- US consumer and wholesale inflation figures came in below estimates.

- The Fed forecast only one rate cut this year.

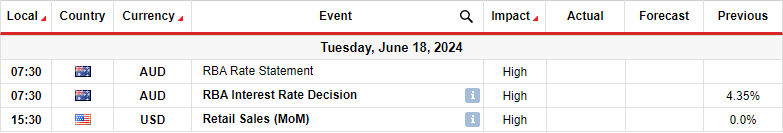

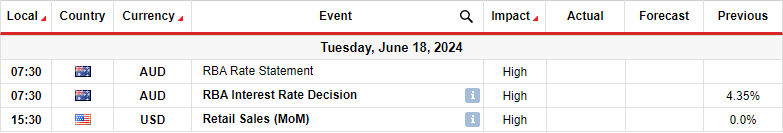

- The Reserve Bank of Australia will hold its policy meeting next week.

The AUD/USD weekly forecast is slightly bearish as the dollar recovers on the Fed’s outlook for one rate cut in 2024.

Ups and downs of AUD/USD

The Aussie ended on a bullish candle but closed well below its highs as the dollar rallied towards the end of the week. During the week, investors focused on consumer and wholesale inflation figures, which came in below estimates. Consequently, there was more confidence that the Fed would cut rates twice this year.

–Are you interested in learning more about Bitcoin price prediction? Check our detailed guide-

However, the Fed had a more hawkish outlook, with policymakers noting that the economy remained strong. As a result, the central bank forecast only one rate cut this year. Therefore, although the dollar started the week down, it ended strong, leading to a decline in the AUD/USD price.

Next week’s key events for AUD/USD

Next week, the Reserve Bank of Australia will hold its policy meeting, probably keeping interest rates unchanged. Furthermore, investors will focus on the US retail sales report, which will show the state of consumer spending in the country.

The RBA is widely expected to maintain rates. However, the market focus will be on the messaging after the meeting, which might indicate when the central bank will start cutting interest rates. Futures currently show a lower than 50% likelihood of a cut in December.

Meanwhile, the US retail sales report will likely show no growth during the month, increasing policymakers’ confidence that the economy is slowing down.

AUD/USD weekly technical forecast: Price fluctuates within 0.6580 support and 0.6701 resistance

On the technical side, the AUD/USD price is caught in a range between the 0.6580 support and the 0.6701 resistance levels. However, bears show more strength within the range, with bigger candles than bulls.

–Are you interested in learning more about forex basics? Check our detailed guide-

Moreover, the price sits below the 22-SMA, a sign that bears are in the lead. The RSI has also crossed below 50, supporting bearish momentum. Therefore, there is a high chance that the price will break below the 0.6580 range support. If this happens, it might collapse further to retest the 0.6401 support level. The price will confirm a downtrend when it starts making lower highs and lows.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/06/16/aud-usd-weekly-forecast-fed-signals-one-rate-cut-for-2024/