- Fed’s Waller said the recent inflation readings support a delay in rate cuts.

- The likelihood of a Fed rate cut in June has fallen to 60%.

- BoE’s Jonathan Haskel warned against expecting early rate cuts.

The GBP/USD outlook is bearish as the dollar gains strength amidst fading expectations of a Fed rate cut. Moreover, market participants are gearing up for more economic data from the US that might give clues on Fed rate cuts.

-Σας ενδιαφέρει να μάθετε για το καλύτεροι μεσίτες forex συναλλαγών AI? Κάντε κλικ εδώ για λεπτομέρειες-

The dollar strengthened after Fed Governor Christopher Waller said the recent inflation readings support a delay in Fed rate cuts. Notably, some policymakers have lost confidence in the progress of inflation after the last report beat forecasts. As a result, investors are also doubting whether the Fed will be able to implement three rate cuts.

The likelihood of a rate cut in June has fallen to 60%, boosting the dollar. However, this figure could change as more data comes in. The US will release data on GDP and jobless claims. However, the focus is on Friday’s core PCE report, which will show the state of inflation.

Another higher-than-expected inflation figure could further strengthen the dollar, as it would diminish rate-cut expectations. Moreover, markets might price in less than three cuts in 2024.

Meanwhile, the Bank of England has assumed a more dovish stance. However, some policymakers still believe rate cuts are a long way off. BoE’s Jonathan Haskel warned against expecting early rate cuts. According to him, although headline inflation has dropped, the BoE is focused on persistent and underlying inflation, which remains high. Therefore, June might be too early for the central bank to start easing its monetary policy. Markets currently expect the first cut to be in June or August.

Βασικά γεγονότα GBP/USD σήμερα

- US final quarter-on-quarter GDP

- Αμερικανοί αρχικοί ισχυρισμοί για την ανεργία

- Εκκρεμείς πωλήσεις κατοικιών στις ΗΠΑ

- καταναλωτικό συναίσθημα των ΗΠΑ

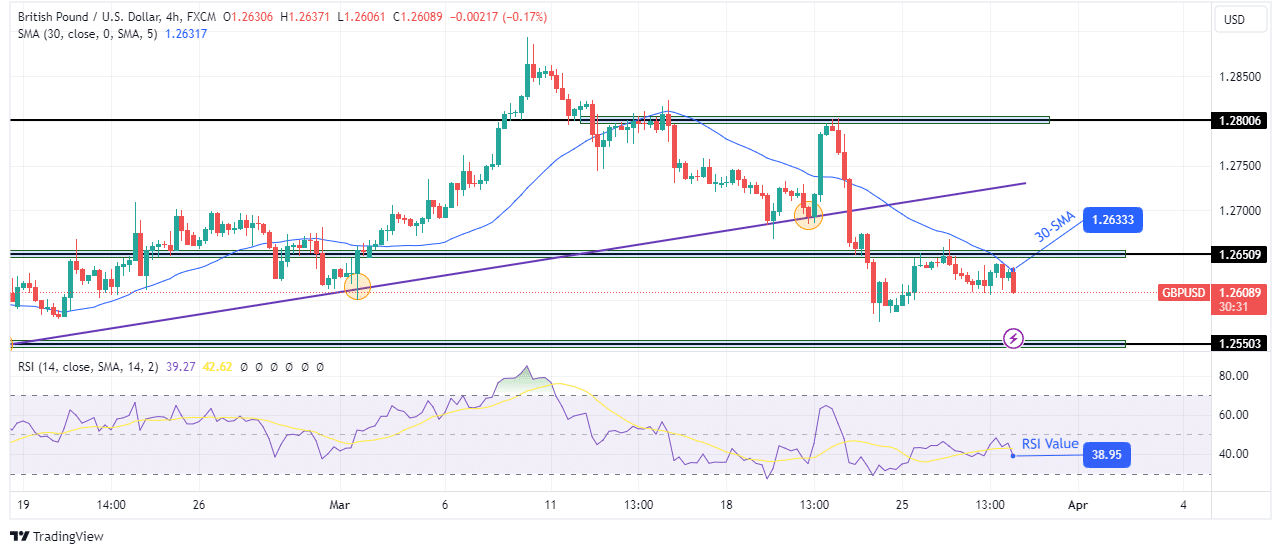

GBP/USD technical outlook: Price dips following 1.2650 resistance

On the charts, the GBP/USD price is declining after retesting and respecting the 1.2650 key resistance level. The bearish bias is strong as the price has established its downtrend with lower highs and lows. At the same time, it is now respecting the 30-SMA as resistance and might soon swing well below the line.

-Σας ενδιαφέρει να μάθετε για το forex δείκτες? Κάντε κλικ εδώ για λεπτομέρειες-

Meanwhile, the RSI is in bearish territory, below 50. Therefore, bears might soon make another lower low. The next immediate target for the downtrend is at the 1.2550 support level. The decline will continue below this level if the price stays below the SMA.

Θέλετε να ανταλλάξετε forex τώρα; Επενδύστε στο eToro!

Το 68% των λογαριασμών επενδυτών λιανικής χάνουν χρήματα όταν ανταλλάσσουν CFD με αυτόν τον πάροχο. Θα πρέπει να εξετάσετε εάν μπορείτε να αναλάβετε τον υψηλό κίνδυνο απώλειας των χρημάτων σας.

- SEO Powered Content & PR Distribution. Ενισχύστε σήμερα.

- PlatoData.Network Vertical Generative Ai. Ενδυναμώστε τον εαυτό σας. Πρόσβαση εδώ.

- PlatoAiStream. Web3 Intelligence. Ενισχύθηκε η γνώση. Πρόσβαση εδώ.

- PlatoESG. Ανθρακας, Cleantech, Ενέργεια, Περιβάλλον, Ηλιακός, Διαχείριση των αποβλήτων. Πρόσβαση εδώ.

- PlatoHealth. Ευφυΐα βιοτεχνολογίας και κλινικών δοκιμών. Πρόσβαση εδώ.

- πηγή: https://www.forexcrunch.com/blog/2024/03/28/gbp-usd-outlook-fed-rate-cut-expectations-decline/