When it came to startup funding, Credit Suisse was no Silicon Valley Bank.

That said, the troubled Swiss banking behemoth, which was just acquired by rival UBS, was no slouch in the venture investment and debt arena either.

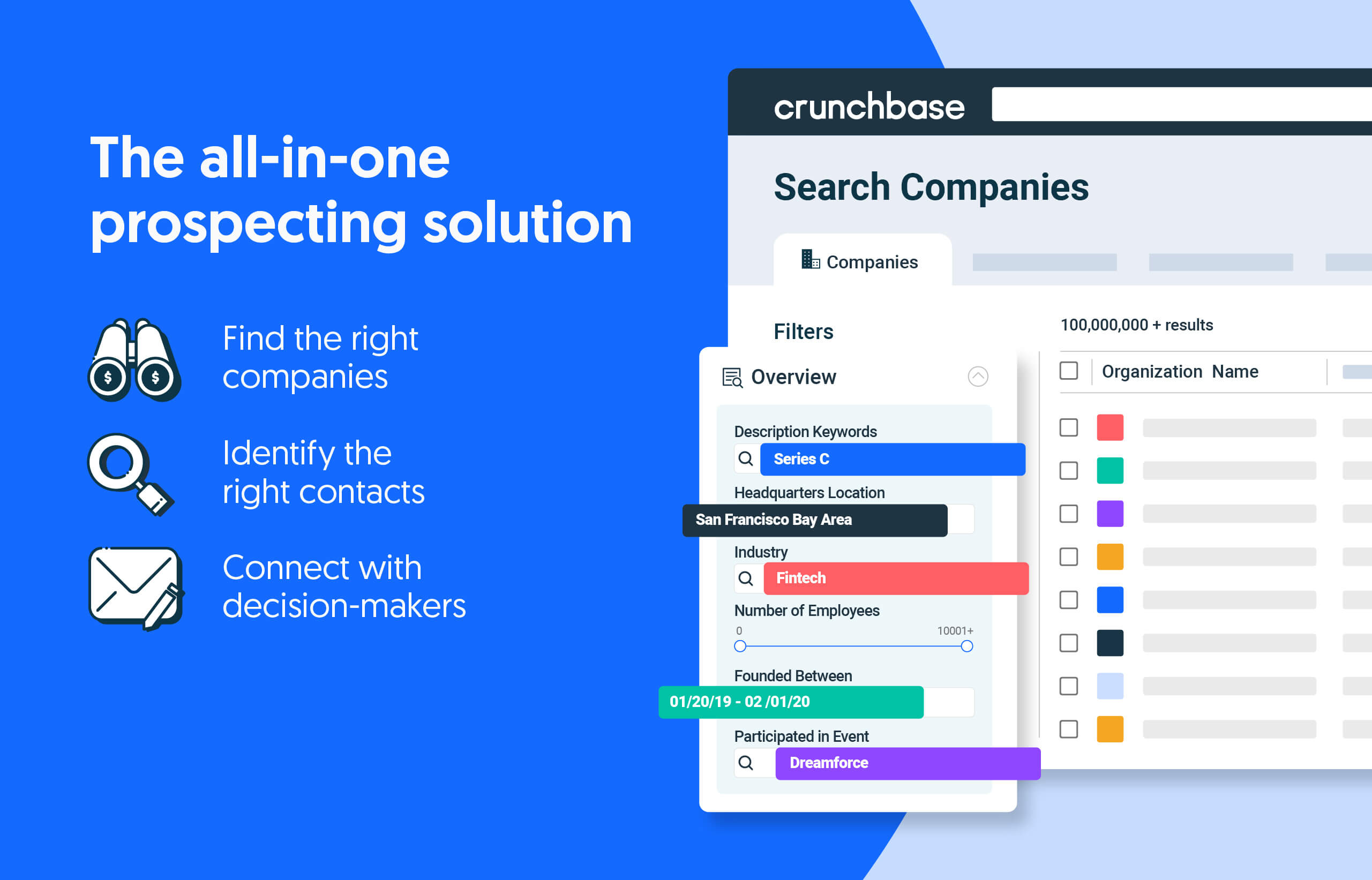

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Per Crunchbase data, Credit Suisse participated in at least seven venture or debt financing rounds for startups in the past year, including six that it led. Four of the financings were for U.S. companies, while three were for European startups.

Some of the Credit Suisse-led financings were pretty large ones, for companies including:

- Curve, a London-based credit card and digital wallet platform offering cash and crypto rewards, closed on $1 billion in loans in December with a facility provided by Credit Suisse.

- Sunbit, a Los Angeles-based buy now, pay later provider focused on unexpected everyday expenses like healthcare and repair bills, announced in December that it had closed a $250 million revolving debt facility with an affiliate of Credit Suisse.

- Wayflyer, a Dublin- and Atlanta-based provider of funding and marketing analytics for ecommerce companies, picked up $253 million in debt financing from Credit Suisse in September.

- Wander, an Austin-based provider of short-term luxury rentals, secured a $100 million credit facility with Credit Suisse in November.

Over the past six years, Credit Suisse led over $3.4 billion worth of debt financings for at least 17 companies that have raised venture or seed funding. Fintech appears to be the biggest area of focus, with the majority of debt-funded companies coming from that industry, including well-known names like corporate card platform Brex and business lender Kabbage.

To a lesser extent, Credit Suisse was also a participant in equity funding rounds. Most recently, for instance, the bank took part alongside a long list of investors in a $24 million Series B round for Brooklyn-based energy technology startup BlocPower.

Beyond investments, Credit Suisse also has a history offering services, support and sponsored events for startups, with a particular interest in Swiss entrepreneurship. It offers startups tailored packages of banking services alongside potential access to its Credit Suisse investors’ platform to connect to capital providers.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://news.crunchbase.com/venture/credit-suisse-startup-investments/