Whilst DeFi governance tokens remain firmly in bearish territory, investors get a glimmer of hope this week, as blue chips rally in a strong uncorrelated move up ~+20% against the broader market.

Amongst all the bearish sentiment, small parts of the sector continue to show flashes of activity. While the majority of mid to small cap projects resemble ghost towns, a handful of DeFi projects on Ethereum are establishing signals of persistent adoption.

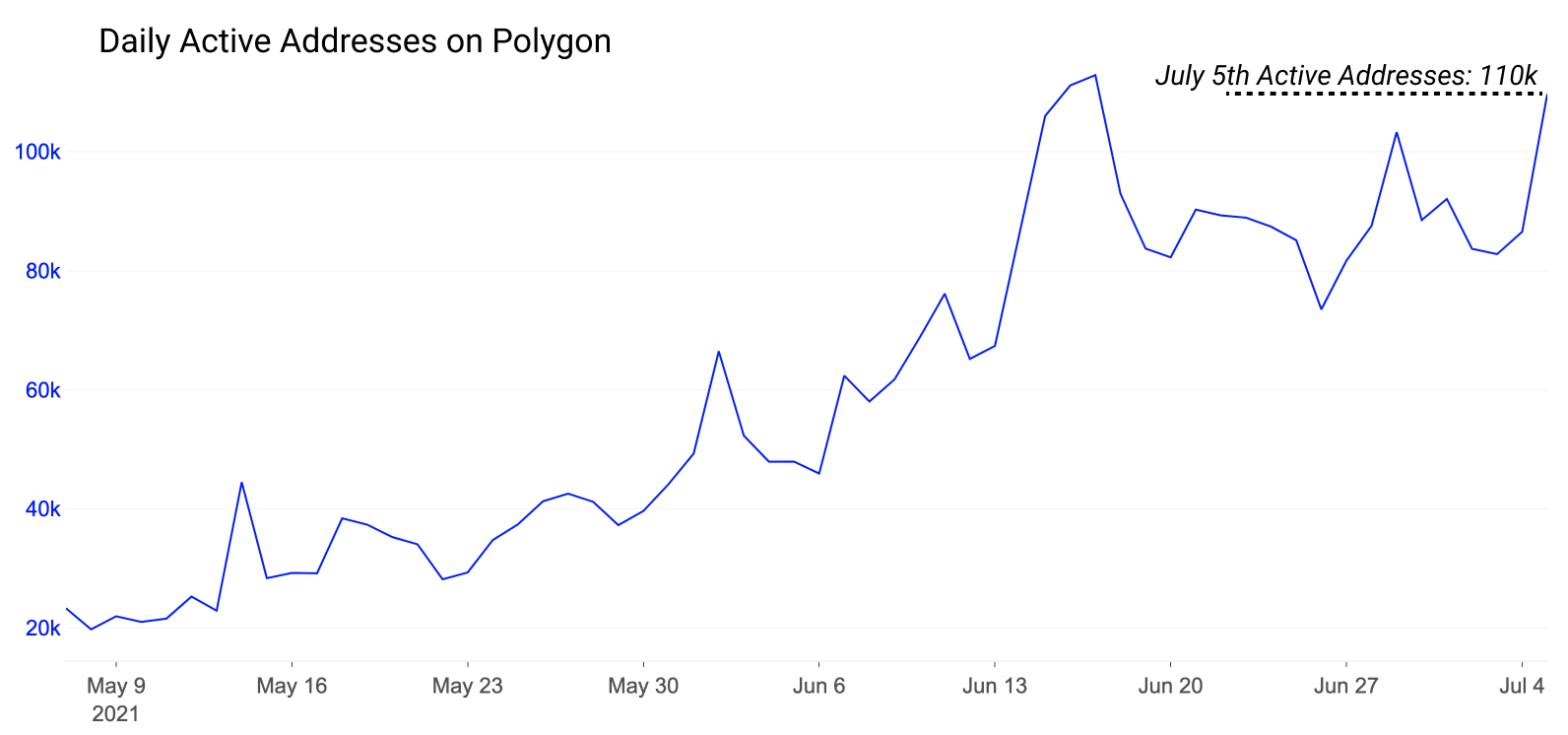

Demand for higher yields and high risk appetites continues to inflate activity on low fee chains like the side chain Polygon. A key question is whether activity on Polygon is fueled by actual value settlement, or is it dominated by many small transactions from a limited number of users who are otherwise priced out of the main-chain?

This week we explore recent market conditions covering:

- Activity on Ethereum and finding uncorrelated returns,

- An assessment of the activity on Polygon.

To keep up to date with the latest Glassnode analysis of the DeFi ecosystem, be sure to subscribe to this DeFi specific content series here.

Activity Remains Quiet, Despite a DeFi Bounce

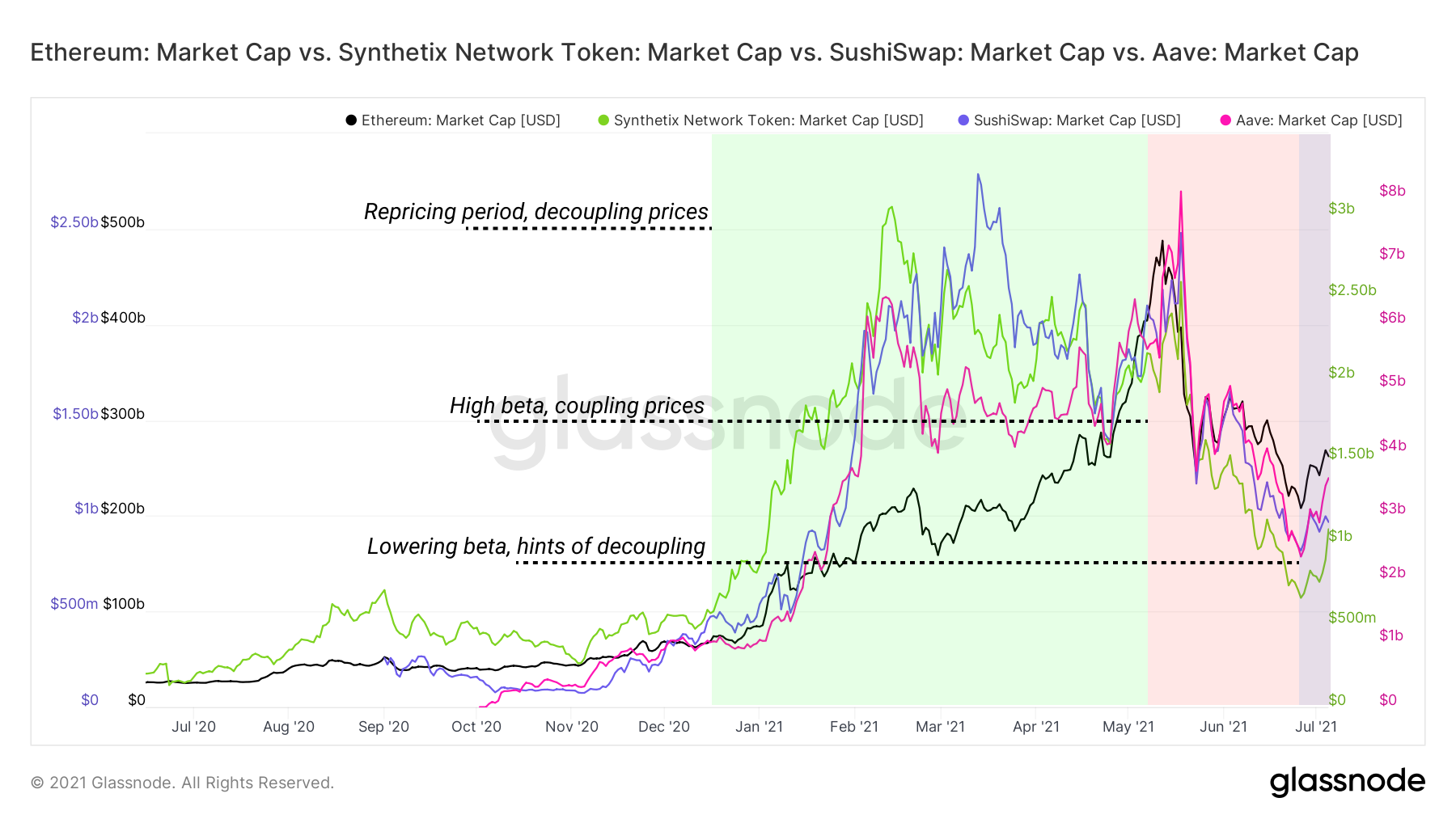

The last 7 days have seen DeFi governance tokens catch a notable bid. Many of the blue chip tokens have rallied 50%+ on the heels of mostly sideways movement in BTC and ETH. The chart below demonstrates how on the way down, the entire move was correlated strongly to BTC and ETH. On the recent relief rally, DeFi tokens are finally printing some uncorrelated returns, even finding a hint of strength against ETH.

While these uncorrelated moves are positive for DeFi, DeFi is far from out of the woods on under-performance. Even the best performing governance tokens remain firmly in bearish territory relative to ETH, a trend we explored in this analysis piece.

Correlated moves across all assets without repricing blue chips against the benchmarks generally signifies that the market is satisfied with the pricing of DeFi assets. On the otherhand, a strong uncorrelated move can mark an interest in repricing these assets against the benchmark; with such moves typically lead by changing fundamentals and narrative shifts.

Assessing Activity

DEX volume remains flat through June, with many major metrics remaining unchanged since we covered the crash back in May. While the flat volume remains relatively insignificant, activity on Curve (in orange) has slowed considerably last month, marking a period where many stablecoin swaps are being settled elsewhere.

Major stablecoin pairs on Uniswap V3 for example are now seeing >$50M daily volume while Curve currently ranges between $75-$150M total daily volume on average days. This is despite Curve having more liquidity than any project in the space ($10B+) – a reminder that liquidity does not always translate to volume.

The price rise in blue chip DeFi tokens shows no correlation to inflated gas fees. Instead, the recent spike over the last few days in gas has been the cause of Shiba launching a range of Uniswap clones. Their Shibaswap and rewards showing 5,000% APY at launch, but not without heightened risk and concerns over smart contract security being raised by devs across DeFi. We’ve also seen an additional player show up on the gas consumption radar as Axie Infinity, an experiment in community-owned gaming, sees rapid growth.

Note in the following table that 6 of the 16 highest gas guzzling contracts of the past few days were related to Shiba products.

Liquidations on-chain remained calm amidst rising token prices. Users with lots of borrow in assets that rally 20% (such as borrowed short positions) can face liquidations if the value borrowed exceeds their collateral. Most were able to add collateral, close positions, and overall keep lending markets healthy (<$500k in 7 day liquidations).

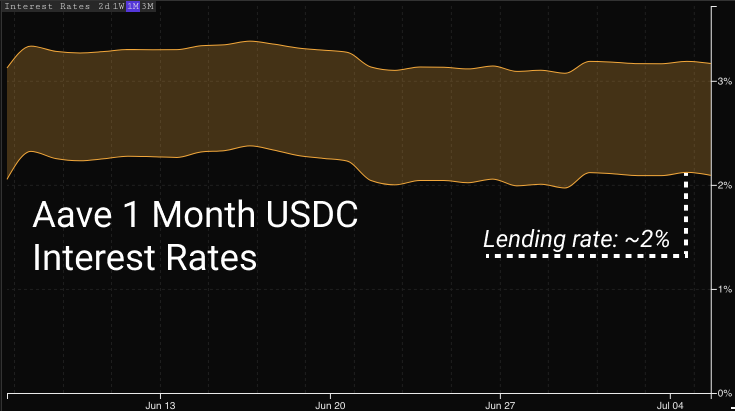

Rates have remained flat since May, settling at the 3% mark for borrowers. Yields contracting is generally a bearish signal; it shows a lower appetite for borrow and risk. If DeFi continues its move upwards we may see a tick up in interest rates. For now, rates remain uninspired during this leverage-limited move.

Notice how in the early days of SNX, SUSHI, and AAVE (and most other DeFi blue chips), the tokens saw similar pricing behavior against beta (ETH), but quickly repriced as the narrative shifted into the second half of 2020 (‘DeFi summer’). At the time of moving into top 100 tokens by market cap, they showed strong uncorrelated returns against ETH as they were actively repriced to match TVL and usage metrics.

Into the price correction of May/June, we’ve seen prices recouple and experience high beta to ETH. In the past 7 days we’ve seen hints of DeFi reclaiming ground, somewhat decoupling from beta, however one week remains too short a time-frame to be conclusive on whether this is a new trend.

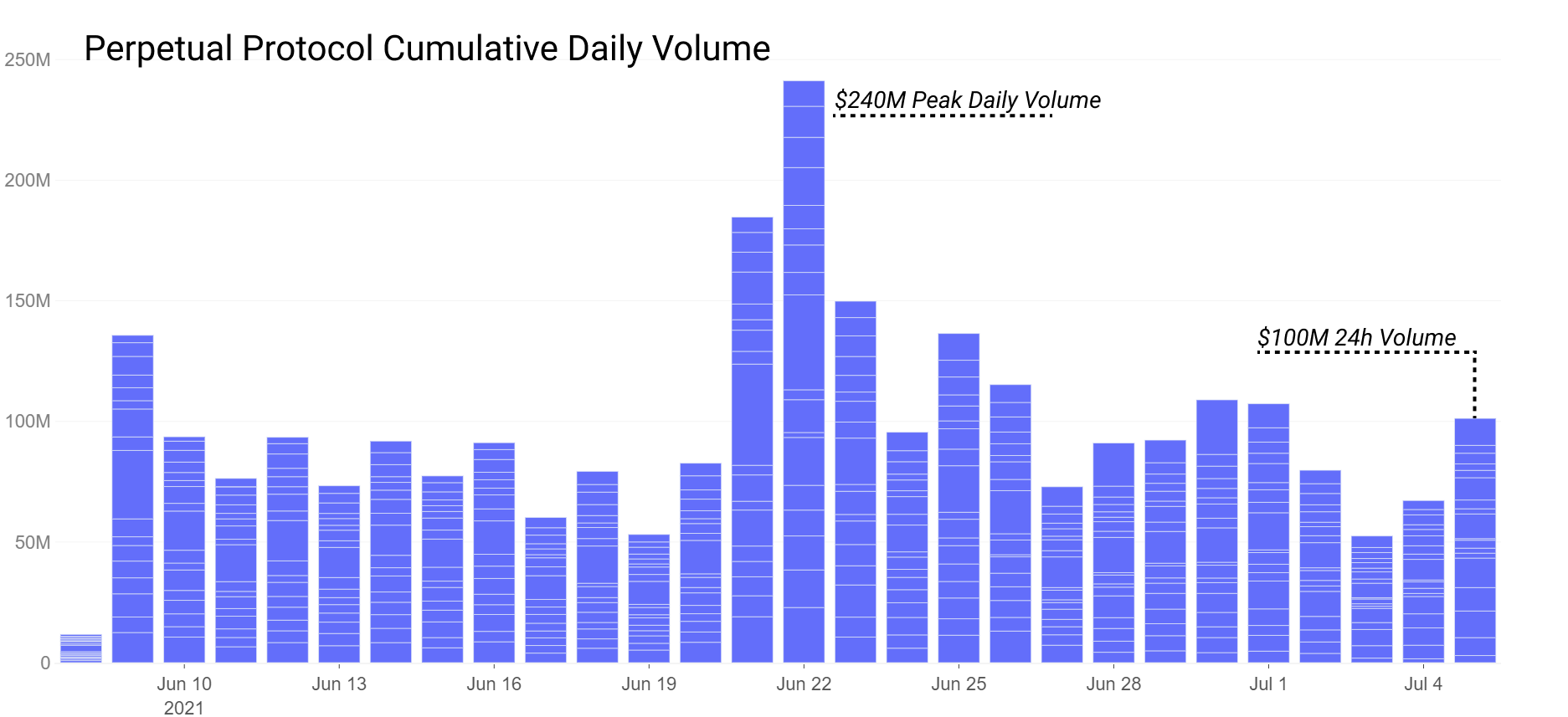

Perpetual Protocol is one such asset of the last few months that has seen its governance token reprice upwards alongside bullish fundamentals. The governance token has spiked 375% in the last 14 days. It has been a standout in activity growth over the last 90 days but has calmed down over time. As trading volume approaches a cumulative $20B, the perpetual contracts stand out against competitors in the on-chain derivatives space, even placing it in the middle of the pack relative to smaller spot DEXs.

Note that this trading volume is carried by a relatively small user base of less than 400 daily active addresses. Daily fees accrued by the protocol is consistently breaching $100k, and the project is currently working on a renewed reward structure for token stakers to receive these fees in the recently announced v2.

Polygon Activity Peaks

On Polygon, cheap gas fees continue to drive activity. Users find their way to chains like Polygon for the significantly reduced gas fee friction, and heightened prospect of reward, although usually at the expense of heightened risk. Currently about 110k unique addresses are sending transactions on Polygon daily, approaching an all-time-high.

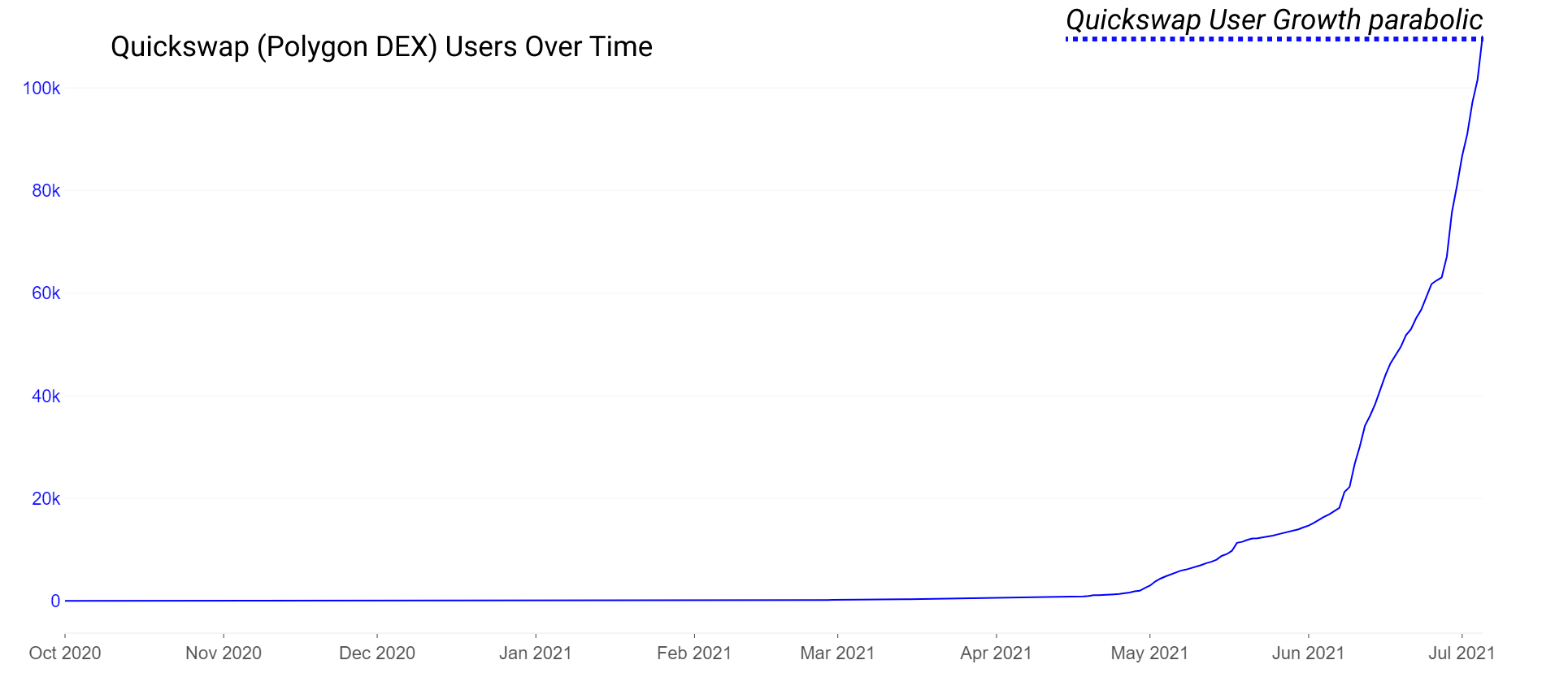

The most active DEX on Polygon is Quickswap, continuing to grow users at a parabolic rate. But are users translating to liquidity and volume?

With $1B in liquidity and $115M in 24h volume, Quickswap comes in first by liquidity and usage metrics on Polygon. Note that while volume and actual value settled on Quickswap is trending down, liquidity remains strong. Incentives via yield farming across the Polygon ecosystem remains strong, and Quickswap’s liquidity remains a primary beneficiary of these incentives.

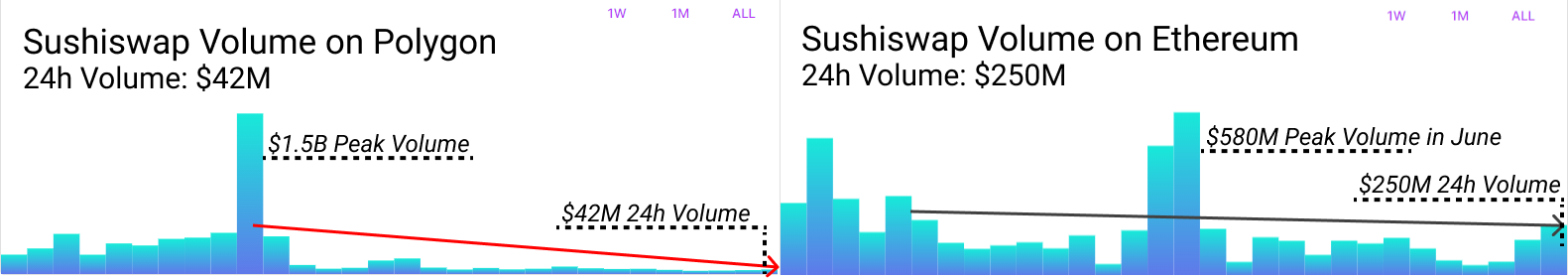

Sushiswap comes in a close second at $600M in liquidity, and $40M 24h volume. While Quickswap growth is interesting, Sushiswap is especially interesting as the second largest DEX on Polygon because of its fragmented liquidity across L1 Ethereum and Polygon.

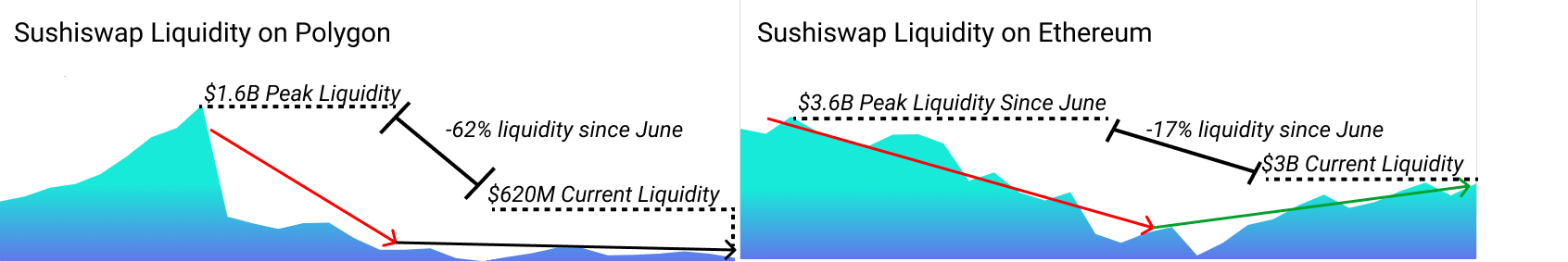

Many projects have been going multi-chain, bringing their projects over to Polygon and elsewhere to expand reach. It’s interesting to compare the relative growth achieved by participating projects on each chain. Sushiswap, for example, saw strong growth on Polygon in its early days (June launch). This was during a period of extremely high liquidity mining incentives.

As rewards calm down however, total Sushiswap volume on Polygon has correspondingly trended lower, despite Sushiswap volume on Ethereum remaining strong.

While Polygon continues to experience an increased number of transactions and users, large value settlement remains firmly on the Ethereum main-chain. Additionally, liquidity remains much stickier on Ethereum; on Polygon, liquidity shows next to no loyalty, rotating to whichever pool it perceives as short-term profitable. It becomes quickly evident that short-term thinking is dominant on Polygon, while many long-term oriented traders and investors inhabit L1.

0x Labs noted an interesting piece of data on average transaction size. While in many cases Polygon transaction count can exceed that of Ethereum, the size of trades is dwarfed by Ethereum. The average trade size on Polygon currently sits at $755 while Ethereum sits at about $19,000 on 0x protocol.

While growth by total users and transaction counts remain strong on Polygon, total value settled remains relatively insignificant against the main chain.

It will be fascinating to see how fragmented liquidity becomes when Optimism, Arbitrum, and other L2 solutions come fully online. Will Polygon liquidity stay on Polygon? Will Ethereum liquidity further fragment to L2? Or will new scaling solutions predominantly compete with the likes of Polygon and Binance Smart Chain? For now, it’s evident that there is demand from users for lower cost transactions and higher risk appetites, but it’s not clear significant value settlement will take over on Polygon any time soon.

Uncovering Alpha

This is our weekly segment that briefly discusses some of the most important developments of the prior and upcoming week.

Never a dull week in DeFi. Lots of product releases and announcements as L2 season continues to heat up.

- Barnbridge launches Smart Exposure. The tranched products darling continues to innovate, adding “Smart Exposure,” their tranched product for liquidity provision. They additionally launched their products on Polygon.

- Sushiswap integrates Archer DAO. Archer DAO is one in a number of new products looking to protect traders against blockchain externalities like sandwich attacks. Sushiswap traders can now optionally use protected orders via their Archer DAO integration.

- Alchemix and Ruler Finance partner up on liquidity incentives. The two projects announced a partnership for order book liquidity mining with alUSD. Similar to Alchemix, Ruler boasts non-liquidatable loans. They differentiate themselves with fixed-rate, time based loan repayments.

- Abracadabra continues to innovate. Spell added leveraged yield positions for their lenders. The platform allows borrow/lend of popular Yearn yvVault positions. Now added leverage and flashloans as they continue to add features to their platform.

- Aave Pro gets a rough release date. The institutionalized Aave has a date set for its KYC product in July. It will start with BTC, ETH, AAVE, and USDC.

- Fixed-rate products remain hot as Element launches. Element launched their fixed-rate AMM. More and more fixed rate products continue to come to market as investors speculate on future growth of DeFi through more consistent yields. While most degens bias towards variable rates due to their higher risk/higher reward, some are betting that the less risk-on investor will be fond of fixed-rate products for their predictable yield.

- Balancer launches on Polygon. Yields have been high on the early days of Balancer pools launching on Polygon. It will be interesting to see how liquidity continues to fragment as more projects launch on Polygon and Optimism + Arbitrum come online in coming months.

- Perpetual Protocol announces their V2 on Arbitrum. The token popped on the rumor and news, sitting now at $9 from $4 lows in late June. Their decentralized perpetual contracts remain a hot corner of DeFi.

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

PlatoAi. Web3 Reimagined. Data Intelligence Amplified.

Click here to access.

Source: https://insights.glassnode.com/defi-uncovered-defi-showing-signs-of-life/