Crypto Lending | Dec 20, 2023

Image: Unsplash/Traxer

Image: Unsplash/TraxerIn 2023, the crypto sector witnessed a remarkable rebound in private credit, with a 55% increase since the start of the year

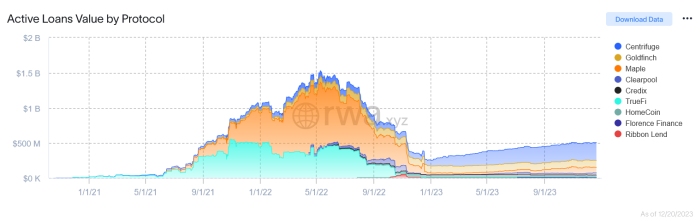

This resurgence is particularly notable given the backdrop of last year’s crypto crisis and the current environment of elevated interest rates. According to Bloomberg News, active private loans via digital ledgers have escalated to about $408 million as of November 28, 2023. This growth, tracked by RWA.xyz (See: Active loans value by procotcol), is significant though it still trails the near $1.5 billion peak of June last year and is a fraction of the traditional $1.6 trillion private credit market.

See: ‘Mugshot Edition’ Trump NFTs Blending Politics, Memorabilia and Digital Assets

Blockchain-based private credit offers lower borrowing costs compared to traditional credit, with some protocols charging less than 10%. This affordability, coupled with increased transparency and efficient liquidation mechanisms, makes blockchain-based credit increasingly attractive.

Industry Perspectives

Traditional private credit has been criticized for its opacity, as noted by Pimco and the European Central Bank. In contrast, blockchain protocols offer more transparency and faster liquidation processes, making them more appealing to borrowers and investors alike.

In the blockchain iteration of private credit, platforms including Centrifuge, Maple Finance, and Goldfinch facilitate the aggregation or provision of investor capital. Commonly, these protocols employ the Ethereum blockchain and stablecoins such as USDC, which are anchored to the US dollar’s value. Borrowers then access these funds, adhering to conditions embedded within smart contracts.

See: TransUnion Offers Credit Scores for DeFi Borrowers Utilizing Crypto Assets

These protocols adopt measures like loan structuring or backing loans with tangible assets, enhancing the trust of investors. Data from RWA.xyz shows that consumer, auto, and fintech sectors are leading in blockchain-based private credit utilization, followed by real estate, carbon projects, and crypto trading.

Outlook

The crypto industry still faces challenges, including banking access and the absence of a credit rating system in crypto lending. However, the industry is adapting, with platforms like Maple Finance and Goldfinch providing innovative lending solutions. The 55% jump in private credit within the crypto sector in 2023 shows the sectors resilience and adaptability.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/blockchain-private-credit-grew-55-in-2023/