- The Swiss National Bank cut interest rates by 25 basis points.

- Fed policymakers emphasized caution as the central bank prepares to cut rates.

- The data revealed a drop in consumer sentiment in Australia.

The AUD/USD outlook points upwards as the dollar steps back from recent peaks as traders take profits. However, the journey hit a minor bump as Australia unveiled disappointing consumer sentiment figures for March.

-Σας ενδιαφέρει να μάθετε για το καλύτεροι μεσίτες forex συναλλαγών AI? Κάντε κλικ εδώ για λεπτομέρειες-

The dollar rallied last week as it became clear that major central banks were preparing to cut rates later this year. This came after the Swiss National Bank cut interest rates by 25 basis points to 1.5%. Notably, the move highlighted the more cautious Fed, leading to a rally in the dollar.

On Monday, Fed policymakers emphasized caution as the central bank prepares to cut rates. Some, including Raphael Bostic, even lost confidence that inflation would soon reach the 2% target.

Furthermore, the currency is subdued ahead of a slow, short week. Investors are now expecting the core PCE price index figures to provide a better look at the state of inflation. If the figures beat forecasts, it could lead to another rally in the dollar, as it would increase doubts about a Fed rate cut in June.

Meanwhile, in Australia, data revealed a drop in consumer sentiment due to economic worries. This decline followed the RBA meeting, in which the central bank became more neutral. However, the report shows that consumers have little expectation for rate cuts in the country. This led to a brief decline in AUD/USD before the pair recovered due to the weaker dollar.

Βασικά γεγονότα AUD/USD σήμερα

- Εμπιστοσύνη καταναλωτή CB των ΗΠΑ

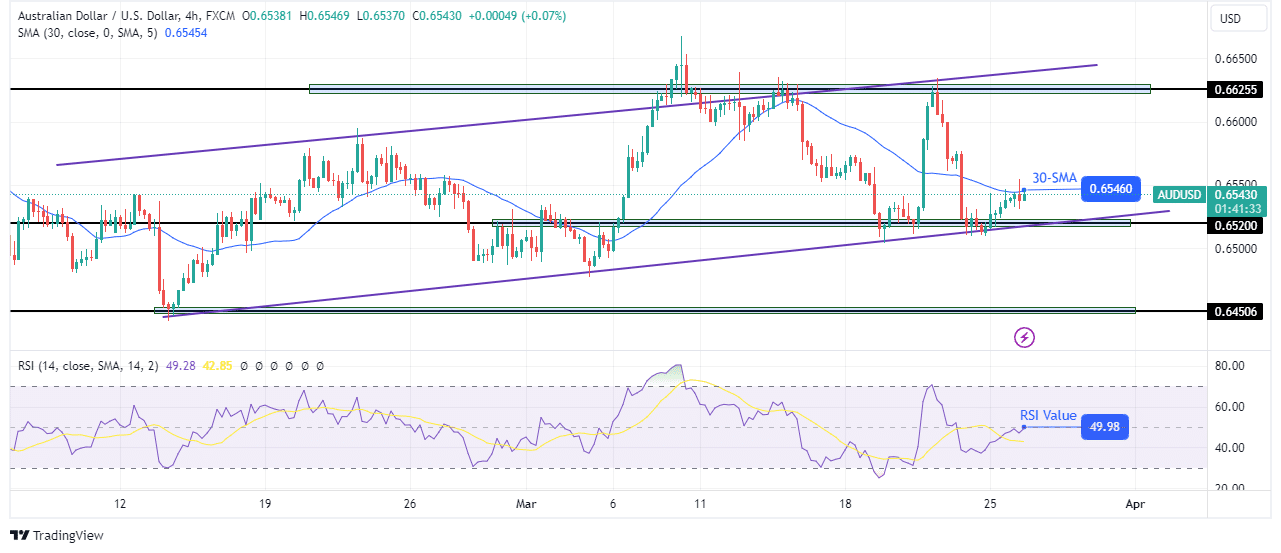

AUD/USD technical outlook: Weak bulls challenge 30-SMA resistance

On the technical side, the AUD/USD price is climbing after retesting a support zone comprising the 0.6520 support level and its channel support line. Notably, the price has been trading in a bullish channel, bouncing higher every time it retests the support. At the moment, bulls have taken charge.

-Σας ενδιαφέρει να μάθετε για το forex δείκτες? Κάντε κλικ εδώ για λεπτομέρειες-

However, price action shows weak momentum, as seen in the small-bodied candles. At the same time, the price is facing the 30-SMA resistance, which might pose a challenge. If the SMA holds firm, the price might break out of its channel to retest the 0.6450 support level. On the other hand, if bulls push above the SMA, the price will likely make a new high above the 0.6625 level.

Θέλετε να ανταλλάξετε forex τώρα; Επενδύστε στο eToro!

Το 68% των λογαριασμών επενδυτών λιανικής χάνουν χρήματα όταν ανταλλάσσουν CFD με αυτόν τον πάροχο. Θα πρέπει να εξετάσετε εάν μπορείτε να αναλάβετε τον υψηλό κίνδυνο απώλειας των χρημάτων σας.

- SEO Powered Content & PR Distribution. Ενισχύστε σήμερα.

- PlatoData.Network Vertical Generative Ai. Ενδυναμώστε τον εαυτό σας. Πρόσβαση εδώ.

- PlatoAiStream. Web3 Intelligence. Ενισχύθηκε η γνώση. Πρόσβαση εδώ.

- PlatoESG. Ανθρακας, Cleantech, Ενέργεια, Περιβάλλον, Ηλιακός, Διαχείριση των αποβλήτων. Πρόσβαση εδώ.

- PlatoHealth. Ευφυΐα βιοτεχνολογίας και κλινικών δοκιμών. Πρόσβαση εδώ.

- πηγή: https://www.forexcrunch.com/blog/2024/03/26/aud-usd-outlook-dollar-retreats-amid-profit-taking/