- Gold price settles around $1,950 after extending retracement on Monday.

- Bright metal volatility is here to stay in the short term.

- Balance between inflation, growth and financial stress will shape Gold market.

Gold price has settled around $1,950 in a quiet start to Tuesday trading. The bright metal extended its retracement on Monday on another volatile day, dipping to $1,944 before closing at $1,957, losing more than 1% on the day. It was the seven consecutive day where Gold price range moved over 1%, either up or down.

Things look a lot calmer now, although a sneaky busy Tuesday economic docket could shake things up again. Central bank bosses Andrew Bailey (Bank of England) and Christine Lagarde (European Central Bank) scheduled to speak at different events and the publication of the CB Consumer Confidence in the United States. The banking sector seems to have stopped providing big headlines, but the debate among policymakers on whether to tighten or ease the monetary policy amid sticky inflation figures will likely keep the market guessing and swinging.

What’s next for Gold in a volatile market?

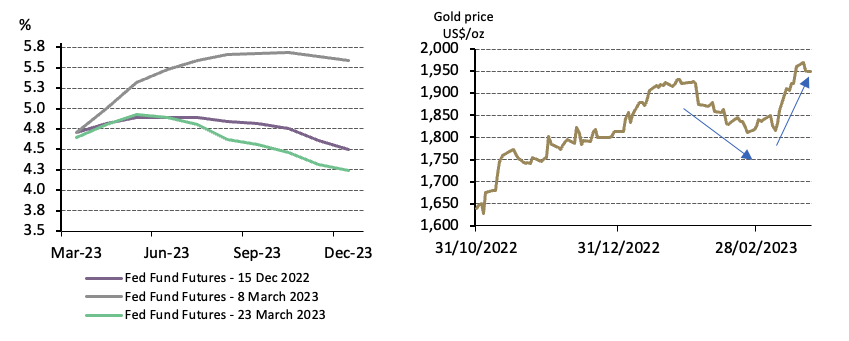

The surging volatility seen recently in financial markets could be here to stay as expectations over future interest rates remain unclear. All central bankers, most notably the US Federal Reserve (Fed), refused to indicate a clear path for their monetary policy in their recent meetings, and the market is trying to figure out what that means.

Gold price reacting to recent fluctuations in interest rates (Source: World Gold Council)

Jeremy de Pessemier, Asset Allocation Strategist at the World Gold Council (WGC), analyzes the implications of this blurry scenario for Gold price in an article published on the WGC website. De Pessemier says that while it is “unknown” for “how long the Fed will hold rates at elevated levels”, the US central bank “is under a lot of pressure to fight inflation” and “avoid a replay of 1970s.”

The World Gold Council strategist also acknowledges, though, that “getting inflation down to 2% is causing economic and financial damage”, which makes him write that “we may be close to the peak of central bank hawkishness”. If this is true, Gold price would be supported, “particularly if accompanied by a mild recession.” De Pessemier believes determining “the extent to which the crisis of the past week causes banks to tighten credit” is “a key issue” to understand what market we will live in.

His analysis concludes that short-term developments in “growth and inflation” will determine the immediate moves of Gold price. Regardless of that, de Pessemier also points to a long-term bullish scenario for the precious metal:

“Longer term, gold has a key role as a strategic long-term investment and as a mainstay allocation in a well-diversified portfolio. While investors have been able to recognise much of gold’s value during times of market stress, the structural dynamics pointing towards a low-growth, low-yield environment should also be supportive for the precious metal.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.fxstreet.com/news/gold-finds-support-at-1-950-volatility-to-continue-as-market-awaits-central-bankers-next-move-202303280818