Elon Musk’s legal team has reportedly requested the dismissal of a $258 billion racketeering lawsuit alleging he operated a pyramid scheme to boost the value of cryptocurrency Dogecoin.

The lawsuit, filed by Dogecoin investors, claims Musk’s tweets about the cryptocurrency were designed to manipulate its value and that he and others profited from this manipulation.

Musk’s lawyers have dismissed the lawsuit as a “fanciful work of fiction” and argued that their client’s tweets were harmless and protected by the First Amendment.

This development follows ongoing scrutiny of Musk’s tweets and their impact on financial markets.

Omg @elonmusk just made #dogecoin the most recognizable cryptocurrency on Twitter by giving #doge a hashflag! pic.twitter.com/e3TwV2lRVD

— Doge Dillionaire (@DogeDillionaire) April 1, 2023

Musk, the Twitter and Tesla CEO, is a huge Dogecoin fan and often tweets about it. While some of Musk’s tweets have resulted in sharp increases in the value of certain cryptocurrencies, others have faced criticism for being misleading or manipulative.

Also Read: Are Tesla Bots Already Helping to Build Cars?

Symbolic Doge tweets

Investors who filed the racketeering lawsuit failed to provide any evidence to support their claim that Musk intended to deceive or defraud anyone, according to lawyers.

They also pointed out that Musk’s tweets, such as “Dogecoin Rulz” and “no highs, no lows, only Doge,” were too ambiguous and lacked the necessary specifics to substantiate a fraud allegation.

Lawyers added that investors did not explain what risks Musk concealed, if any, in his statements.

“There is nothing unlawful about tweeting words of support for, or funny pictures about, a legitimate cryptocurrency that continues to hold a market cap of nearly $10 billion,” stated Musk’s lawyers.

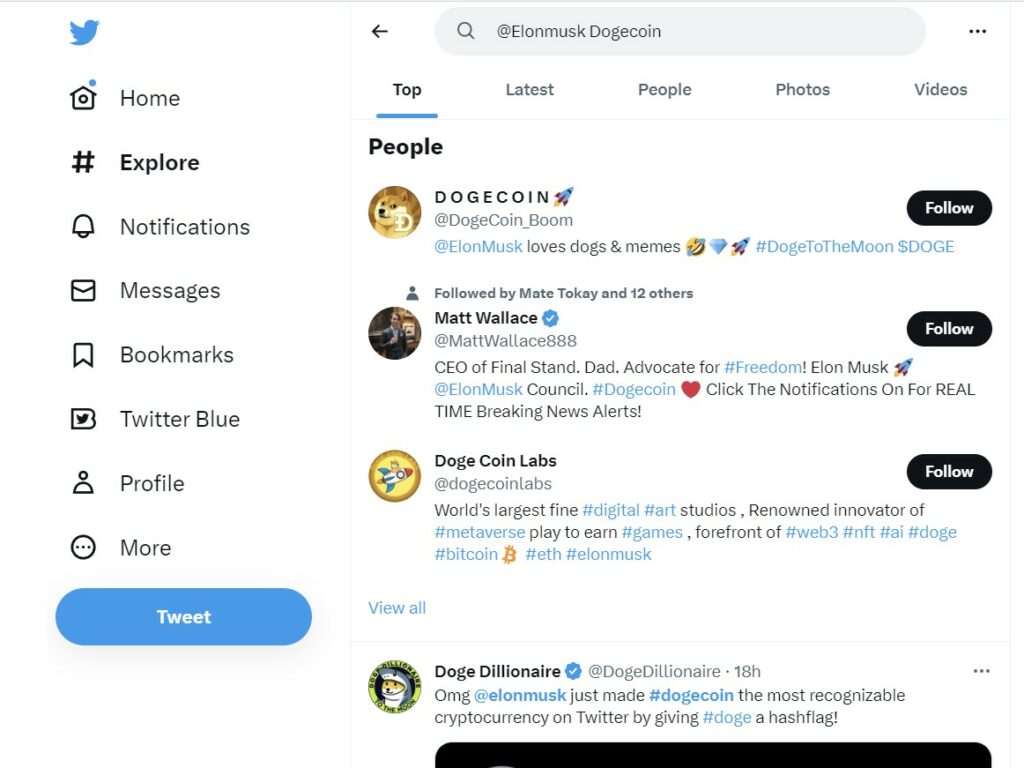

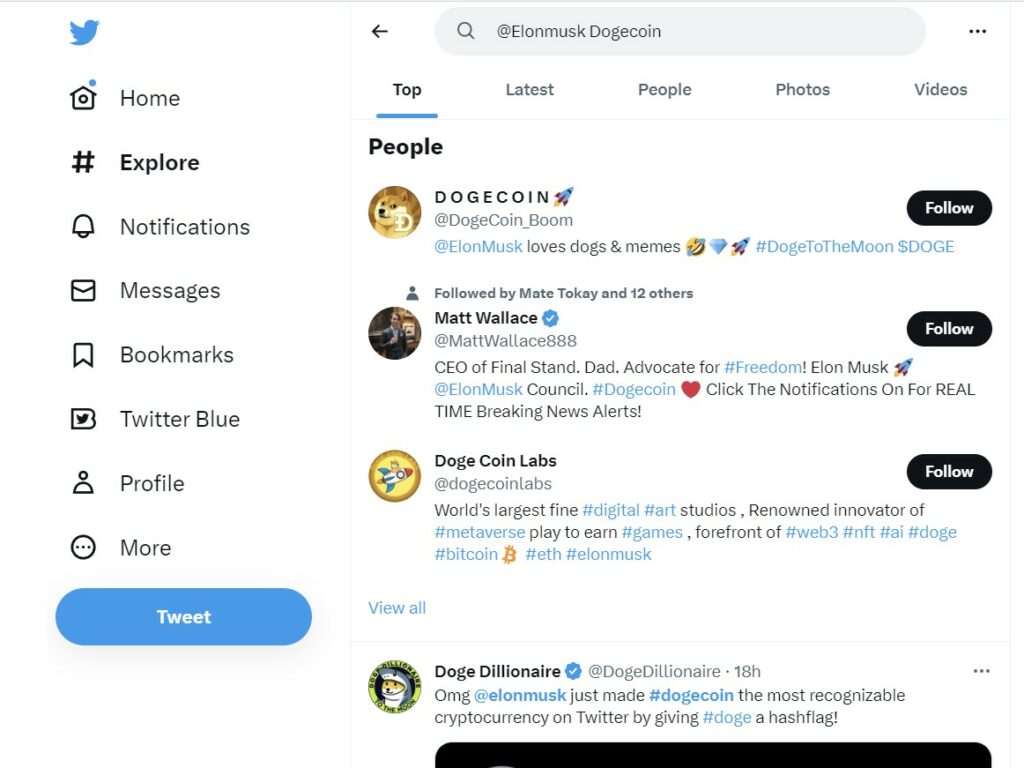

However, Musk has only shared symbolic tweets about Dogecoin and rarely specifically mentioned it. We can hardly find any tweets from Musk that explicitly mention ‘Dogecoin’ in the text of his tweets.

“This court should put a stop to plaintiffs’ fantasy and dismiss the complaint,” argued Musk’s legal team.

Lmao pic.twitter.com/OKnh38hRwp

— lizard (@StockLizardKing) November 1, 2022

Last November 1, Dogecoin rallied over 25% following a tweet by Musk.

36,000% up before crashing

Investors have accused Musk, the world’s second-richest person, of intentionally driving up the price of Dogecoin by more than 36,000% over a two-year period. Dogecoin is being traded at $0.07 per coin at the time of writing, according to CoinGecko.

They also claim Musk allowed it to crash, resulting in billions of dollars in profit for himself at the expense of other Dogecoin investors.

Musk, the most followed person on Twitter, was aware Dogecoin had no intrinsic value, yet he still manipulated its price for his own gain, the investors argue. They referenced his appearance on a “Weekend Update” segment of NBC’s “Saturday Night Live” in which he portrayed a fictitious financial expert and referred to Dogecoin as a “hustle.”

The damages being sought in the lawsuit total $258 billion, which is triple the estimated decline in Dogecoin’s market value during the 13 months leading up to the filing of the lawsuit.

Fixed it for you, added the #dogecoin touch pic.twitter.com/3hD5AkbkeU

— Doge Whisperer 🐕 (@TDogewhisperer) March 31, 2023

The non-profit Dogecoin Foundation is also named as a defendant and is seeking the dismissal of the lawsuit.

Musk’s numerous Twitter posts have prompted multiple lawsuits, including a recent court victory last February, when a San Francisco jury found him not liable for a tweet he sent in August 2018 regarding financing for taking Tesla private.

The case against Musk and others is currently ongoing and is being heard in the U.S. District Court for the Southern District of New York, under the case name Johnson et al v. Musk et al (No. 22-05037).

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://metanews.com/blur-cements-status-as-no-1-nft-marketplace-after-q1-highs/