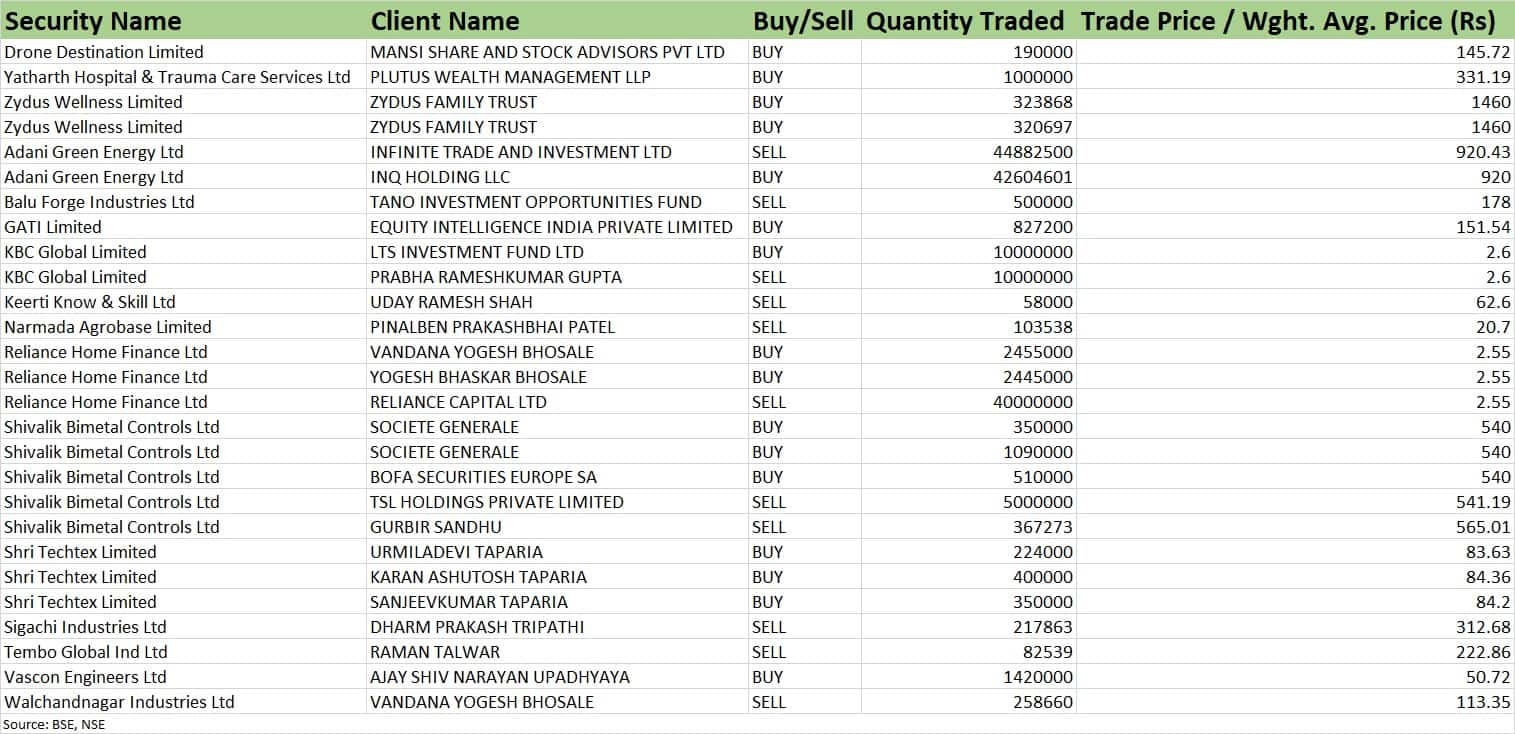

INQ Holding LLC purchased 4.26 crore equity shares in the Adani Group company at an average price of Rs 920 per share.

Yatharth Hospital & Trauma Care Services, which made its debut on the bourses recently, has seen good buying interest from Plutus Wealth Management, on August 7.

Plutus has bought additional 10 lakh equity shares, which is equivalent to 1.16 percent of paid-up equity, in the Noida-based super-speciality hospital chain.

The average buying price was Rs 331.19 per share. Plutus already held a 2.33 percent stake in Yatharth Hospital as per the shareholding data disclosed by the company last week.

Yatharth Hospital shares rallied 11.3 percent to close at Rs 333.85 on its listing day.

Meanwhile, Qatar-based sovereign wealth fund INQ Holding, a subsidiary of Qatar Investment Authority, has picked a 2.7 percent equity stake in Adani Green Energy, the renewable energy company, via open market transactions on August 7.

INQ Holding LLC purchased 4.26 crore equity shares in the Adani Group company at an average price of Rs 920 per share, as per the bulk deals data available on the exchanges. The stake buy was worth Rs 3,919.6 crore.

However, promoter Infinite Trade and Investment was the seller in this deal, offloading 4.48 crore equity shares or a 2.8 percent stake in Adani Green Energy. The average selling price was Rs 920.43 per share and the stake sale was worth Rs 4,131.1 crore.

Promoters had held a 56.27 percent stake in Adani Green Energy as of June 2023. The stock corrected by 4.6 percent to Rs 965.9 on the NSE.

Gati was also in focus, rising 1.6 percent to Rs 153.85. Ace investor Porinju Veliyath-owned Equity Intelligence India has bought 8.27 lakh equity shares or 0.6 percent stake in the logistics company at an average price of Rs 151.54 per share.

Among others, promoter entity Zydus Family Trust has bought 6.43 lakh equity shares or 1.01 percent shareholding in Zydus Wellness at an average price of Rs 1,460 per share. The stock rose 2.4 percent to Rs 1,464.5.

Balu Forge Industries was also in focus, falling nearly 1 percent to Rs 178. Tano Investment Opportunities Fund, owned by alternative asset management firm Tano Capital, has sold 5 lakh equity shares or 0.51 percent stake in the company at an average price of Rs 178 per share.

Shivalik Bimetal Controls, which corrected sharply in the last five out of six sessions, has seen a multi-fold jump in trading volumes on August 7. The stock was down 6.8 percent at Rs 584.2 on the NSE.

Europe-based financial services group Societe Generale has bought 14.4 lakh equity shares in Shivalik Bimetal Controls, and BoFA Securities Europe SA purchased 5.1 lakh shares in the company, at an average price of Rs 540 per share.

However, promoters offloaded a 9.3 percent stake in the company, with TSL Holdings selling 50 lakh shares at an average price of Rs 541.19 per share, and Gurbir Sandhu selling an entire personal holding of 3.67 lakh shares at an average price of Rs 565.01 per share.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.moneycontrol.com/news/market-edge/bulk-deals-|-plutus-wealth-management-buys-additional-116-stakeyatharth-hospital_17162071.html