Singapore’s burgeoning fintech landscape, reliable physical infrastructure and progressive regulations are attracting Australia’s fast-growing high-potential, insurtech startups looking to take on Southeast Asia.

Citing the city-state’s strategic location, high digital adoption, vibrant ecosystem of industry stakeholders eager to embrace cutting-edge technology, combined with the support of Accelerator programmes, like Firemark Accelerate, startups such as ActivePipe, Gruntify, ProofTec and Truuth, view Singapore as the gateway to the region.

Backed by Insurance Australia Group (IAG) and supported by the Australian Trade and Investment Commission (Austrade) Landing Pad, Firemark Accelerate was launched in 2020 as the leading insurtech accelerator in APAC.

Stephen Skulley

“The Firemark Accelerate programme and Austrade are an excellent partnership to launch Australian technology scaleups into Singapore and ASEAN. This co-delivery partnership brings together Firemark’s expertise in technology and innovation, and Austrade’s knowledge on navigating overseas markets and connecting Australian businesses to the world.

Following the success of the first season, we have now expanded our partnership to support the market expansion activities of another six scaleups across deep tech, cybersecurity and digital services,”

said Austrade’s Senior Trade and Investment Commissioner, Stephen Skulley.

The programme lays the foundations for startups to land and expand into new markets, to find new potential partners and investors, and to become corporate ready.

Meet four of the seven participating startups from Season 2:

ActivePipe

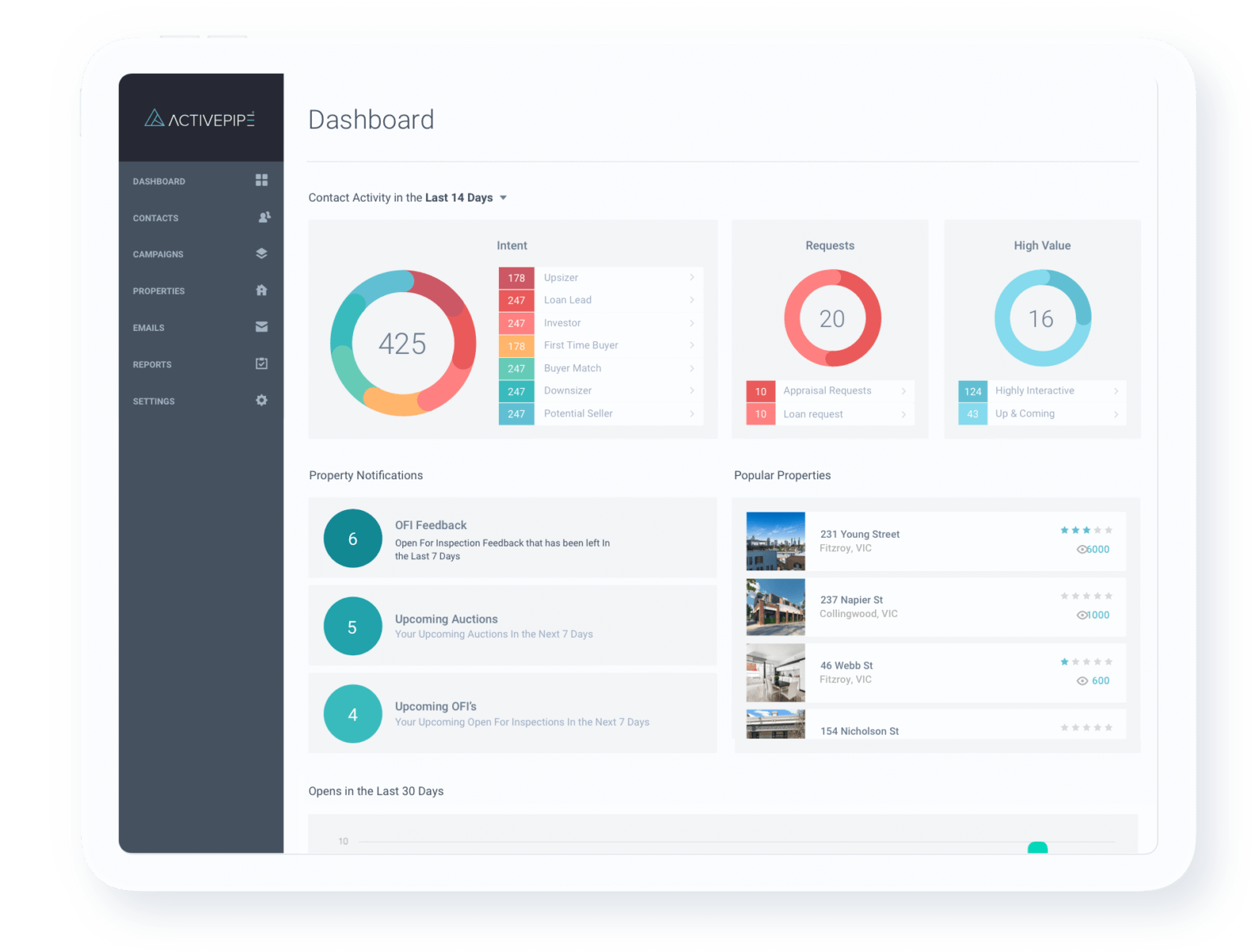

ActivePipe is an email marketing and lead-nurturing platform for real-estate professionals that leverages predictive technology to make it easier for property managers to understand their customers.

Their solution uses surveys and behavioural data to automatically deliver relevant property content, from intelligently matched listings and open house reminders, to expertly written articles.

Founded in 2014, ActivePipe builds, sells and services lead nurturing and sales enablement software for real estate brokerages, agents and mortgage brokers. Through email marketing, ActivePipe can identify a consumer’s intent to buy, sell or invest in real estate and make sure that they are receiving relevant, timely content from their real estate agent.

With an interest to tap into Singapore’s tech expertise and capabilities, the team from ActivePipe shared:

“Singapore is well known for being the technology and innovation hub of Asia. ActivePipe is excited to be able to leverage this to mature its data capabilities.”

ActivePipe has already signed several clients overseas, notably in North America where it will continue to strengthen its foothold this year and onward.

ActivePipe dashboard, activepipe.com

Gruntify

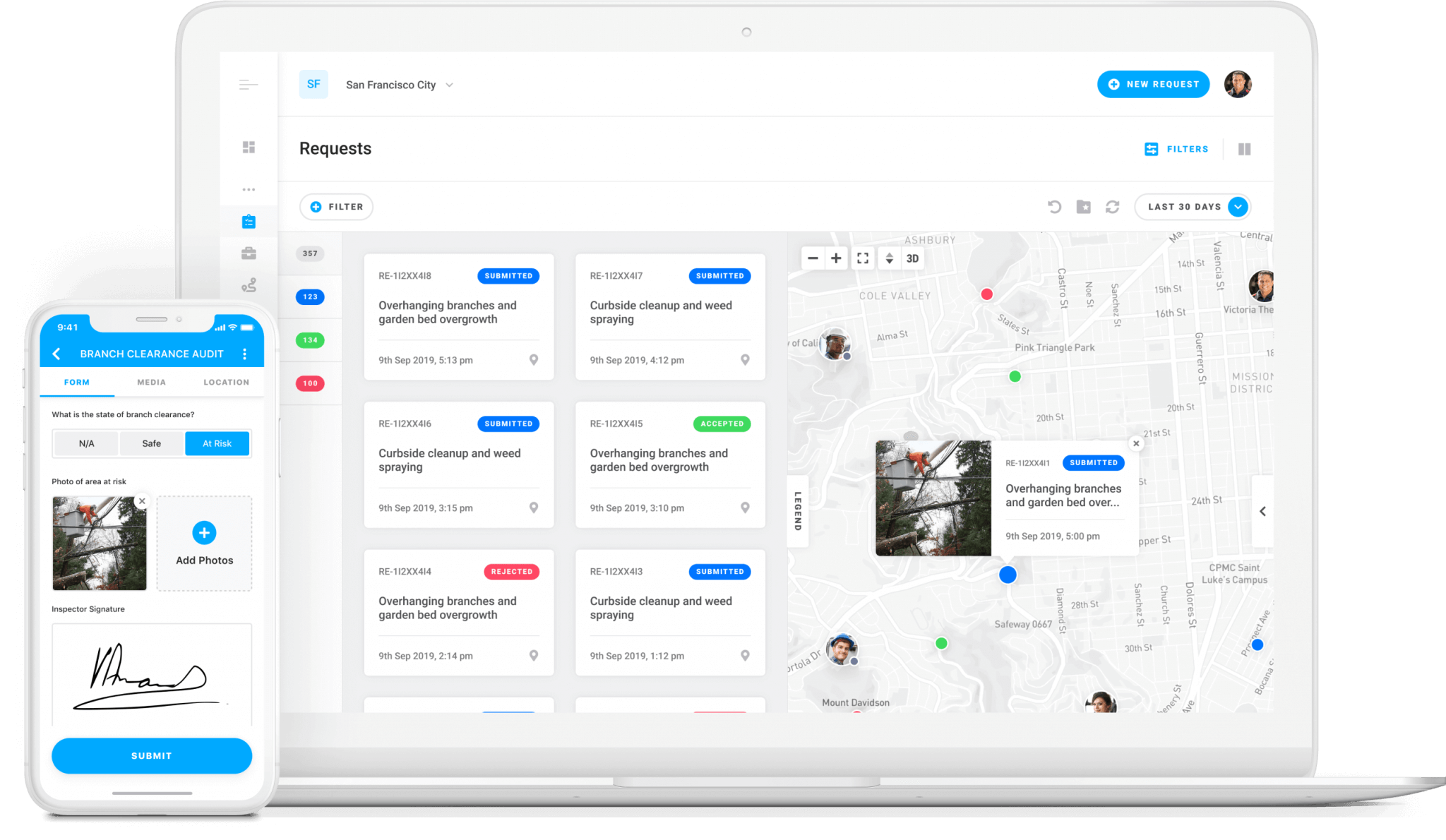

For Gruntify, a cloud-based technology platform for field productivity and workflow automation, Singapore’s strategic location in Asia paired with their business-friendly environment makes it “a perfect choice to springboard into the broader Asian market”, explained Founder and CEO, Igor Stjepanovic.

“Singapore is also a very multicultural place with strong work ethics, where innovation is clearly valued – those traits, attributes and values are very important to us and fundamental to our own purpose,”

Igor added.

“Consequently, we consider Singapore the epitome of location we want to be doing business in.”

Gruntify, which emerged from an Open Innovation Challenge hosted by PwC and Queensland Government back in 2015, helps organisations collect field data, manage assets, automate job assignment, manage teams and automate business processes, all from a single platform. With powerful metrics and location intelligence, businesses can discover trends and get answers fast, reducing costs and minimising risks.

Gruntify platform, via Gruntify.com

ProofTec

ProofTec’s founders, Danny Cohen and Dr Jeroen Vendrig, know that unbiased evidence about car damage gives peace of mind for the driver as well as accurate cost recovery when things do go unexpectedly wrong.

Founded in 2017, ProofTec has developed an automated damage detection technology platform that identifies, assesses and reports incremental changes on a vehicles’ exterior condition.

ProofTec was established to make all parties in a car rental transaction happy using proprietary vision AI technology.

Their solution leverages a proprietary AI image processing algorithm and can be deployed through fixed security cameras as well as on standard smartphones or tablets through a mobile app.

When asked about what their future looks like after finishing the 12-week Firemark Accelerate programme in mid-June 2021, Danny Cohen, Founder and CEO shared,

“We’re excited to continue our expansion into adjacent business domains, particularly insurance, to help data driven decision making.

Finally, we are very much looking forward to a post COVID world where we can once again meet face-to-face with our current and prospective global customers in countries outside of Australia!”

He also shared that Singapore is an ideal landing pad and logical stepping stone for ProofTec given the mature stakeholder ecosystem and it being a gateway for their business to springboard into other regions across ASEAN.

Image provided by ProofTec

Truuth

Truuth, a startup providing an integrated suite of digital identity services, has a mission to deliver the world’s most accurate, secure, and user-friendly digital identity services.

Founded in 2018, Truuth is already serving clients like Macquarie Bank and Australian Finance Group (AFG) and their solution can be delivered through a globally scalable SaaS platform.

They’re scheduled for a global launch of Truuth Biopass, a multi-biometric “passwordless” authentication solution, in the next 3 months. Biopass aims to empower users to append to their digital identity and use any combination of biometrics (face, voice or fingerprint), thereby enabling them to replace insecure passwords with their biometrics for all online interactions.

Founder and CEO, Mike Simpson, has named Asia one of its primary target regions, and is now looking to establish a presence in Singapore.

“We see a great fit with Truuth as our technology is world leading and our business model is disruptive.

“As we plan for our Series A funding round, we see Singapore as a key market for Truuth to have a presence in … and a logical launch pad for expansion throughout Asia,”

Mike shared.

Truuth Biopass, How it works, via truuth.id

Firemark Accelerate also worked with startups like Detexian, who were able to establish a strong presence in Singapore during season 1, where it has, since participating, landed three new customers in Singapore.

Detexian is an Australian startup providing businesses with an automated risk management solution powered by software-as-a-service (SaaS) applications.

Tan Huynh, CEO of Detexian said,

“Staying on top of multiple SaaS apps without automation is an impossible endeavour.

We help Singapore modern workplaces continuously track their SaaS use at ease, minimising risks and cost wastages.”

Singapore, one of the largest fintech hubs in the world, is home to some of Asia’s top insurtechs, a large community of committed investors, and major insurance and broking companies.

Visit the Australian Trade and Investment Commission’s website here.

Featured image credit: Unsplash and Pexels

PlatoAi. Web3 Reimagined. Data Intelligence Amplified.

Click here to access.