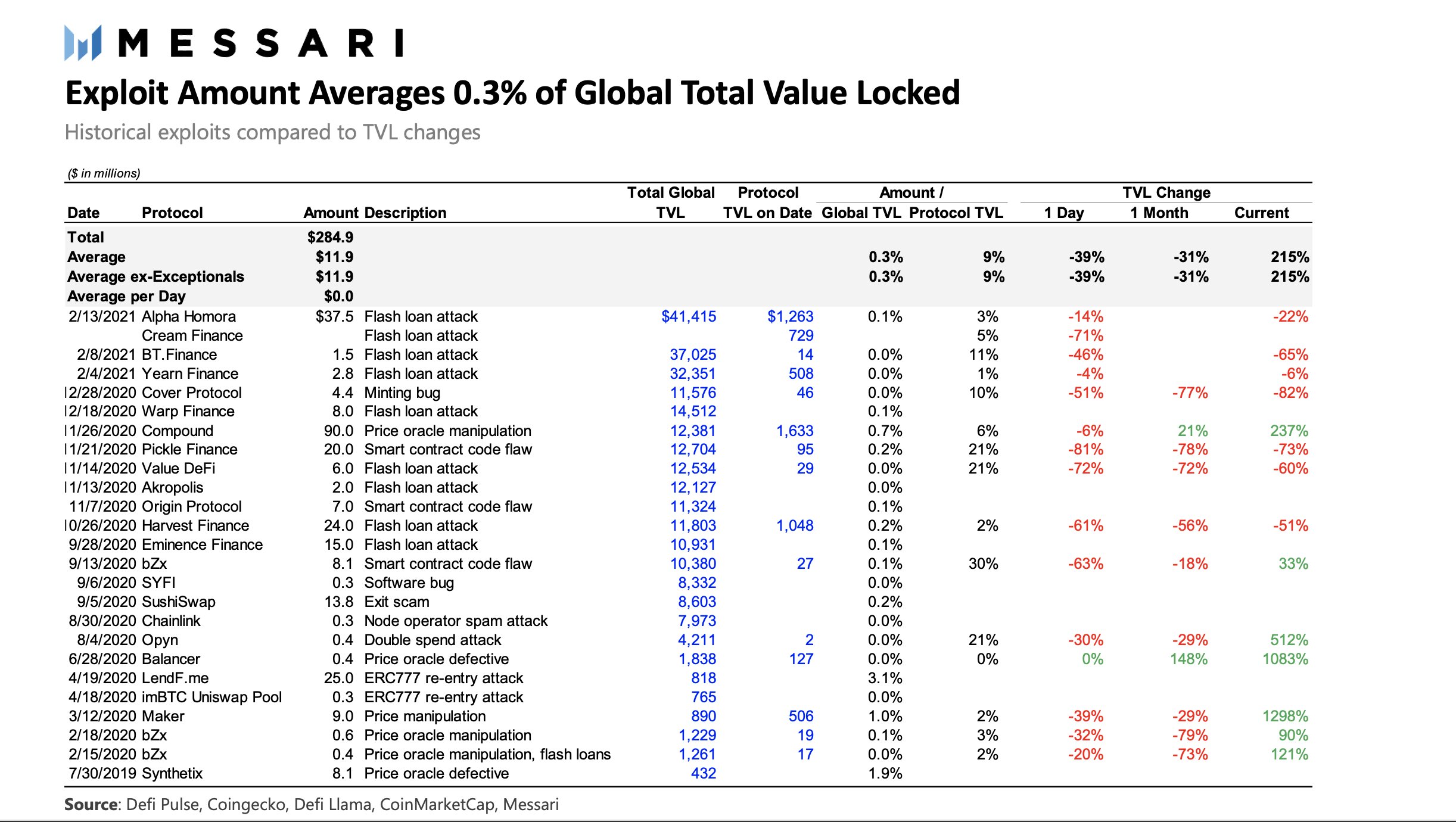

Messari has calculated that over $284 million has been lost to hackers from decentralized finance (DeFi) hacks and exploits since 2019.

Crypto data platform Messari has revealed that over $284 million in DeFi hacks since 2019 has been lost for good. Messari tweeted the calculation, providing details on individual hacks.

It also pointed out that the DeFi insurance market only covered a fraction of the losses, emphasizing the need for insurance growth.

DeFi dangers

The exploits amount to about 0.3% of the current total value locked (TVL). DeFi’s TVL currently stands at $117.6 billion, though the figure could be much higher.

Several hacks have occurred since the DeFi sector started gaining momentum. Many of these were due to oversights in smart contract coding. The most notable of these were the Alpha, Cream Finance, bZx, and Compound hacks. Most recently, EasyFi was hacked for $6 million.

By amount, one of the largest hacks was BzX, which suffered multiple attacks—one of which was for $8 million. Another notable incident was when a hacker stole $25 million from dForce, exploiting the same vulnerability that was used in the 2016 DAO hack.

But the most notable of them all to occur recently was the Binance Smart Chain based Uranium, which was exploited for a whopping $50 million. The hack occurred as Uranium was upgrading to a newer version. The attacker is having trouble cashing out the funds, most of which are in wrapped BNB and BUSD.

Such incidents have shown some doubt in the market, but nowhere near enough to kill the momentum. The increasing number of hacks led to protocols placing an emphasis on auditing. However, decentralized insurance coverage has emerged as an additional layer of security for investors.

Time is ripe for decentralized insurance

Messari suggests that the time could be ripe for insurance protocols which, sure enough, are growing tremendously. Projects include Nexus Mutual and Etherisc, among many others. Nexus Mutual itself was subject to an $8 million hack.

These protocols have pooled funds that cover losses by investors should an incident occur. It has been gaining traction since late 2020, but has not risen to the point where it is ubiquitous.

Perhaps that is because projects are now ensuring that no hack can occur in the first place. But crypto being so early in its years, perhaps there are still ways in which smart contracts can be exploited going forward. Chainlink co-founder Sergey Nazarov pointed out last year that flash loan attacks would probably rise.

It would certainly offer some peace of mind to investors, who are taking to DeFi as much as ever. DeFi’s TVL has been growing strong, despite having a phenomenal 2020.

Some analysts believe that the Bitcoin bull run will result in profits flowing into DeFi. The new inflow will then support lending protocols that result in steady gains over time, which will be reinvested in Bitcoin.

Several new protocols, including scalable networks and P2P lending protocols, are supporting a new wave of DeFi dapps. In such an environment, decentralized insurance could prove to be very valuable.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Coinsmart. Beste Bitcoin-Börse in Europa

Source: https://beincrypto.com/messari-defi-exploits-total-284-million-since-2019/