- The USD/JPY pair maintains a bearish bias if it stays within the downtrend channel pattern.

- A new lower low activates more declines.

- The US inflation data could change the sentiment tomorrow.

The USD/JPY price was trading in the red at 145.52 at the time of writing. The greenback lost significant ground versus its rivals as the US dollar extended its corrective phase.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

On the other hand, the JPY appreciated versus its rivals as the Yen Futures rallied in the short term. Fundamentally, the USD remains sluggish ahead of the US inflation data.

Tomorrow, the US Consumer Price Index is expected to report a 0.6% in October versus 0.4% growth in September. The CPI y/y could report a 7.9% growth, while Core CPI m/m may register a 0.5% growth. The economic figures are seen as high-impact. The USD/JPY pair could register sharp movements around the US data dump.

Today, the Japanese economic data came in mixed. The Economy Watchers Sentiment came in at 49.9 points versus the 50.0 expected. The current account was reported at 0.67T versus 0.01T estimates, while Bank Lending registered a 2.7% growth exceeding the 2.5% forecasts.

On the other hand, the US is to release the Final Wholesale Inventories, which is expected to report a 0.8% growth.

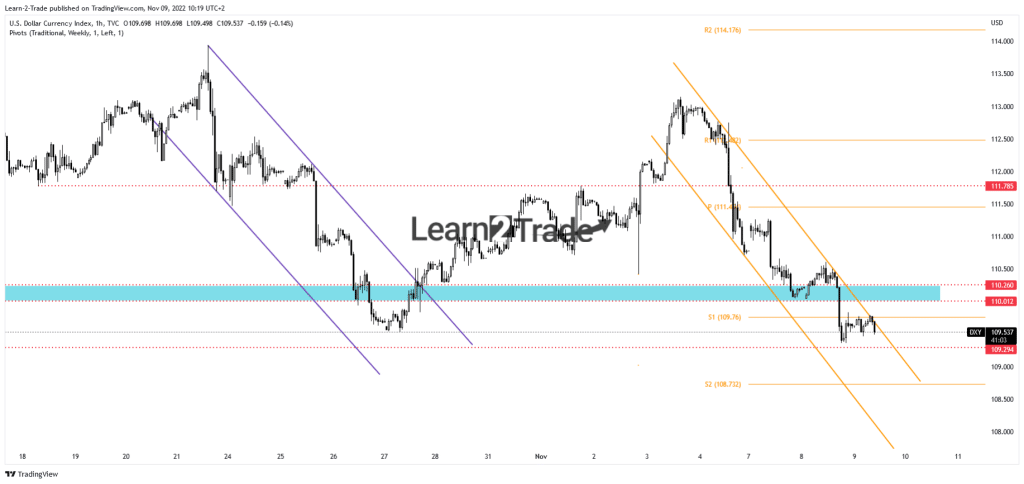

Dollar Index price technical analysis: Downtrend to continue

The DXY slipped and reached the 109.29 historical level. The index could approach and reach new lows if it stays within the downtrend channel pattern. This scenario could announce that the USD could lose more ground versus its rivals. Only staying above 109.29 and making a valid breakout through the downtrend line could announce a new leg higher.

USD/JPY price technical analysis: Down channel

From a technical point of view, the USD/JPY pair stands within a demand zone. It’s trapped between 144.96 and 145.90. The price could drop deeper if it stays within the downtrend channel pattern.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The major down trendline represents dynamic resistance. So, a new leg higher could be activated only after a valid breakout above this upside obstacle. On the other hand, a new lower low, a valid breakdown below 144.96, opens the door for a larger drop.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.