Any discussion about the most popular vehicles in the US has to

include the Toyota RAV4. Since January 2019, this compact utility

has ranked among the five most popular vehicles in the country for

thirty-nine out of forty-four months (see summary below). Moreover,

the RAV4 ranked second in retail registrations in 11 of those 44

months, and first this past February.

It therefore is not surprising that in August 2022, the most

recent month for which new retail registration data are available,

more retail customers opted for the RAV4 than for any other model

except the Ford F Series pickup, and the gap between the two was a

mere 230 units.

RAV4 has several strengths. One is its longevity in the market:

RAV4 launched in the US in 1996, earlier than any other in-market

compact car-based crossover except the Kia Sportage, which arrived

a year earlier. (Honda CR-V and Subaru Forester came to market in

1997.) And while the RAV4 obviously has gone through numerous

re-designs and enhancements, it has gone by the same name

throughout its 26-year history, earning coveted model-level equity

with US consumers. In fact, 31% of RAV4 households acquire another

one, above industry-wide model loyalty of 25% in the first eight

2022 ayları.

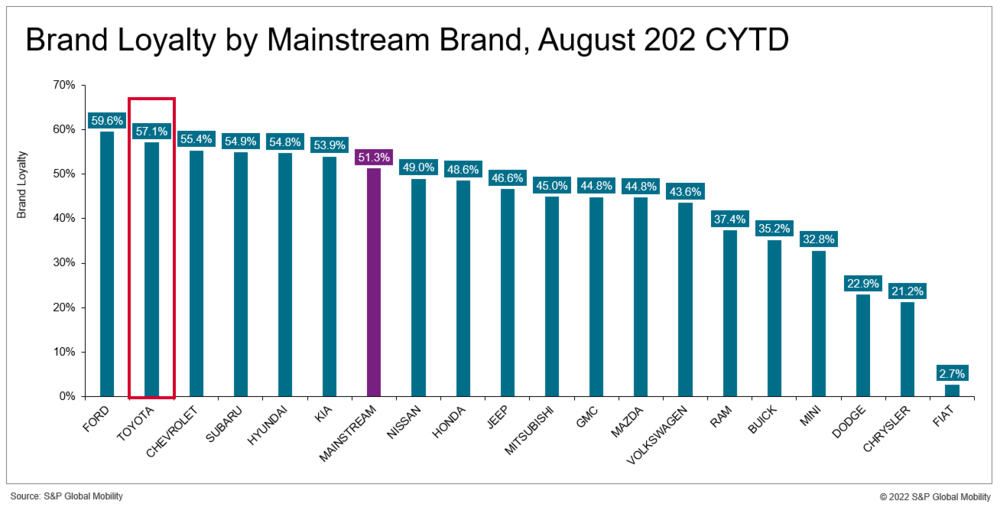

The compact utility also benefits from being part of a strong

brand – 57% of Toyota owners who have returned to market so far in

2022 acquired another Toyota, the highest brand loyalty in the

mainstream market after Ford; this obviously provides a plentiful

source of sales for the RAV4.

The RAV4 also attracts competitive owners at an impressive rate.

Looking again at the first eight months of 2022, RAV4’s

conquest/defection ratio of 1.04 not only indicates a net inflow of

customers (for every 104 households conquested by the RAV4 from

other models, 100 RAV4 households defect to other models), but it

also surpasses Toyota’s average ratio of .88 and is second highest

among Toyota volume models after the Tacoma. However, it is

noteworthy that RAV4 struggles against several competitors, with a

ratio below 1.0 (net outflow) with Jeep Wrangler, Mazda CX-5, VW

Tiguan, Sportage, and Hyundai Tucson, among others.

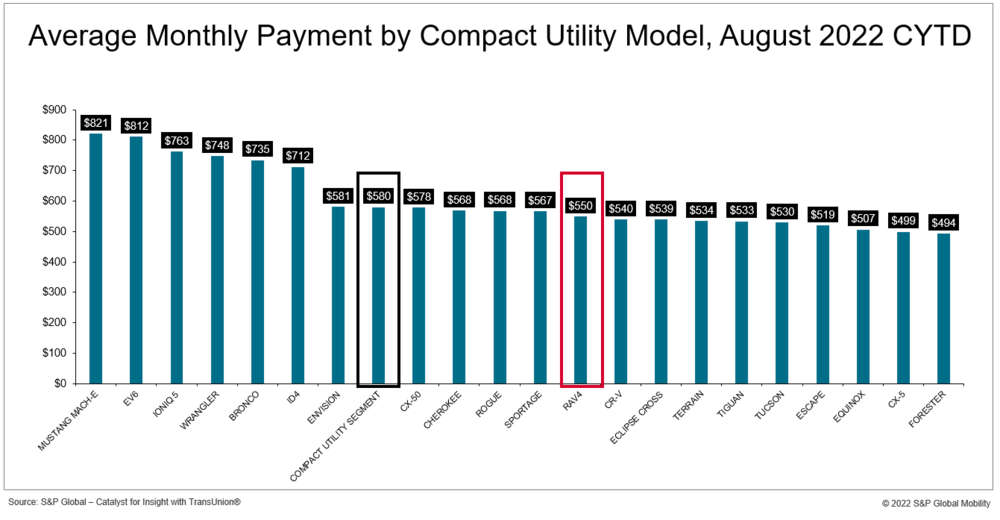

Since vehicle prices still rank high with many consumers, it is

relevant that RAV4 actual monthly payments are very competitive.

Monthly payments for a new RAV4 with a 60-month (or greater) loan

averaged $550 August 2022 CYTD, less than the average Compact

Utility Segment payment of $580 during the same time period. RAV4’s

payment is the tenth lowest among the 23 compact utilities for

which S&P Global Mobility has sufficient financial data, but

still above the payments for such competitors as Forester, CX-5,

Chevrolet Equinox, Ford Escape, Tucson and Tiguan.*

RAV4 also benefits from a choice of powertrains, including both

the traditional internal combustion engine as well as a hybrid

gas/electric offering (Escape, CR-V, Tucson, Wrangler, Sportage,

and Nissan Rogue also offer these two choices). RAV4’s hybrid

installation rate has been rising and reached 58% in Q2 2022,

surpassing 50% for the first time (partially driven by the hybrid’s

impressive combination of fuel efficiency and performance).

Importantly, a RAV4 hybrid buyer will pay just $39 more a month

(with a 60+ month loan) than a RAV4 gasoline customer ($569 vs.

$530), but the hybrid buyer now has an “electrified” vehicle, very

much in vogue these days. In contrast, if the customer acquired the

Toyota BZ4X, the electric counterpart to the RAV4, his monthly

payment of $810 would be $280 above the gasoline monthly

ödeme.

RAV4 hybrids also bring an indirect benefit to the Toyota brand.

Industry-wide, when a hybrid household returns to market, about

13.4% will migrate to an electric vehicle; in contrast, when a

gasoline household acquires a new vehicle, only 4% will migrate to

an EV (see chart below). In this sense, the hybrid serves as a

bridge to a fully electric vehicle, the final destination of the

entire US auto industry.

Note: S&P Global Mobility loyalty data cited in this

report are derived from the Household Methodology, in which the

newly acquired vehicle is not necessarily a replacement for the

original vehicle but may be an addition to the household

filo.

——————————————————————————————————-

İlk 10 Sektör Trendi Raporu

Bu otomotiv içgörüsü, aylık Üst 10

Sektör Trendleri Raporu. Rapor bulguları şu adresten alınmıştır:

yeni ve kullanılmış kayıt ve bağlılık verileri.

Ağustos 2022'yi içeren Ekim raporu kullanıma sunuldu

CFI ve LAT verileri. Raporu indirmek için lütfen aşağıya tıklayın.

Bu makale, S&P Global'in ayrı olarak yönetilen bir bölümü olan S&P Global Ratings tarafından değil, S&P Global Mobility tarafından yayınlanmıştır.