It’s not about the cards you’re dealt, but how you play the hand. That would be an accurate depiction of the insurtech industry in Singapore.

Insurance has been a tough nut to crack, especially in the city-state. Singapore is home to one of the highest saturated insurance markets globally – measured by gross written premiums (GWP) as a percentage of per-capita gross domestic product (GDP).

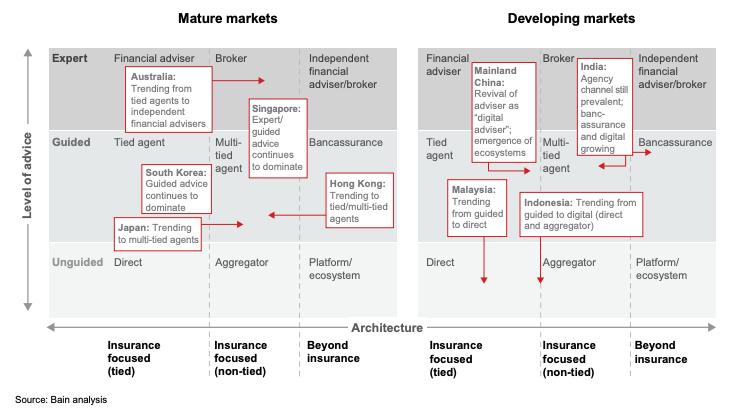

A report by Bain showed incumbents accounted for more than 45 per cent of GWP and annual growth was at 1 per cent for the general insurance market. Furthermore, traditional distribution channels through agents and financial advisors remain the preferred avenue for local consumers to purchase their policies.

Advice from physical advisors and agents remain the dominant distribution channel for insurance in mature markets such as Singapore. (Image Credit: Bain)

In a mature market with incumbents maintaining a strong foothold, insurtech firms in Singapore have been dealt a challenging hand. However, they have played it well.

Insurtech in Singapore is far from a laggard industry. There are more than 80 insurtechs registered on the Singapore Fintech Association. And there has been no shortage of investment into the sector. According to BCG, funding for local insurtech firms accounted for 29 per cent of total fintech funding in 2019. The sector has witnessed significant M&As too. Last year, Singlife merged with Aviva in a US$3.2 billion deal.

Hence, it is clear insurtechs have a role to play within Singapore’s insurance industry.

Supporting role

Given the Republic’s high insurance penetration rate, the value proposition of insurtechs does not lie in reaching new customer segments.

Instead, it is working with incumbents to improve current insurance services and offerings. Therefore, the bulk of services offered by insurtechs are intended to assist incumbent providers to be more customer and data-driven.

While accessing insurance is not a problem for many Singaporeans, challenges around policy applications and processing claims remain. Both require applicants to furnish multiple documents that are a hassle to retrieve. Furthermore, processing timelines can last months on end with the need to communicate through multiple agents.

A number of insurtechs in Singapore are looking to change this narrative with their digital offerings. bolttech is one such example. Under Richard Li’s Pacific Century Group (PCG), the Singapore-based insurtech firm claims it operates the world’s largest online insurance exchange, having transacted US$5 billion in premiums, with over 5,000 products and 150 insurance providers on its platform.

Leveraging PCG’s strength in the insurance space – FWD Insurance is among the investment group’s portfolio – bolttech was able to serve over 7.7 million customers within a year of its launch in 2020. It recently raised a US$180 million Series A round which saw the company valued at over US$1 billion.

While bolttech’s impressive numbers offer local insurtechs a hint of the global insurtech market size they could target, we should not discount the fact being backed by a corporate powerhouse like PCG did significantly accelerate bolttech’s rise.

Undiscovered segments

While the bulk of insurtechs in Singapore focus on working with incumbents to improve their offerings, a few are also looking to launch solutions targeting untapped segments of the market.

Although microinsurance is typically found in developing countries and provides coverage for lower-income families through more affordable policies, local insurtech firm Igloo spun a new take on it by designing one that insures consumer goods instead.

Besides offering conventional personal insurance plans, the company also provides insurance to protect lower-value assets such as electronic gadgets and e-commerce goods.

With digital commerce booming, the move seems to be paying off. Igloo claimed its GWP grew by three times in 2021 over the same period last year.

Igloo’s Transit Insurance Plan protects against e-commerce goods lost or damaged during transit (Image Credit: Igloo)

Meanwhile, Gigacover targets the gig economy by partnering with supply-side platforms to provide white-label insurance solutions. It currently partners with Gojek and Pickupp to provide health insurance for drivers and delivery agents respectively.

Regulators

Apart from market factors shaping the growth of insurtech within Singapore, regulatory support has played an equally important role.

The Fintech Regulatory Sandbox launched by the Monetary Authority of Singapore (MAS) has been widely lauded to promote innovation within the financial services industry and elevate the country to its current status as the region’s fintech hub.

The sandbox enables financial institutions and fintechs to experiment with innovative financial products or services in a live environment but within a well-defined space and duration. PolicyPal was the first graduate in 2016 after completing a 6-month stint within it.

While the sandbox promotes innovation, its efficacy is limited as it only functions as a temporary testing environment. Outside of the sandbox, there has been a lack of long-term policies promoting innovation.

A country local regulators can learn from would be Hong Kong. The country’s Insurance Authority has been supportive of the development of insurtech through its Fast Track authorisation scheme.

The scheme has a dedicated queue for firms seeking to enter the insurance market in Hong Kong using solely digital distribution channels. Since launching in September 2017, four virtual insurers have been granted authorisation by utilising the Fast Track scheme.

Outlook

Given incumbents such as Aviva and Great Eastern maintain a stronghold of Singapore’s insurance market, the long-term success of insurtechs within the city-state would rely on their ability to synergise digital offerings with incumbent solutions.

While the value provided by these startups are clear, working together with a larger incumbent often goes beyond tangible terms. Local insurtech founders noted it has been challenging for startups to work with large organizations, due to resistance caused by conflicting agendas from different internal stakeholders.

However, the recent M&As within the insurtech industry represents a step in the right direction and could be a glimpse into the future of how incumbents and startups can work together.

Besides serving as validation of synergies between insurtechs and incumbents, these M&As are healthy for the industry as they represent a proven exit route for insurtechs in Singapore.

This increases investor confidence and the ensuing influx of capital will allow insurtechs to scale their solutions, generate larger exits and create a flywheel effect that will be beneficial for the long-term growth of insurtech in Singapore.

Featured image credit: Photo by Jason Rost on Unsplash

PlatoAi. Web3 Reimagined. Data Intelligence Amplified.