(Last Updated On: March 20, 2023)

Cryptocurrencies are the future of the financial world, and BONE is a name that you should know. It’s no secret that Bitcoin has been making headlines for years, but now there’s a new kid on the block: BONE. In this blog post, we’re going to tell you everything you need to know about BONE crypto and how to use to get profit.

Bone crypto, or $BONE is the native governance token of decentralized exchange, ShibaSwap. It is used to facilitate liquidity, staking, and swapping within ShibaSwap. Bone holders have the opportunity to participate in the governance of the platform.

BONE is a utility-enabled token, providing users with the means to vote on proposals for ShibaSwap. BONE owners can earn tBONE rewards. Additionally, staking BONE gives one the chance to receive BURY rewards.

Furthermore, BONE will be used to pay gas fees on Shibarium, Shiba Inu’s Layer 2 solution. Upon its launch, Shibarium will provide added utility for BONE.

As for the Shibarium – it’s important to mention that news concerning Shibarium launch often leads to increasing BONE price. On Jan. 5, when the Shibarium network confirmed on Twitter that BONE would be used for gas fees BONE price doubled and it was trading at $1.8595.

ShibaSwap stands out through its highly-rewarding passive income system and innovative analytics dashboard (also known as “Bonefolio”).

Through BURY option, BONE, SHIB, and LEASH token holders can earn high-interest yields by staking their tokens and get BONE rewards. Using Bonefolio you can view the top BONE liquidity pairs, such as BONE-ETH, as well as their fees and 24-hour trading volumes. Bone ShibaSwap reward pools are also included, along with the return on investment (ROI) for each $1,000.

Crypto loans provide several unique advantages, including increased liquidity, more efficient capital utilisation, the ability to access funds without selling, and enhanced portfolio diversification. Additionally, interest rates on crypto loans are typically much lower than those of traditional loans, allowing borrowers to access funds at much lower costs. Finally, these loans provide additional peace of mind since crypto collateral is held securely in a cold storage wallet.

Here are some cases where you can use BONE as a collateral and get profit:

- Gain profit from volatility

If the exchange rate of the collateral currency goes up, your loan at CoinRabbit does not change. For example: you got a loan against 10000 BONE with 90% LTV (Loan-to-value-ratio) when its price was $0.8 ($8000 approx) and you got 90% of your collateral – $7200. You need to repay this amount to get your BONE collateral back. When the BONE price goes up to $1.3 – you still need to repay $7200, no more. So when you’ll repay the loan, you actually get $13000 instead of $8000. As such, crypto loans provide users with a unique opportunity to leverage their assets while potentially earning a profit at the same time.

- Make a huge purchase and continue holding

When you take the crypto loan you are able to enjoy the value of the invested fiat money while inflation reduces it permanently. Today the same amount values more than tomorrow. So when you get a crypto loan against BONE – you still holding your BONE assets but gain extra funds to spend it today, as we all know that’s tomorrow your wishes will cost more 😉

- Optimise taxes

In some countries you need to pay up to 40% of your crypto investments profit. Most people don’t know, but loans are a non-taxable event because there is no direct profit in the loan transaction as in trading or exchanges. So you can safely take a loan and maximise your tax efficiency.

- Risk Management Technique

Rather than holding BONE tokens and risking the unpredictable fluctuations of the crypto markets, crypto investors now have the opportunity to utilise their investments as collateral for a BONE loan. This allows them to manage their risks by accessing funds while their assets remain safely stored. By doing so, they can take advantage of the decreased interest rates of a crypto loan while still protecting themselves from any potential losses due to market volatility.

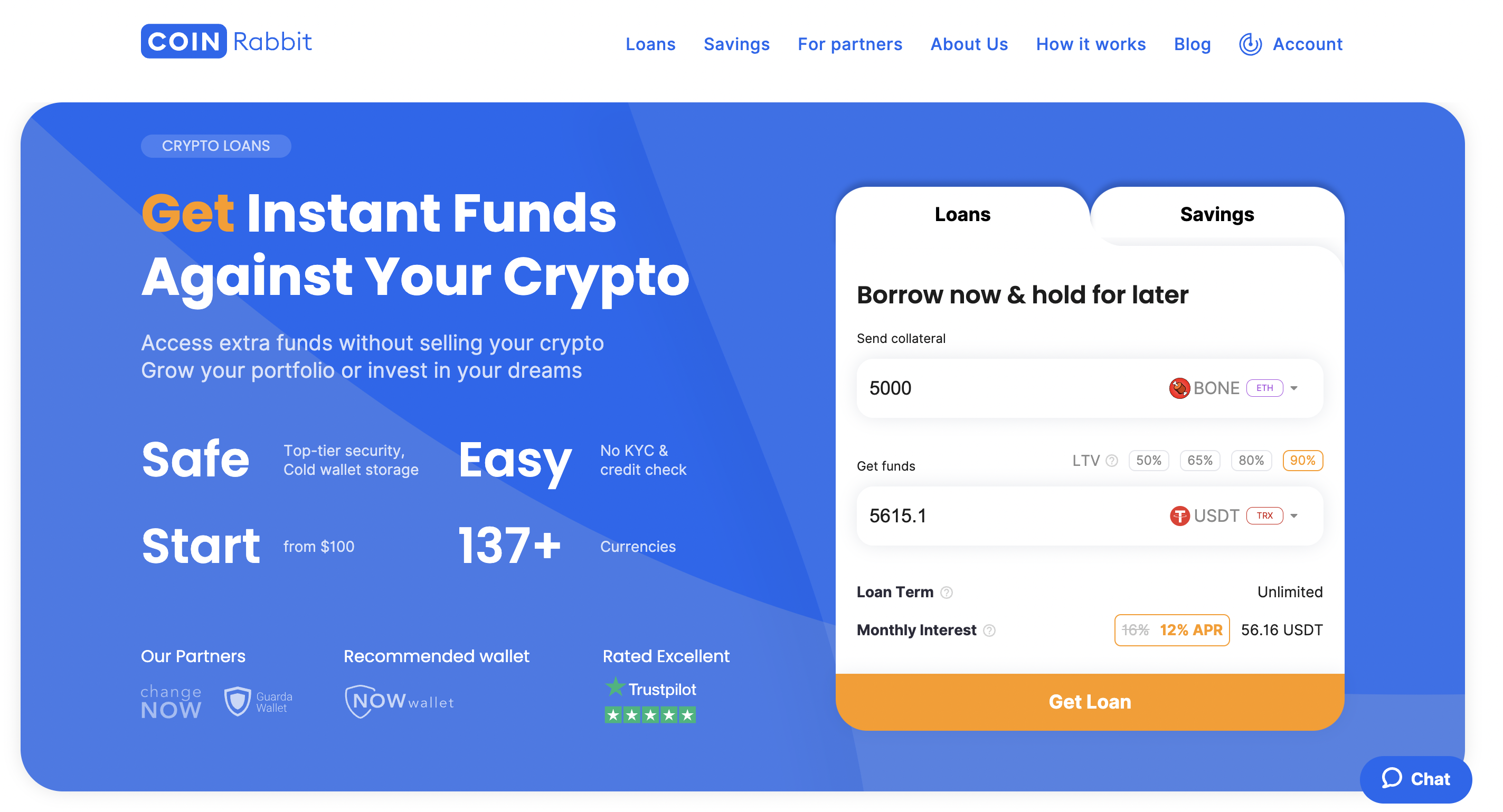

Today, crypto loan platforms like CoinRabbit have significantly simplified the loan application processes. To get a BONE crypto loan today, all you need to do is go to CoinRabbit’s homepage and follow the steps below.

- On the homepage, under the Loan calculator section, select BONE crypto as your preferred collateral.

- Enter the amount of Bone ShibaSwap crypto you want to deposit as collateral, and the Calculator will show you the Loan Amounts you will receive and Click “Get Loan.”

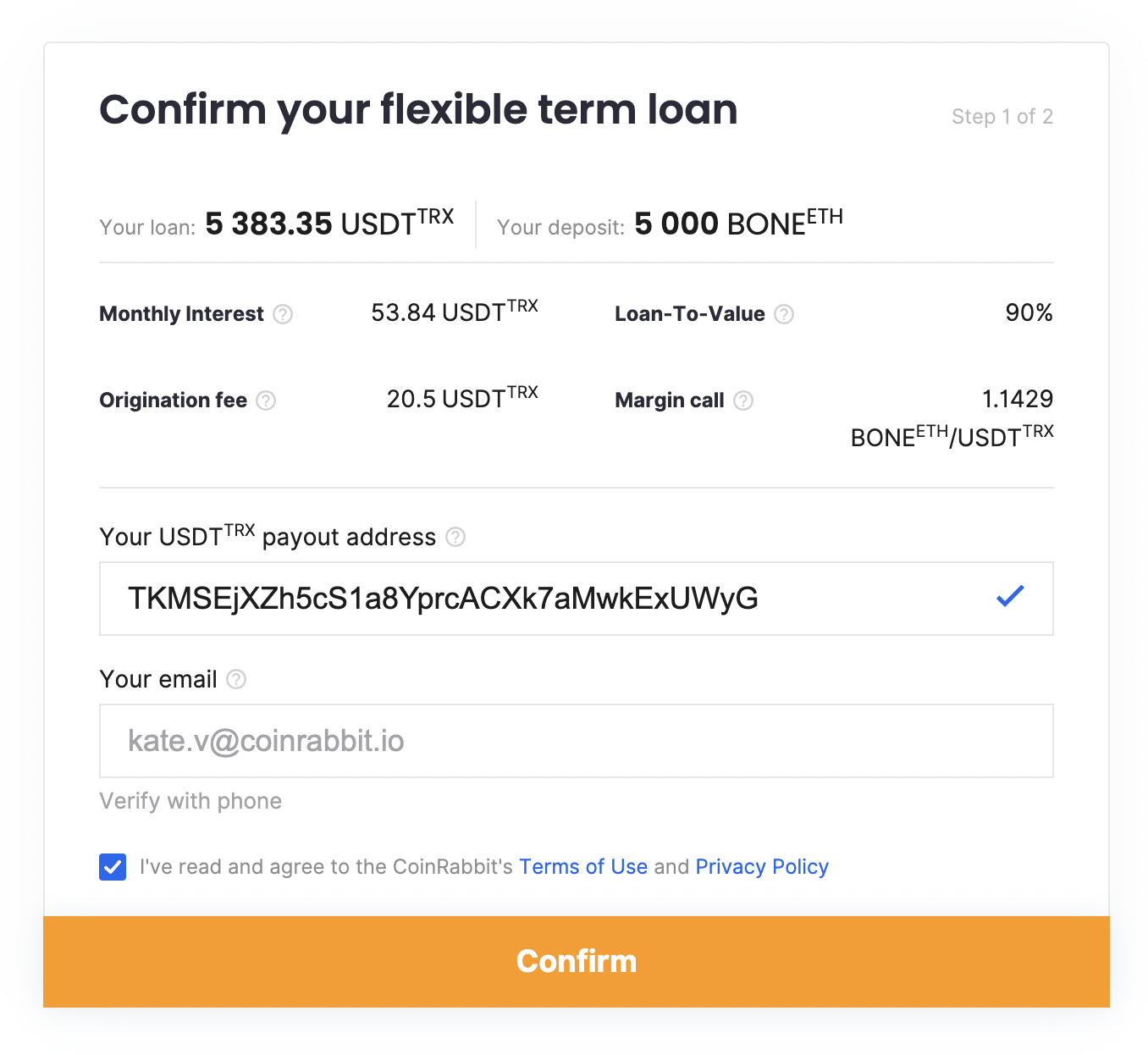

- After clicking “Get Loan,” we will ask you to confirm the details, enter your stablecoin address, and verify your email:

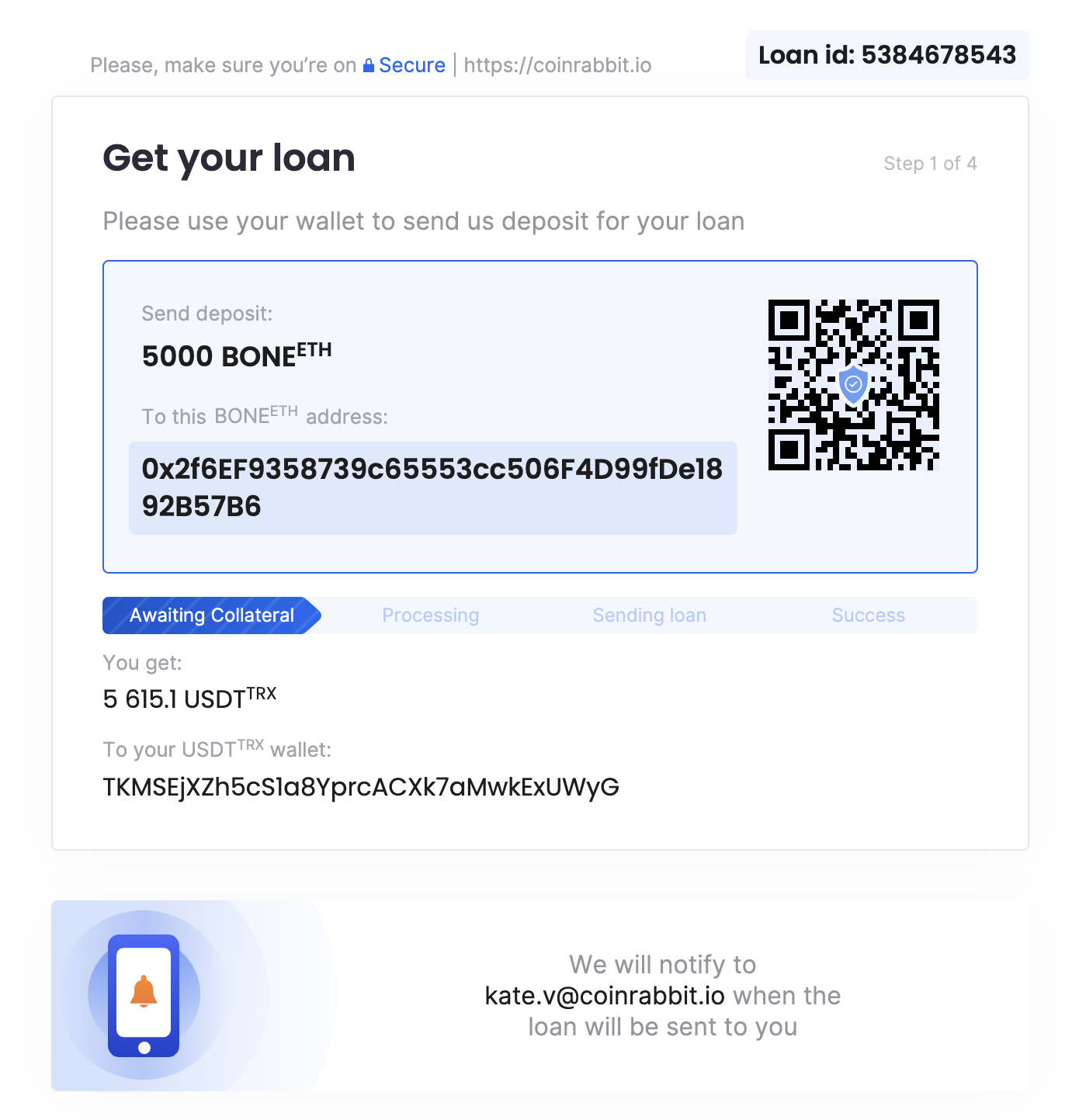

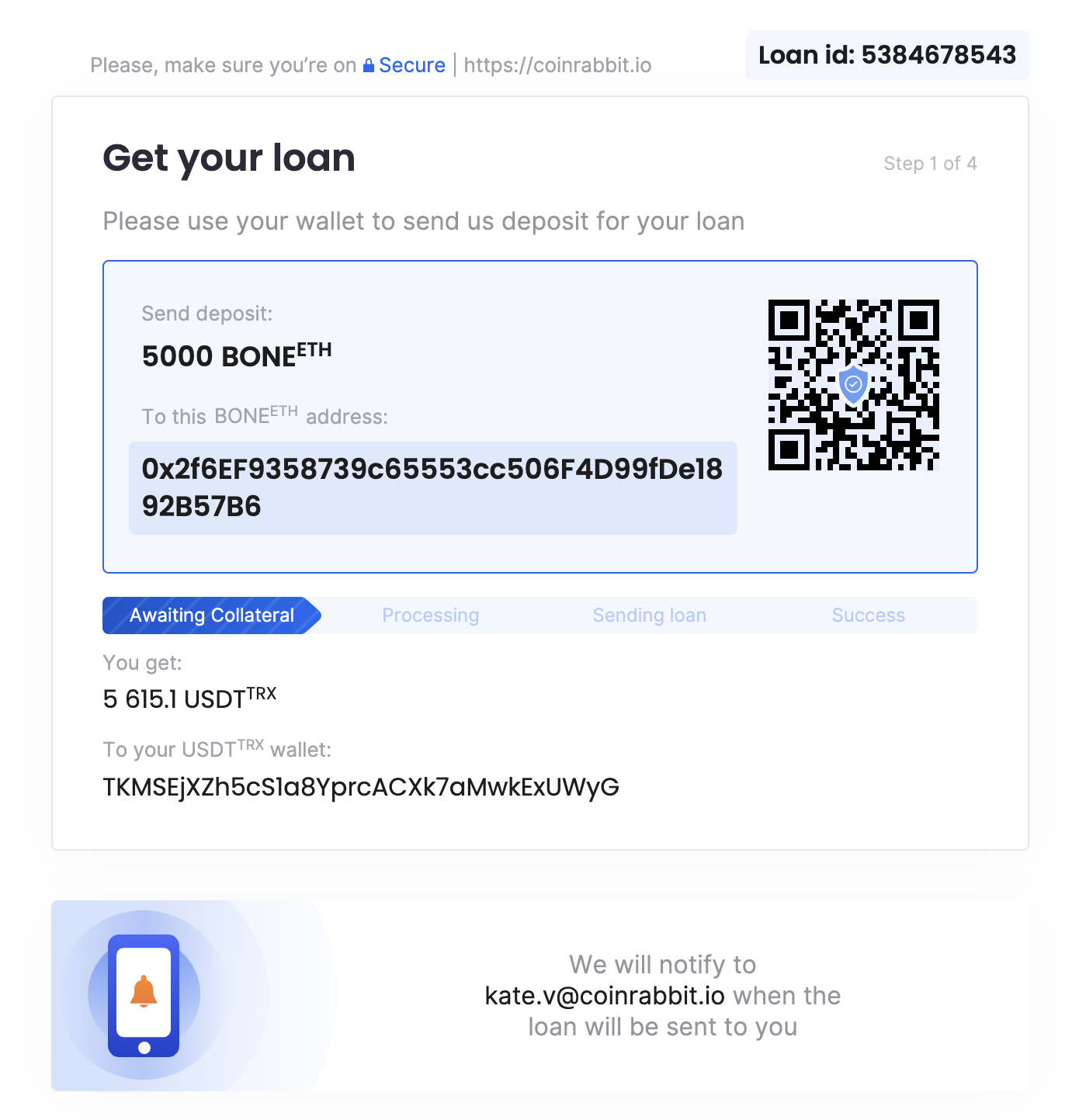

- Next, send BONE to the displayed address. After we receive your collateral, the loan will be sent to you immediately.

BONE crypto loans with CoinRabbit – is a great tool for crypto investors and holders: you can use a crypto loan to optimise your taxes, make a huge purchase, reinvest in new cryptocurrencies and many many more while continuing holding your digital assets.

It’s important to remember that all operations with crypto are highly risky. When you get a loan with any crypto lending platform – don’t forget to check the status of your crypto loan periodically and add collateral if it’s needed to avoid liquidation of the loan.

If you still have any questions you can always contact our team and customer support on our website and we will gladly help you. Or join our telegram group.

Rethink forward crypto loans with CoinRabbit.

Not financial advice. Do your own research and take everything moderately. Crypto-backed loans have their own risks that should be taken respectively.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://coinrabbit.io/blog/bone-crypto-all-you-need-to-know/