The Fed Will Likely Opt for a small Interest Rate Hike – If It Hikes At All, That Is

Crypto and stocks rallied Friday after the publication of data that show inflation in the U.S. cooling in February.

Bitcoin and Ether are up just over 2% after U.S. inflation rose at a slower rate than expected, signaling the Federal Reserve may cool the pace of interest rate hikes.

Crypto rises at the prospect that the Fed may slow its rate hikes. Lower rates make borrowing cheaper, which in turn means there will be more capital available to buy risk assets. Digital assets have rebounded this year from the worst bear market since 2019 in part as speculation grows that the U.S.’s fight against inflation with hawkish monetary policy is finally paying off.

Cooling Inflation

The Commerce Department on Friday said the personal consumption expenditures price index, stripped of volatile food and energy prices, had increased three-tenths of a percent month-over-month, and 4.6% year-over-year.

That measure tracks the “broadest set of goods and services,” according to the San Francisco branch of the Federal Reserve, and is often called the Fed’s preferred inflation gauge.

ETH Price + BTC Price + SPY Price + QQQ Price, Source: The Defiant Terminal

According to crypto investment firm GCR, the core PCE price index figures were better than expected. And they show inflation in the U.S. cooling since January, when they rose six-tenths of a percent month-over-month, and 4.7% year-over-year.

Banking Crisis

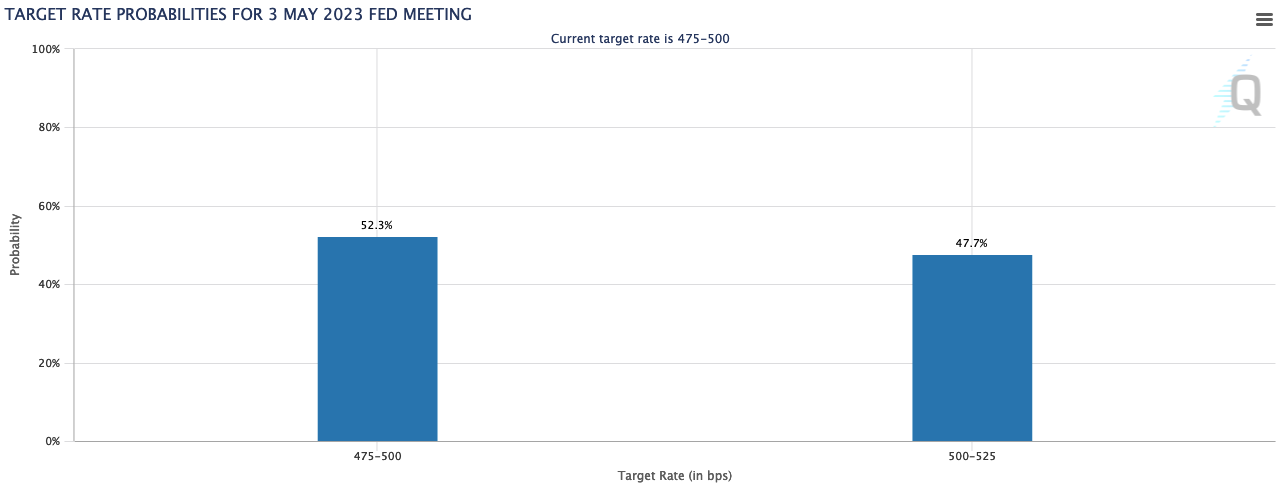

Along with a banking crisis triggered by the Federal Reserve’s aggressive interest rate hikes, the data have cemented investor predictions that the Fed will opt for a small increase at its next meeting on May 2, if it chooses to raise interest rates at all.

A week ago, just after the emergency acquisition of Credit Suisse by its rival UBS, and only a week after the collapse of Silicon Valley, Silvergate and Signature banks, investors were betting the Fed would keep interest rates flat at its May 2 meeting, according to the CME FedWatch tool.

But fears of a widespread banking crisis have eased somewhat, and the odds of a slim interest rate hike spiked at the beginning of the week. That belief hardened Friday after the release of inflation data. Investors now believe the odds of no hike or a 25 basis point hike are roughly even.

Biggest Movers

Stocks jumped Friday, with the S&P 500 and the Nasdaq rallying about 1.3% and 1.6%, respectively.

In crypto markets, big winners Friday include liquid staking protocol Lido, along with Ethereum competitors Cardano and Fantom, each of which grew more than 6% day-over-day.

LDO Price + ADA Price + FTM Price, Source: The Defiant Terminal

Meanwhile, Binance’s BNB token was flat. Investors fled the token Monday after the Commodity Futures Trading Commission sued Binance for allegedly allowing Americans on its international platform.

Market Shrugs Off CFTC Lawsuit Against Binance

Declines in Binance TVL and token barely outpacing broader crypto market.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://thedefiant.io/crypto-markets-rally-on-bets-fed-will-slow-pace-of-rate-hikes/