Happy Sunday, Friends!

One of the more unusual businesses to emerge over the last decade is that concerning aerial firefighting and wildfire management. This isn’t too surprising, given that the frequency of wildfires, coupled with the increase in severity, has cost governments and businesses billions of dollars around the globe. One of the companies that have emerged as a winner in the space over the last decade is Bridger Aerospace, which recently made its public debut after a SPAC deal. Will Bridger Aerospace continue to spark its growth ablaze, or will it fizzle out?

Nature’s Fury

To understand the reason for the emergence of the aerial firefighting industry, one only needs to look at the data surrounding the increase in wildfires and their subsequent impact on the economy. Climate change, coupled with land management practices, has led to a severe increase in fire-related disasters (and are only projected to get worse – with instances of wildfire growing by 50% by 2100). According to the UNEP report, over the last two decades, there was an average of 423 million hectares of land burned per year globally (equivalent to the landmass of the EU).

Wildfires have especially been more pronounced in California, with thirteen of the twenty most destructive incidents taking place in the past five years. All in all, the United States witnesses over 60 wildfires annually, collectively destroying 40,000 homes, businesses, and properties, costing the economy tens of billions of dollars in the process.

While traditional firefighting has been ground-based, Air-based suppression has started quickly growing thanks to its speed and mobility, increased water capacity, and better access to harder-to-reach areas. In fact, air-based suppression now accounts for 43% of the $22 billion Firefighting addressable market.

The logistical challenges coupled with the rapid response time required to mobilize resources have meant that federal and state agencies have become increasingly motivated to outsource aerial firefighting to private organizations in the past few years. Bridger Aerospace, which was founded in 2014 by former Navy SEAL Tim Sheeby, has emerged as one of the companies to benefit from this change.

Sponsored this week by…

Want to Find the Best De-SPACs? Try Benzinga

(Offer Expires 02-12-2023)

I use tons of trading software to help me better understand the market and make smarter trading decisions. One thing I love about Benzinga Pro is its versatility. It wasn’t built for just one type of trader but for a wide range of experienced investors like myself. I can create custom watchlists, and then quickly monitor the performance of my investments.

Some great news – Benzinga is giving all subspac readers a free two week trial!

From Combat to Crisis Control

Bridger started off as an aerial company focused on assisting ranchers with tracking cattle from the air but quickly pivoted a year later after they saw the opportunity in aerial firefighting. Bridger has continued to land various local, state, and federal contracts over the last few years, including from the US Department of Interior, US Department of Agriculture, Minnesota’s Department of Natural Resources, Nevada’s Division of Forest, California Department of Forestry & Fire Protection, and others.

The company primarily provides aerial wildfire management, relief, and suppression to its federal and state clients, using its fleet of aircraft. Bridger has 20 aircraft in total, which includes a mix of Super Scoopers capable of dropping 100,000 gallons of water per day, Air Attack and Logistical Support aircraft to monitor data, and Unmanned Ariel Vehicles to provide situational awareness in night operations and low visibility conditions. In addition to the firefighting services, Bridger offers a data surveillance and reporting platform that complements its core business.

This includes analyzing layered data to understand fire intensity, size, and location, consolidating information and imagery, and delivering it through a near real-time interface to users for the potential impact of wildfires. Despite the company’s successful track record of growing its fleet and commercial operations, investors remain skeptical about the size of the market and the potential to replicate its technology.

While there’s enough reason to be skeptical, Bridger should continue to see its commercial revenues grow, both as a result of increased governments as well as fleet expansion, as the number of wildfires along with the duration of the wildfire season expands in the coming decade. Furthermore, given the significant capital investments and regulatory hurdles to build and operate a fleet, it isn’t likely that there would be many challengers trying to stop the incumbent.

Financials and Valuation

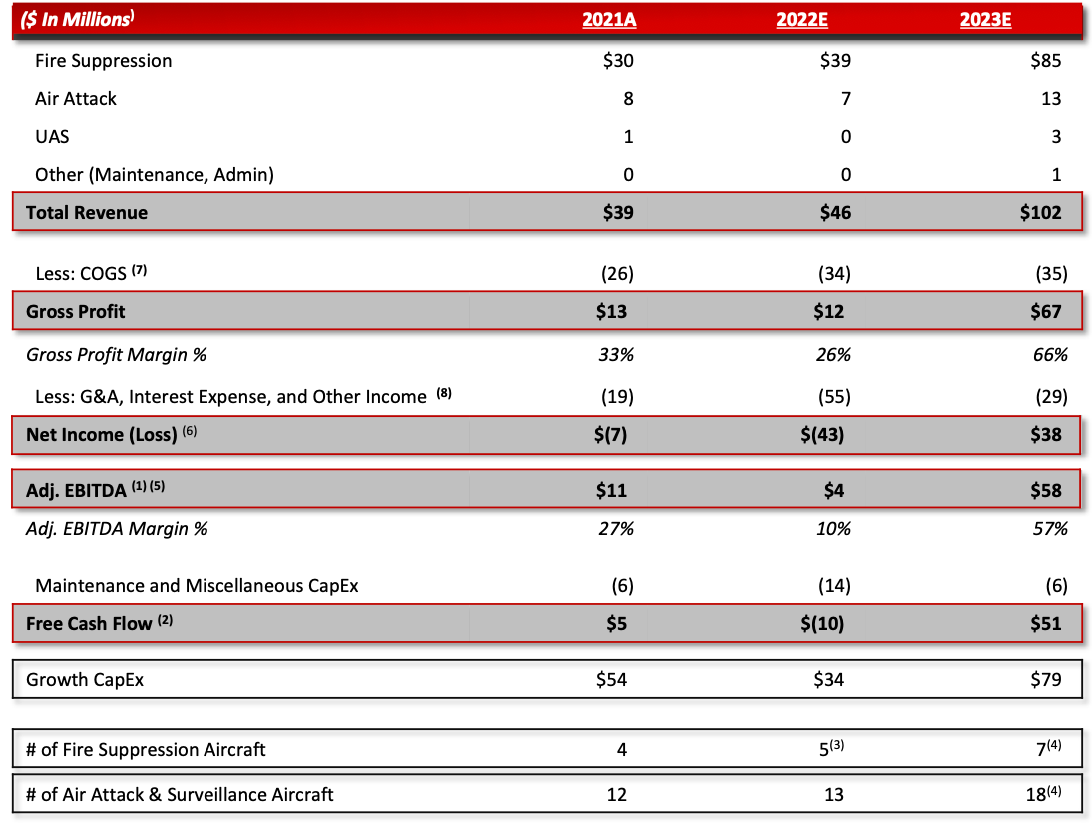

Bridger went public in a deal that valued the firm at an enterprise value of $915 million. Since the merger closed, the company’s value has nearly halved, indicating that the initial deal could have overvalued the company. Bridger reported revenues of $46 million in 2022 (16% growth vs. 2021) while projecting revenues of $102 million for 2023.

However, these projections will depend on the severity of the wildfires across the US and the duration of the actual wildfire season. There are other variables to consider, including the number of additional contracts that the company lands and the number of super scoopers acquired. Bridger says each scooper costs $32 million but can add between $6 and $11 million in EBITDA.

The company said it plans to add two new super scoopers in 2023, funded from the existing cash on hand. This is expected to add incremental operating leverage, increasing the company’s margins from 27% to 57% by 2023.

Assuming that the SPAC merger generated at least $100 million (redemption numbers were not released after the deal, so cash proceeds are unclear), this could result in an expansion of operating profits to $84 million by 2024, bringing the valuation to a reasonable 5.8x forward EV/EBITDA multiple. However, investors should proceed with caution, given the heavy capital expenditure nature of the business and the unpredictable/seasonality that could drive revenues and profits.

Bottom Line

Aerial firefighting services provider Bridger may be overlooked by many since its operations may be too niche or too simple to replicate. However, these investors may be overlooking the rapidly growing addressable market and the barriers to entry that currently exist to service government contracts. Bridger has had a consistent track record of growing its fleet, rolling out new products and features, and landing new multi-year contracts with local, state, and federal authorities. Investors looking at the opportunity should still consider waiting on the sidelines, given the unpredictable nature of the business, the capital requirements, and the lack of visibility on future growth.

Source: Fighting Fire With Fire

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://spacfeed.com/fighting-fire-with-fire?utm_source=rss&utm_medium=rss&utm_campaign=fighting-fire-with-fire