Pan-African digital classifieds company Jiji has raised $21 million in Series C and C-1 financing from six investors, led by Knuru Capital.

The Nigeria-based venture, co-founded by Ukrainian entrepreneur Vladimir Mnogoletniy, has an East to West presence that includes Ghana, Uganda, Tanzania and Kenya.

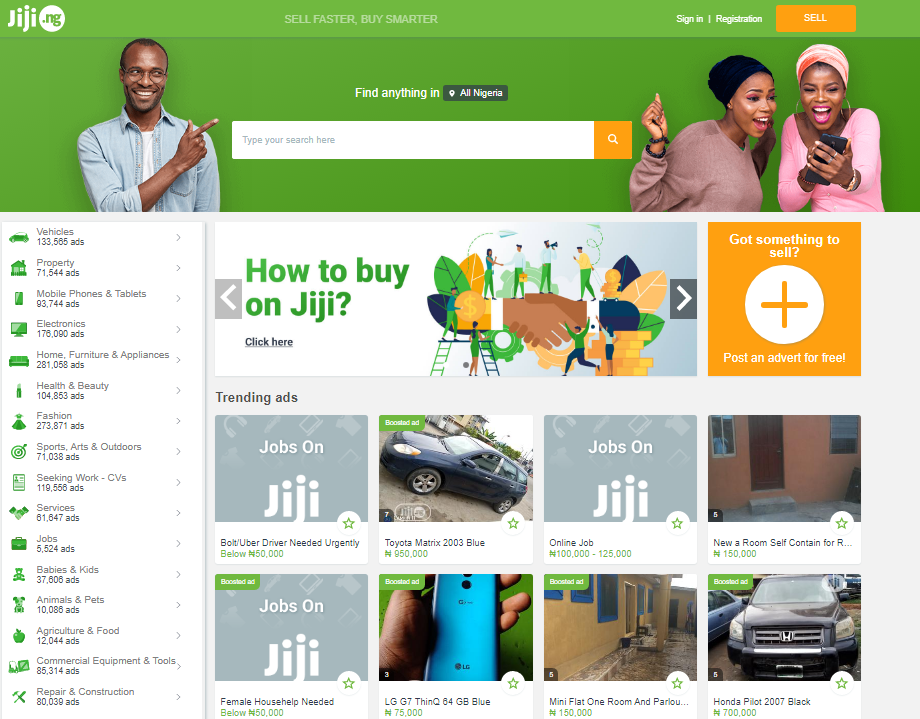

Buyers and sellers in those markets use Jiji to transact purchases from real estate to car sales.

“We are the largest marketplace in Africa where people can sell pretty much anything…We are like a combination of eBay and Craigslist for Africa,” Mnogoletniy told TechCrunch on a call.

The classifieds site has two million listings on its Africa platforms and hit eight million unique monthly users in 2018, per company stats.

Jiji sees an addressable market of 400 million people across its operating countries, according to Mnogoletniy. The venture bought up one of its competitors in April this year, when it acquired the assets of Naspers-owned online marketplace OLX in Nigeria, Ghana, Kenya, Tanzania and Uganda.

Jiji’s top three categories for revenues and listings (in order) are vehicle sales, real estate and electronics sales (namely mobile phones).

With the recent funding, the company’s total capital raised from 2014 to 2019 comes to $50 million. Knuru Capital CEO Alain Dib confirmed the Abu Dhabi-based fund’s lead on Jiji’s most recent round.

Jiji plans to use the latest investment toward initiatives to increase the overall number of buyers, sellers and transactions on its site. The company will also upgrade the platform to create more listings and faster matching in the area of real estate, according to Mnogoletniy.

For the moment, Jiji doesn’t have plans for country expansion or company purchases. “Maybe at some point we will consider more acquisitions, but for the time being we’d like to focus on those five markets,” Mnogoletniy said — referring to Jiji’s existing African country presence.

For the moment, Jiji doesn’t have plans for country expansion or company purchases. “Maybe at some point we will consider more acquisitions, but for the time being we’d like to focus on those five markets,” Mnogoletniy said — referring to Jiji’s existing African country presence.

To ensure the quality of listings, particularly in real-estate, Jiji employs an automated and manual verification process. “We were able to eliminate a high-percentage of fraud listings and estimate fraud listings at less than 1%,” said Mnogoletniy.

He recognized the challenge of online scams originating in Nigeria. “We take data protection very seriously. We have a data-control officer just to do the data-protection verification.”

With the large consumer base and volume of transactional activity on its platform, Jiji could layer on services, such as finance and payments.

“We’ve had a lot of discussions about adding segments other than our main business. We decided that for the next three to five years, we should be laser-focused on our core business — to be the largest marketplace in Africa for buying and selling to over 400 million people,” Mnogoletniy said.

The company faces an improving commercial environment for its goals, with Africa registering some of the fastest growth in the world for smartphone adoption and internet penetration.

Jiji also faces competitors in Africa’s growing online classifieds space.

Pan-African e-commerce company Jumia, which listed in April in an NYSE IPO, operates its Jumia Deals digital marketplace site in multiple African countries.

Swiss-owned Ringier Africa has classified services and business content sites in eight French and English-speaking countries. On car sales, Nigerian startup Cars45 has created an online marketplace for pricing, rating and selling used autos.

Adding to the trend of foreign-backed ventures entering Africa’s internet business space, Chinese-owned Opera launched an online buy/sell site, OList, last month connected to its African payment app, OPay.

And eBay operates a partnership with Mall for Africa for limited goods sales from Africa to the U.S., but hasn’t gone live yet on the continent.

On outpacing rivals in its markets, Jiji’s co-founder Mnogoletniy touts the company’s total focus on the classifieds business, market experience and capital as advantages.

“We’ve spent five years and raised $50 million to build Jiji to where it is today. It would take $50 to $100 million for these others to have a chance at building a similar business,” he said.

Read more: https://techcrunch.com/2019/12/09/jiji-raises-21m-for-its-africa-online-classifieds-business/