- Japanese bond yields surpassed the central bank’s target.

- The yen has increased by 6% in slightly more than three weeks.

- The US consumer price index dropped to 6.5% in December.

Today’s USD/JPY outlook is bearish. On Friday, the yen gained as investors applauded a decline in US inflation, reaching a seven-month high. Japanese bond yields surpassed the central bank’s target as markets questioned Tokyo’s dedication to losing monetary policy.

–Are you interested in learning more about forex robots? Check our detailed guide-

The yen, which jumped 2.7% against the dollar overnight, continued to climb, rising another 0.2% to $128.65. Since the Bank of Japan shocked markets by enlarging the range around its target yield on 10-year bonds, it has increased by 6% in slightly more than three weeks.

Bets on a future departure from the ultra-easy policy intended to keep rates close to zero have increased in response to a newspaper report indicating the potential for greater flexibility.

On Friday morning, the 10-year Japanese government bonds yield exceeded its new ceiling of 0.5% at 0.53%. In response, the BOJ started conducting unplanned bond purchases.

Naka Matsuzawa, the chief Japan macro strategist at Nomura, made this statement about the central bank’s upcoming meeting, which will take place from January 17–18. “The market is expecting that they will increase the band for the 10-year again at the next meeting,”

Beyond Japan, overnight US December inflation data that more or less met consensus expectations dominated the market’s mood. From 7.1% in November, the annual growth rate in the main consumer price index dropped to 6.5% in December.

Investors’ expectations for US interest rates were revised downward in response. Nearly everyone anticipates a 25 basis point increase from the Federal Reserve rather than a 50 basis point increase next month. The futures markets have also priced in several rate decreases this year.

USD/JPY key events today

No key economic releases from the US or Japan are scheduled for today, so investors will keep reflecting on the US inflation report.

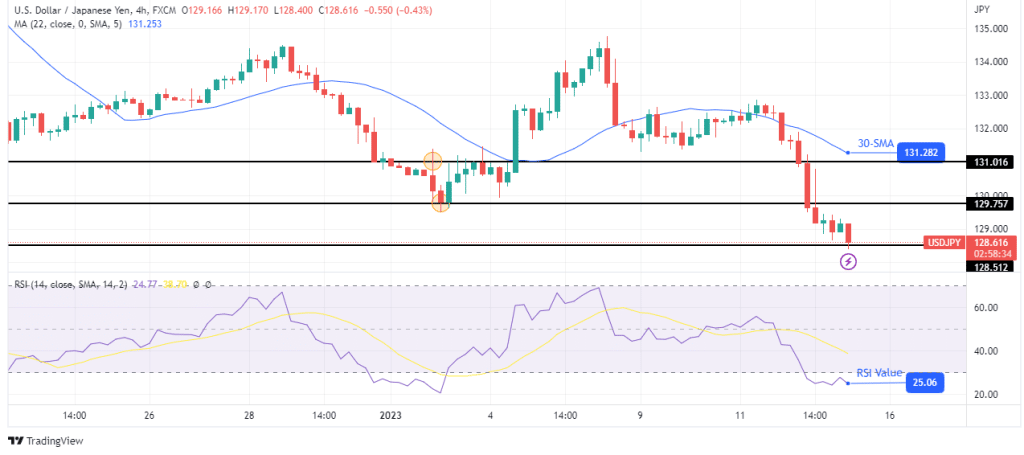

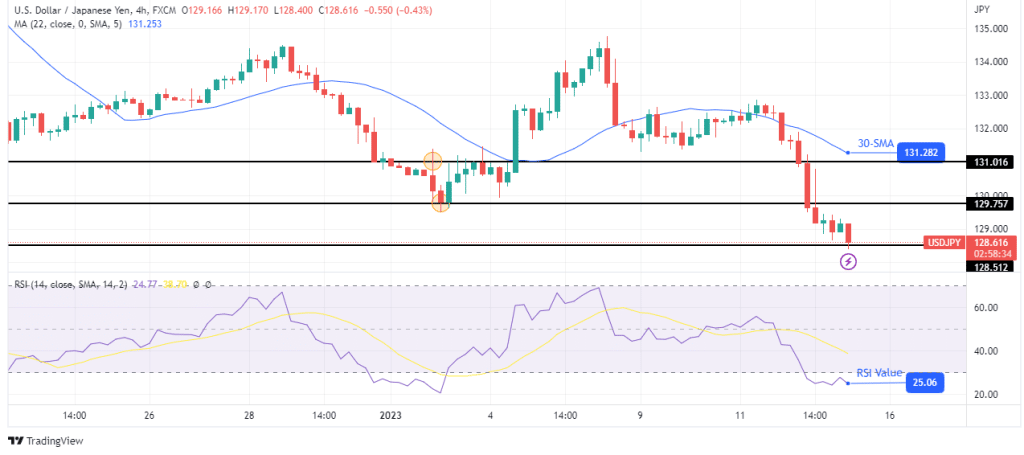

USD/JPY technical outlook: Bulls might return to the oversold region

The 4-hour chart shows USD/JPY in the oversold region after making a strong impulsive move that broke below several support levels. The price is trading far below the 30-SMA, showing the move down was steep.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

However, the move might pause at the 128.51 level as bulls return for a retracement. This might see a pullback before the downtrend goes on and breaks below the 128.51 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-outlook-yen-bulls-applaud-a-decline-in-us-inflation/