As any crypto industry observer surely knows, 2022 was one of the most turbulent years since Bitcoin hit mainstream notoriety and digital asset markets became a sphere of interest for fintech companies and private investors alike.

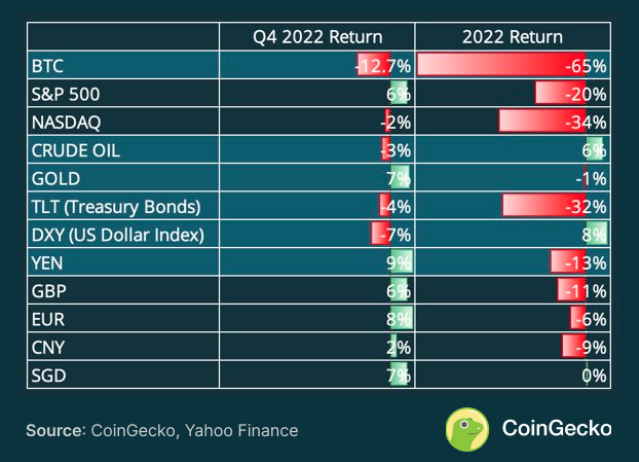

The early part of 2022 saw the cryptocurrency markets turning bearish as the global economy soured. It was not just the crypto industry either, as CoinGecko’s 2022 Annual Crypto Industry Report highlighted how poorly traditionally major assets like crude oil and the US Dollar had performed by the end of 2022.

Still, the single worst-performing asset in 2022 was Bitcoin, shedding 64.2% of its value since the beginning of the year. On January 1st 2023, the market capitalisation of the entire crypto industry stood at US$829 billion, nearly two-thirds (64.1%) less than the US$2.3 trillion market cap that started off 2022.

The challenging macroeconomic climate, rising inflationary trends, and a close correlation between the crypto market and US equities all boded negatively for the industry overall for most of 2022 – but crypto winter truly set in with the series of scandals and exits that was catalysed by the collapse of the FTX exchange in November 2022.

The fallout is still besieging the crypto industry in 2023, but nevertheless, there were valuable lessons and cautionary measures that can be taken away by fintech startups, investors, and other participants of the digital assets ecosystem.

Here are some lessons the crypto industry should have learned from the tumultuous year that was 2022, and what are some factors to keep an eye on heading deeper into 2023.

Overspeculation will lead to contagion

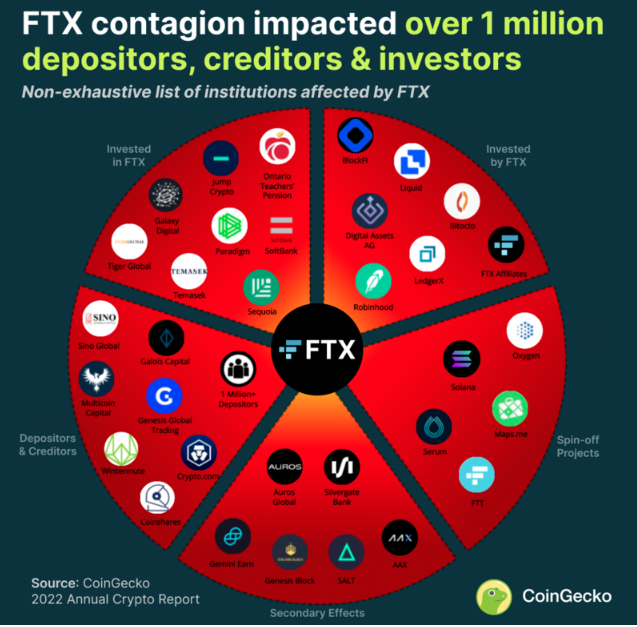

The massive ripple effect did not start with the FTX contagion. Instead when the Terra Luna crypto crash happened, and Terra Luna lost 99.9% of its value, it was uncovered that FTX sister company Alameda Research had most of its assets in FTT tokens issued by FTX.

Alameda has become insolvent following the Terra Luna crash, leading largest crypto exchange Binance’s CEO Changpeng ‘CZ’ Zhao to publicly reveal that Binance was dumping its stake in FTT tokens. In a showcase of how speculation-driven the market was, CZ’s announcement triggered mass withdrawals amid fears of insolvency, causing FTX to halt withdrawals and subsequently file for Chapter 11 bankruptcy protection.

It emerged that both FTX and Alameda had borrowed heavily from cryptocurrency lending firms to prop up their investments, leading to the collapse of broker Genesis Global Trading and lender BlockFi, who said they had US$175 million and US$275 million respectively locked up in inaccessible funds on FTX.

Since then, many companies have felt the domino effect of the contagion, pausing operations or cutting back on expenditure, asking clients to withdraw funds, and generally revealing an interdependent state of creditors and debtors.

While the decentralised nature of blockchain protocols were hoped to create a more transparent investing ecosystem, the failure of one crypto institution leading to another has similarities with how other financial failures happened throughout history, including the 1997 Asian financial crisis, the dotcom bubble burst of the 2000’s, and the 2008 subprime mortgage crisis in the US.

These moments of crisis all revealed overly-optimistic investing strategies built up by the continued rise of financial assets, fueling buildups of loans to speculative investors. When the investments bottomed out, the rush for the exits revealed just how speculative the investment momentum had been.

This is not a fault of the underlying technology and protocols of the crypto industry. Rather, it is an inevitable end result of human greed and a speculation driven investment culture. It is expected that the contagion ripple effect from FTX/Alameda will continue to be felt in 2023, as more companies feel the repercussions of 2022.

Digital wallets the solution to custody problem?

It turned out that FTX had been using funds from users to keep it afloat as creditors evaporated, and many were taken aback when a judge ruled in the ongoing bankruptcy of Celsius Network that funds deposited into the Celsius’ ‘Earn’ program belong to the estate (Celsius), and not account holders.

This landmark ruling could have implications for the entire industry as bankruptcies and other crypto failures of 2022 continue to reverberate. Firstly, there are questions over who owns tokens held in custody.

Institutional investors, crypto firms, and retail investors all learned the hard way that what an organisation says is a safe investment space, where customer funds are held securely and separately from other investment funds, is not often the case.

Hence hardware wallets surged in popularity as investors pulled back from the high-profile collapses of the likes of FTX, Celsius, Voyager Digital, Three Arrows Capital and Genesis – all of which involved centralised financial institutions holding and putting customer funds at risk.

If hardware wallets are unwieldy for users who want to constantly reach their funds or use crypto as a medium of exchange, DeFi (decentralised finance) might suit better, as its decentralised nature means there is no intermediary to abuse users’ funds in between.

Yet DeFi projects by themselves, will still need a gateway custodian to store the assets in. Digital or hot wallets might hold (no pun intended) the answer: decentralised digital storage systems like MetaMask and Coinbase Wallet allow users to digitally store their virtual tokens without downloading the entire blockchain, permit access to decentralised apps (dApps), connect with cryptocurrency exchanges online, and even acquire and hold other digital assets such as NFTs.

But as the collapse of Luna Terra showed, DeFi is still vulnerable if a token has flawed principles, or if the smart contracts that bind transactions are breached, or if founders initiate a ‘rug pull’ and skip town with users’ funds.

More comprehensive audit processes are still needed for the DeFi space before it can be a reliable alternative. DeFI protocols lost more momentum last year than most of the market, with its market cap shrinking by 72.9%, as per the CoinGecko report.

Insurance and compliance

The wild events of 2022 have made it clear that some form of insurance or backstop is required to shield investor funds against abuse. What kind of product this will be has yet to be determined, as the crypto industry still faces many questions when it comes to regulations

That draws up another issue, of having stabilised compliance and industry-wide controls that prioritise cybersecurity and investor protection. This will largely depend on the regulatory environment it is found in.

In Asia, economies like Singapore and Japan have prioritised consumer protection, but interestingly there are signs of relaxing regulations for crypto companies in Japan. After several high-profile implosions out of Singapore like Terraform Labs and Three Arrows Capital, the regulatory authority there is looking to pull back even further, with proposed measures to include restricting firms from lending out retail customers’ tokens.

This might see crypto firms there being subjected to similar regulations as banks and brokers, who also provide securities lending under stringent rules, and questions arise if digital assets should be treated differently.

Hong Kong, on the other hand, looked to establish its financial autonomy from China in the wake of restrictive zero-COVID and an outright ban on cryptocurrency trading on the mainland. Hong Kong instead announced it was open to crypto firms and would look to ease restrictions on retail investors to trade using licensed exchanges.

Featured image credit: Freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://fintechnews.sg/69228/crypto/crypto-lessons-from-2022-the-industry-should-avoid-in-2023/