As simple as it may sound – receive the invoice, check for correctness, pay the invoice, close the transaction – invoice processing, in most cases, is not a simple workflow.

Any delay or disruption in this process can have a negative impact on your relationships with suppliers and hinder the timely delivery of services, supplies, and materials. Nearly 1 in 5 companies lose out on favourable terms and discounted rates due to delayed vendor payments caused by ineffective invoice processing.

Let us see how invoice processing works, some of the major challenges in doing it manually, and how AP automation can streamlinethe entire process.

What is invoice processing?

Invoice processing or bill processing is the whole gamut of operations associated with the business-end (pun unintended) of purchasing products/services from a vendor.

Invoice processing is the workflow followed by the accounts payable team from the time it receives a supplier invoice. It encompasses all the steps right from receiving a vendor’s invoice to recording the payment after appropriate checks & approvals.

An invoice can be processed for payment only once it clears all the invoice processing steps.

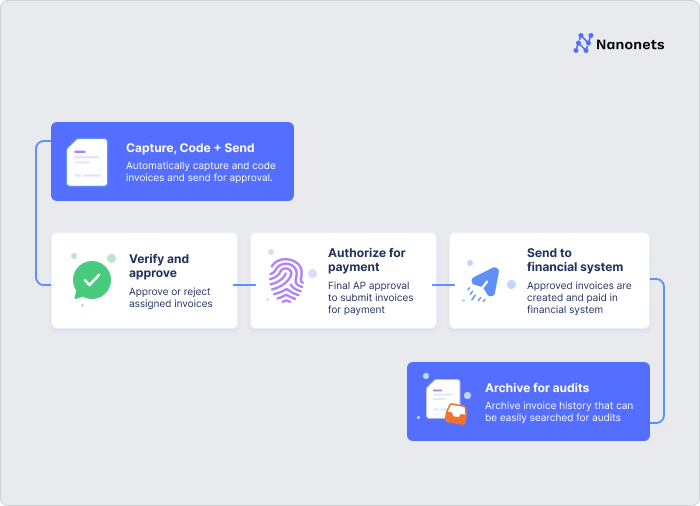

Let’s look at the invoice processing steps in detail:

The invoice processing workflow: How to process invoices?

In medium and large sized companies, invoice processing is part of the accounts payable process. Processing invoices efficiently is important not only to organize cash-flow but also for handling vendors/suppliers to ensure timely procurement.

- Collect and organise invoices sent in via multiple channels: email, post etc.

- Capture invoice data, assign general ledger codes and match the invoice data with supporting documents (POs or receipts).

- in case of discrepancies, the invoice is returned to the vendor.

- Send invoices to authorized approvers to approve or reject, based on internal spend policies.

- Set up payments via wire transfer, ACH or check for the approved invoices.

- Record the payment in your ERP or accounting software.

Challenges in processing invoices manually

Invoice processing can get pretty tedious. Here are some of the most pressing challenges AP teams or finance personnel face while handling invoice processing manually:

Missed or lost invoices

Lost or missed invoices lead to delayed payments, late payment fees, strained vendor relationships, delays in operation, and potential audit issues. This is a problem when a company deals with multiple vendors that send in multiple invoices on a monthly basis. The problem is exacerbated by the fact that invoices can be received by different personnel, in various formats, via multiple sources.

Erroneous or missing data

An invoice contains critical data such as company IDs, tax information, service/product supplied, price, delivery status etc. Since invoices come in various formats, capturing & verifying all relevant invoice data manually becomes quite error-prone. Invoice mistakes lead to both monetary and time losses.

Nearly 40% of invoices contain errors. And nearly a quarter of all invoices are flagged for exceptions that must be addressed by the accounts payable team. Errors in paper-based invoices are pretty expensive to fix – $53.50 per invoice on average!

Invoice approval routing errors

Manually routing incoming invoices to specific stakeholders for approval can get very complicated. Especially if you deal with multiple vendors and have a large organisation. Even the most efficient AP specialist can make a mistake in manually routing an invoice to the appropriate approver/stakeholder. This “high-touch” scenario is particularly stressful, especially when the AP team must close books periodically.

Unknown invoice status

Manual invoice processing keeps vendors pretty much in the dark, unless they reach out personally for updates. Here are some common questions that vendors have due to the lack of transparency: Where is my invoice? Who has approved it What more does it need? When will the payment be processed?

Flagging duplicate invoices

An average AP at a medium scale organisation clerk processes anywhere between 600-800 invoices a month. Identifying duplicate invoices or potential vendor fraud manually is close to impossible!

Automated invoice processing

Manual invoice processing is a pain. Close to 60% of AP personnel reportedly find invoice processing the most detested part of their job. Automating many of the repetitive tasks of the process can conserve time, save money, preserve employee morale, and maintain good vendor relationships.

Automated invoice processing is the process of seamlessly extracting data from invoices entering your system and pushing it into your ERP so that processing a payment can be done in just a few clicks. AP automation software help automate many of the manual steps involved in invoice processing.

Accounts payable teams use AP automation or automated invoice processing software to automate:

- invoice capture and coding

- verification and matching of invoice data against POs and receipts

- approval routing or auto-assigning approvers

- and integrating or reconciling data into accounting or ERP software

The automation of invoice processing offers a clear solution to most, if not all the problems associated with this manual process. Surveys conducted among personnel involved in AP processes shows an overwhelming support for automating a majority of the manual tasks.

Invoice processing steps that are a good fit for automation

Automated invoice processing is clearly a better option than manual invoice processing. It’s faster, more accurate and cost effective in the long run. Here’s a more detailed look at the specific invoice processing steps that could easily be automated:

- Invoice receipt: Given that various formats of invoices are received from different vendors, automatic detection of the various relevant fields in the invoice would help in digitization of the invoice and better management of data. OCR tools come in handy here.

- Invoice validation: It is easy to set up rules to check for data integrity and completeness in invoices. Populating the various data fields in the invoice database can help in detecting incomplete or missing information.

- Three-way matching: Invoices are often raised in response to a PO and are often associated with a receipt. Automated matching of invoices, POs and receipts will hasten the validation process and move the invoice to the next level without delays.

- Exception handling: Exceptions and edge cases are not uncommon in invoice processing. Edge cases may arise due to time zone changes, multiple recurring charges, retrospective price adjustments, and currencies. Some AP automation software, like Nanonets, can handle these edge cases, while others might require differing levels of human intervention.

- The approval process: Digital invoices can be moved along the management hierarchy automatically for approvals based on preset business rules. Or AI-based AP automation tools can auto-assign approvers as well.The setting up of reminders can also help in hastening the process.

- Payment: Digital payments (wire-transfer etc.) can be built into the software to enable automatic payment to the vendor once all approvals have been received.

- Analytics: Automation can enable assessment and analyses of spend patterns and vendor relationships, which could help in course corrections and productive business decisions. AI-based systems would allow better analytics with more training with invoices.

Nanonets for automated invoice processing

Nanonets is an AI-based AP automation software that can streamline the invoice processing for your business. Reduce manual accounts payable effort, save time and resources, set up controls, and gain in-depth visibility into business spends.

Depending on your invoice processing or AP automation needs:

- Automate AP management end-to-end – import, approve and pay invoices in the same platform.

OR - Automate data capture, build workflows and streamline existing AP processes completely.

Takeaway

The automation of invoice processing streamlines the purchase process, enhances transparency of the invoice route, saves time and money, increases employee productivity, and improves vendor relationships. Invoice flow automation allows human employees to concentrate on less mundane, higher-value activities such as planning and strategizing. These can, in turn, lead to improved overall efficiency and profitability of the business.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://nanonets.com/blog/invoice-processing/