New light vehicle sales in August are expected to be up double

digits from year-ago, while maintaining pace with July results

S&P Global Mobility expects US light vehicle sales in August

to remain steadfast in a challenging environment, with a volume

estimate of 1.34 million units. The projected August result would

be up 18% year over year, however compared to the month-prior

result, growth would be a milder 3% even with two more selling

days. This translates to a seasonally adjusted annual rate (SAAR)

of 15.2 million units, down from a July 2023 reading of 15.7

million units.

While the year-over-year growth in the market will be sustained

in August, there are some faint indicators of market softening. The

daily selling rate metric, since peaking at 54,500 sales per day in

April, has realized a mild downward trend since. With 27 selling

days in August, and an estimated volume of 1.34 million units, the

daily selling rate metric would fall below 50,000 units for the

first time since February 2023. S&P Global Mobility analysts

project calendar year 2023 total light vehicle sales of 15.4

million units. Although the daily selling rate has diminished over

the past three months, we do not expect this metric to further

decline over the remainder of the year.

“New vehicle affordability concerns will not be quick to

rectify,” reports Chris Hopson, principal analyst at S&P Global

Mobility. “Rising interest rates, credit tightening and new vehicle

pricing levels slowly decelerating remain pressure points for

consumers.”

In terms of total dealer-advertised inventories, volumes have

stayed relatively static since the beginning of July – at around

2.3 million units, with upward and downward variations of ~100,000

units over the course of a sales month, according to Matt Trommer,

associate director of Market Reporting at S&P Global

Mobility.

On a year-over-year basis, compared to mid-August 2022,

inventories have risen by 57% from just shy of 1.5 million

vehicles, Trommer said. (Note that total advertised inventory

figures include a fractional percentage of vehicles that dealers

may have sold but are still advertising, as well as vehicles

allocated to dealers but are still in transit.)

Various risk factors beyond the US consumer also remain

prevalent in the outlook for the remainder of 2023, including the

potential for North American vehicle supply disruptions as union

negotiations emerge.

“The greatest threat to the forecast in the near-term surrounds

the union negotiations between the United Auto Workers (UAW) in the

US and Unifor in Canada with their respective contracts set to

expire in mid-September 2023,” said Joe Langley, associate director

at S&P Global Mobility.

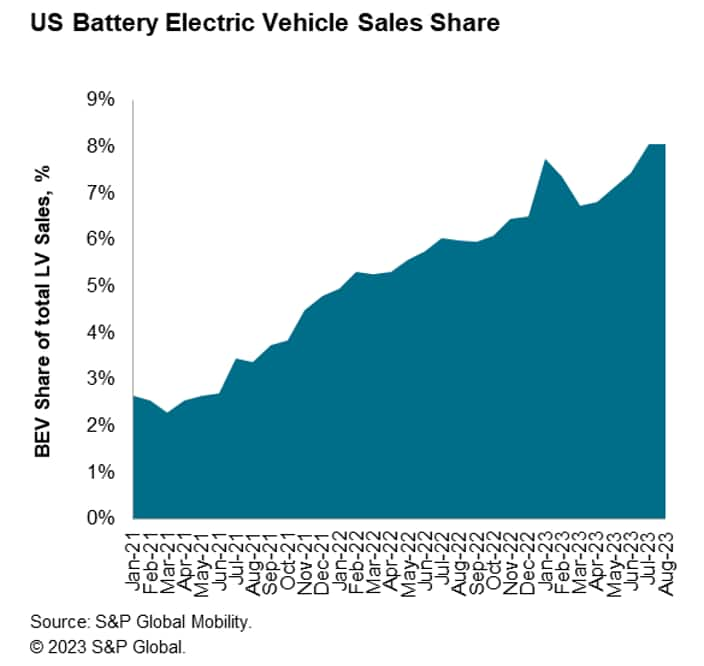

Continued development of battery-electric vehicle (BEV) sales

remains a constant assumption for 2023 although some month-to-month

volatility is expected. BEV share is expected to 8.0% of August

sales, remaining on trend with the preceeding month. Looking at the

remainder of the year, beyond potential future pricing developments

by Tesla, a sustained churn of new and refreshed BEVs and

aggressive BEV production expectations will continue to promote BEV

sales as the year progresses.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/august-us-auto-sales-trends-remain-familiar.html