495.55. Foreign investor Newquest Asia Investments II has sold 30 lakh equity shares or 2.46 percent stake in financial services company. These shares were sold at an average price of Rs 495.19 per share, and were worth Rs 148.55 crore.

As of June 2023, Newquest held 5.17 percent stake in Ujjivan.

However, BNP Paribas Arbitrage and ace investor Sunil Singhania-owned Abakkus Emerging Opportunities Fund-1 were buyers for some of those shares in Ujjivan, purchasing 6.79 lakh shares at an average price of Rs 495.15 per share, and 11.5 lakh shares at an average price of Rs 495 per share, respectively.

Dhabriya Polywood was locked in 2 percent upper circuit at Rs 280.90. Ace investor Ashish Rameshchandra Kacholia has purchased 5.46 lakh shares or 5.04 percent shareholding in the PVC & UPVC profiles manufacturer.

Finavenue Growth Fund has bought 55,000 shares in Dhabriya Polywood, Prateek Jain purchased 85,000 shares and Gaurav Jain 60,000 shares in the company. All four investors bought shares in Dhabriya Polywood at an average price of Rs 280.9 per share.

However, promoter Digvijay Dhabriya was the seller in this deal, offloading 7 lakh shares or 6.47 percent stake at same average price. Promoters held 74.22 percent stake in the company as of June 2023.

We have also seen buying in HP Adhesives, rising 3.46 percent to Rs 517.4. Europe-based financial services group Societe Generale has bought 2 lakh shares or 1.09 percent stake in the adhesive manufacturing company at an average price of Rs 511 per share.

Simplex Infrastructures was locked in 10 percent upper circuit at Rs 55.2, continuing uptrend for eighth consecutive session despite consistent selling by HDFC Mutual Fund which sold another 13.82 lakh shares or 2.42 percent stake in the construction company at an average price of Rs 55.2 per share.

In previous session, HDFC Mutual Fund had sold 5 lakh shares in Simplex at an average price of Rs 52.47 per share, and another 4.81 lakh shares at an average price of Rs 52.35 per share, which is equivalent to 1.7 percent of total paid-up equity. As of June 2023, HDFC Trustee Company Limited-HDFC Flexi Cap Fund & HDFC Infrastructure Fund held 8.84 percent stake in the company.

However, on August 14, Santosh Industries purchased 15.25 lakh shares in Simplex at an average price of Rs 55.15 per share, and ICM Finance bought 4 lakh shares at an average price of Rs 55.2 per share.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.moneycontrol.com/news/buzzing-stocks/bulk-deals-|-rajiv-jain39s-gqg-partners-buys-rs-411-crore-sharesjsw-energy-ashish-kacholia-picks-5-stakedhabriya-polywood_17199471.html