Saxo Bank is a brokerage platform that was founded in 1992, and as the Saxo Bank reviews show, it was originally named Midas. In 2001, the broker got a license from the FSA which is the Danish Financial Supervisory Authority.

Also, the Saxo Bank review noted that the company changed its name after getting the license and today it provides online services to financial markets and customers in 170 countries.

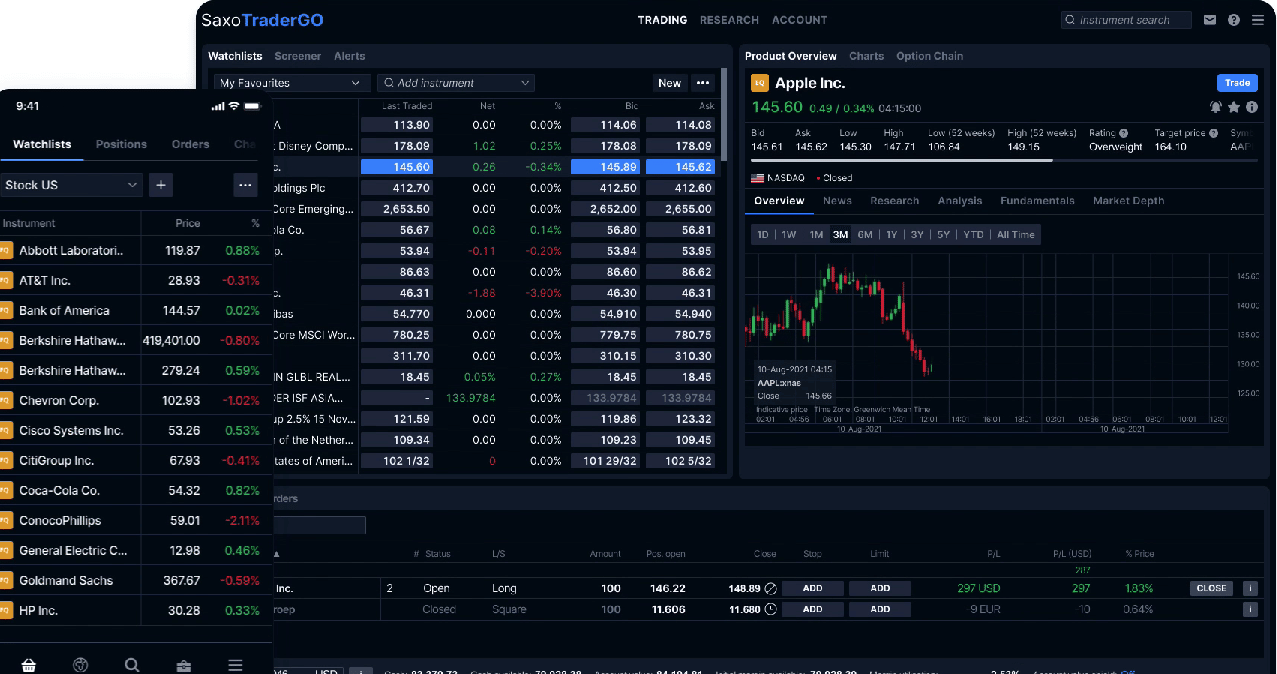

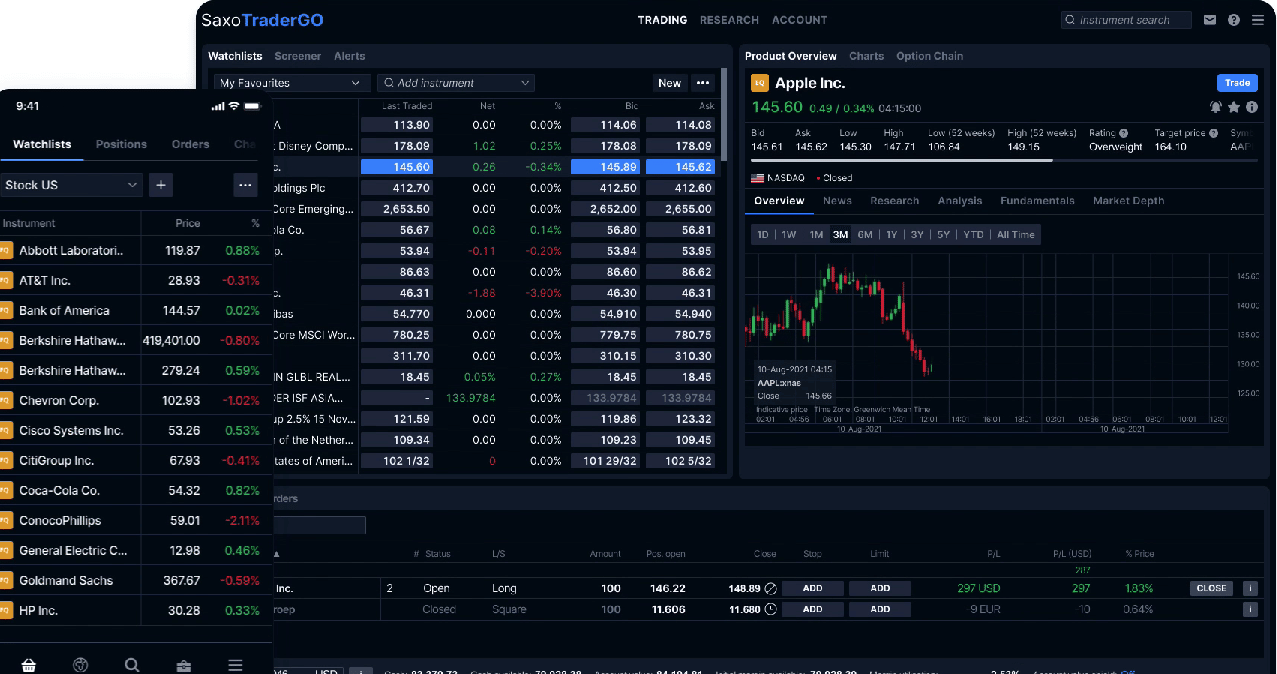

The SaxoTraderGO Terminal, a key feature of the brokerage, was recognized as the best trading platform for active trading. The Danish investment bank was founded in 1992 as mentioned in the Saxo Bank reviews and provides online trading and investment services. What’s also interesting is that it is regulated by the UK’s Financial Conduct Authority, making it one of the safer options on the market.

The brokerage is a global service provider and operates among multiple legal entities in different regions of the world. The services offered by these entities differ slightly concerning fees and product portfolios.

What Types Of Investment Does Saxo Bank Offer?

The Saxo Bank broker review outlines that this is a multi-asset broker that allows investors a huge selection of up to 60,000 tradeable options. In addition, the Saxo Bank forex review shows an opportunity to electronically trade on markets for every asset like FX, FX options, Non-deliverable forwards, Stocks, stock options, Exchange Traded Funds, futures, and bonds.

Exchange-traded securities: Saxo Bank offers ISA/SIPP accounts in addition to CFD shares trading

Cryptocurrency: crypto trading is also available via derivatives but it is not available by simply buying Bitcoin. Also, keep in mind that crypto CFDs are not available to retail traders in the UK.

Fees And Account Types At Saxo Bank

Overall, Saxo Bank broker reviews show that the platform delivers decent all-around pricing. For active traders and all traders that want to maintain large balances, Saxo Bank offers really low pricing options.

Back in 2020, the EUR/USD average spreads were 0.8 and 0.7 as well as 0.6 pips for the Classic, Platinum, and VIP accounts which means that the pricing for the Platinum and VIP accounts ranks among the best options for forex brokers. The Classic Account is much closer to the industry average.

The entry-level Classic account requires up to 2000 EUR of minimum deposit but the minimum deposit can also vary depending on where the user lives.

The Platinum account minimums are set between $200,000 and AUD 300,000 for example. And traders with the Classic account can also qualify to be upgraded to Platinum if they earn enough loyalty points via their Loyalty Program. Simply said, trading over $40 million of forex, will get you about 120,000 points which will be enough to acquire a Platinum level for a year.

The VIP account minimum offers the most savings for an account in pricing and it is reserved for elite investors that can deposit up to a million USD. The traders that want to have their account tier upgraded to VIP will have to trade up to $167 million in forex volume and the upgrade will be available for a year.

Zero Commission– the Saxo Bank trading platform reviews show that they make money off the spread but there is one exception and that is when traders that trade less than 50,000 units each month, will get a ticket fee of up to $3 per side.

What Kind Of Trading Apps Does It Support?

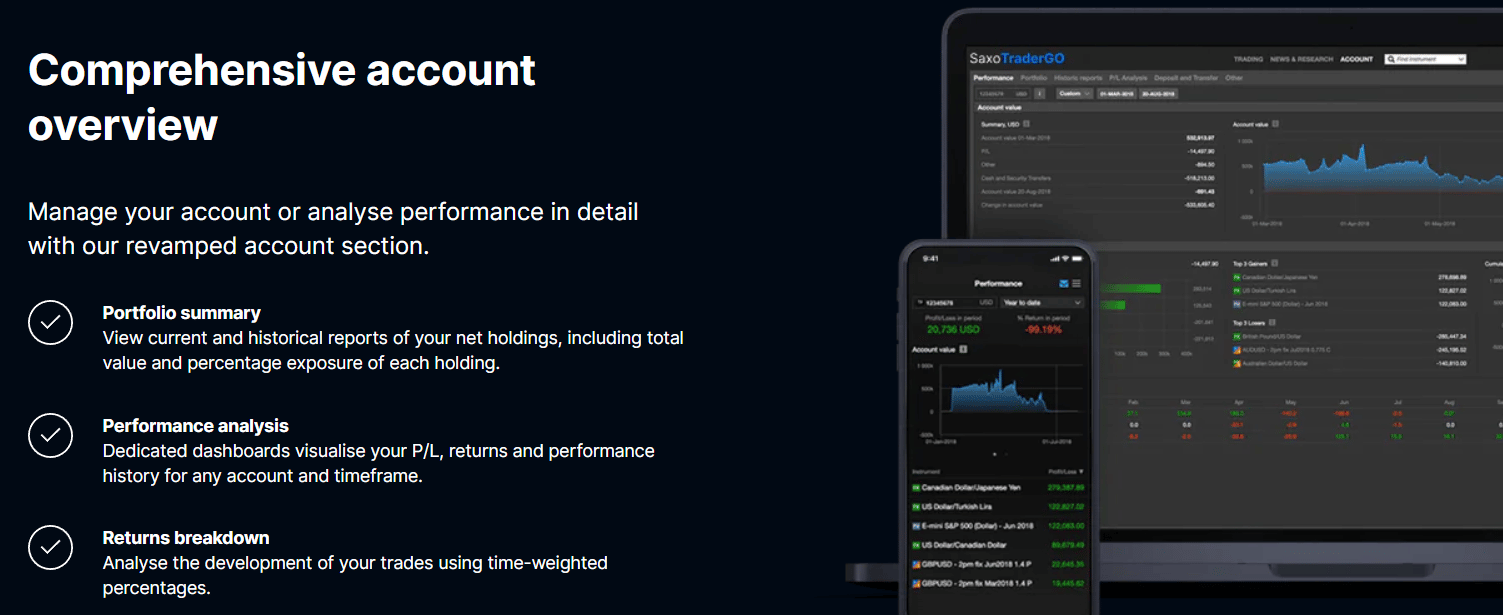

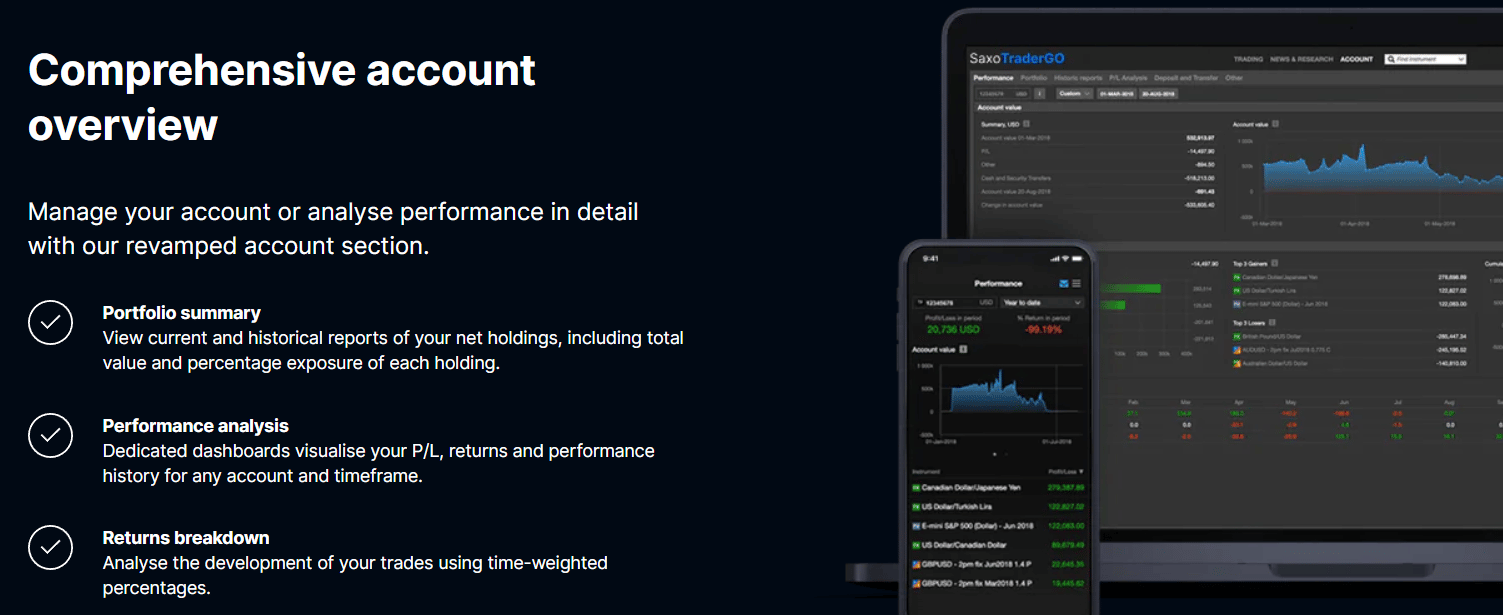

Saxo Bank utilizes the Saxo TraderGO web-based platform on all devices. This mobile app got a few negative comments from users due to bugs and updates but it is still one of the better ones on the market.

The SaxoTradeGO mobile app is really simple to use because of its intelligent design. One main feature that users appreciate is the ability to access useful information in different tabs for a given asset. For example, when seeing the EUR/USD pair, traders can check up on news, articles, headlines, and trading signals. The design of the app and the vast array of available information makes it easy for traders to make better decisions when assessing the markets.

The app also offers comprehensive charting with up to 20 drawing tools and 62 indicators that match the experience on the web-based version. Also, some syncing watchlists and charts are in sync with the browser-based version.

The trading tools that can be located on the web version are also available in the mobile app like the trading ticket window, research tabs, and screener features. The platform offers economic calendars, videos, and market news updates from reliable sources and also, there’s an option for a strategy finder that comes with multiple strategies that can help you out with a given instrument.

The main desktop platform is similar to the mobile app however, the Saxo Bank reviews show that the platform offers a larger selection of trading features.

Saxo Bank License And Regulation

If you decide to trade with Saxo, you can be sure that your money is in a safer space compared to other market competitors.

Saxo Bank is a fully licensed EU-based bank that is supervised by the Danish FSA. They comply with strict reporting requirements and management regulations under the EU directives which aim to protect the users and customers.

The regulatory status only guarantees to keep users’ funds safe and what’s interesting is that it was the first broker in Denmark to gain approval from the EU Investment Directive in 1996. Now, it operates across multiple countries and cooperates with other regulators.

Saxo Bank is incorporated in Denmark as a licensed bank under the number 1149 which makes it regulated under Italy, the Czech Republic, and the Netherlands.

FAQ

Is Saxo Bank Legit?

Being a regulated broker under the Danish and EU laws makes this broker a legit option for trading.

Is Saxo bank regulated?

Yes. Saxo Bank is regulated under Danish law as well as under EU laws and operates as a licensed bank since it was founded in 1992.

Is the customer service satisfactory?

The Saxo Bank broker reviews mostly focused on this part, with many negative comments coming exactly about the lack of customer support.

Is Saxo bank reliable?

Saxo Bank is one of the better reliable options for trading on the market, but always make sure to do your own research and invest only the amounts you are prepared to lose.

- Coinsmart. Europe’s Best Bitcoin and Crypto Exchange.Click Here

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.dcforecasts.com/reviews/saxo-bank/