Following the publication of U.S. unemployment statistics, the price of Bitcoin (BTC) began to rebound from its previous drop. The value of the asset has remained over the significant psychological barrier of $23,000 throughout the entire period as on-chain analytics indicate the recent price surge to continue over the long run.

Bullish On-Chain Metrics

After momentarily exceeding $24,000, the price of Bitcoin (BTC) has lost all of the ground it gained at the beginning of February. However, bulls have successfully defended the $23,000 level, despite the fact that Bitcoin is having difficulty making a rebound to the $24,000 level. The realized Bitcoin price and the realized price for both short-term and long-term holders of Bitcoin, are the on-chain measures that provide a clear sense of whether or not particular cohorts of the market are lucrative or unproductive, respectively.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

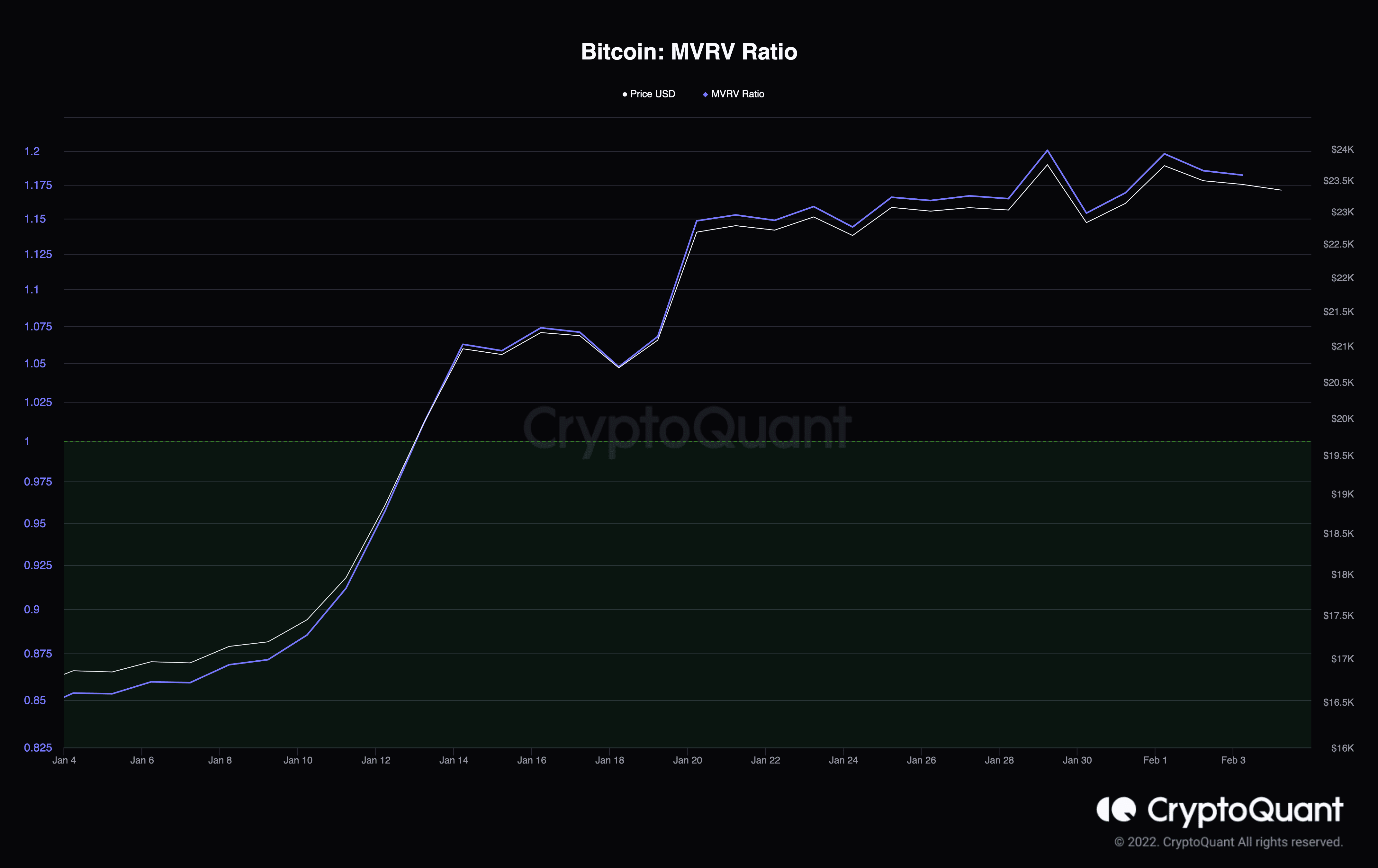

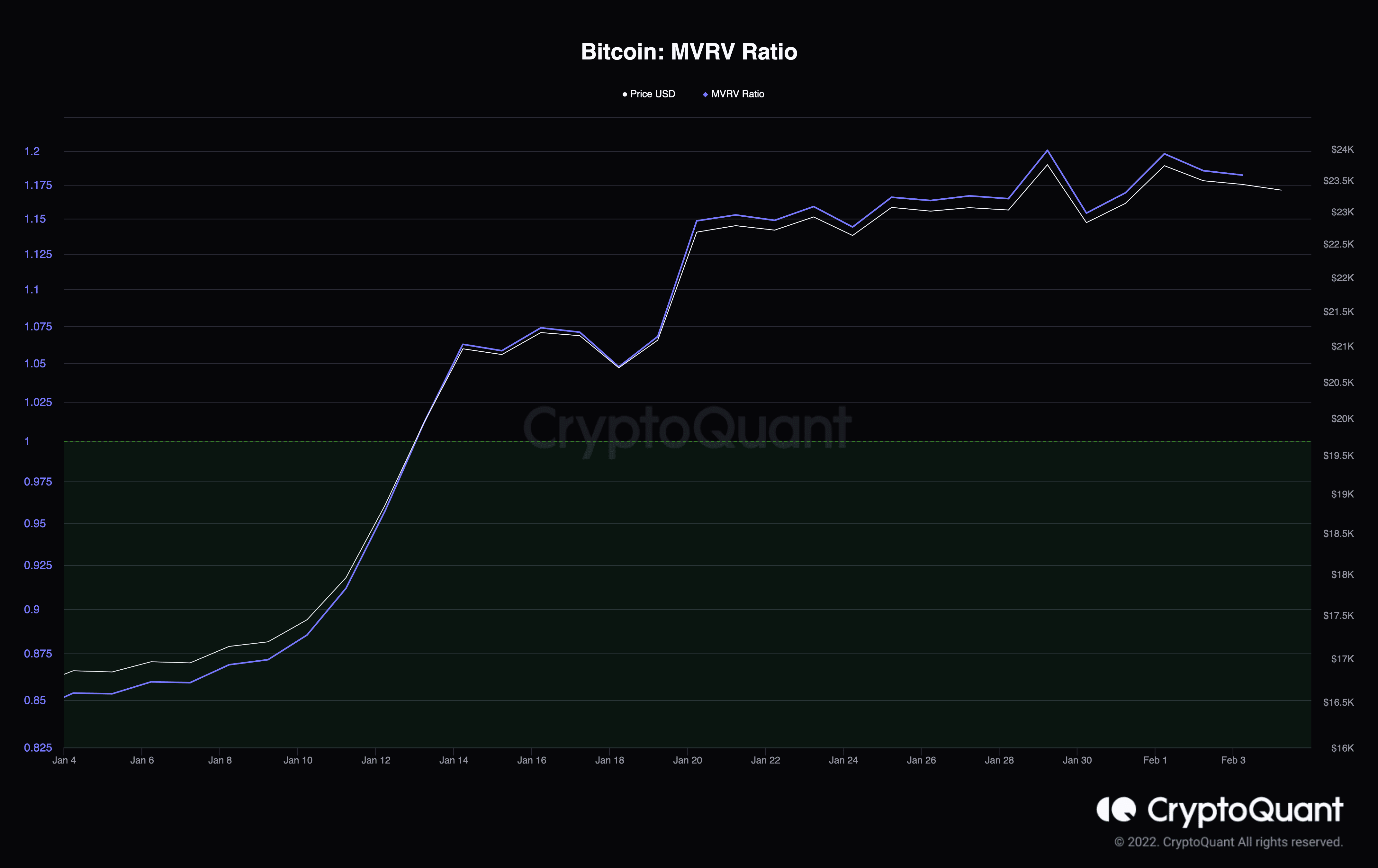

However, market participants in all three categories are no longer in the red now that Bitcoin’s price has risen beyond $23,000. This exemplifies the significance of this level for the many participants in the crypto market. The Bitcoin Market Value to Realized Value (MVRV) indicator is an on-chain indicator that may be used to gain an understanding of when the price is above or below “fair value,” as well as to measure market profitability. The MVRV Ratio is now at 1.18, which is rather near to 1.

Trending Stories

MVRV Ratio below 1 traditionally denotes bear market bottoms and accumulation of smart money. Given that MVRV is at 1.18, this lends credence to the idea that market players are currently accumulating and can potentially see a new local all-time high sometime soon. This has led many to believe, the flagship cryptocurrency’s price to zoom past the $30K price mark with a ceiling at $40K.

Incoming Bitcoin (BTC) Price Dip?

Meanwhile, focusing on monthly timeframes, prominent crypto trader and analyst Rekt Capital, spotted a possible cue for Bitcoin to slump before continuing to move any higher. This was demonstrated by the fact that its Relative Strength Index (RSI) rebounded in January from an all-time low to retake a critical support level. While he did concede that historically, Bitcoin markets haven’t really witnessed double bottoms in RSI, he claimed that there is still a possibility that a higher low might come next.

The same sentiment has been voiced by another crypto pundit Michael van de Poppe as well. According to him, a fall for Bitcoin back to the $20K region is much more plausible and makes “a lot of sense”. Although earlier today, Michael reaffirmed his take on Bitcoin’s bullish outlook of $40k, calling it the “Bitcoin to $35-40K season”.

Theoretically speaking, a correction to $20K makes a lot of sense and would be a great buy opportunity for #Bitcoin.

However, most of the people are waiting for this correction to happen, as a large group is sidelined.

In that regard, continuation upwards is max pain.

— Michaël van de Poppe (@CryptoMichNL) February 4, 2023

As things currently stand, the price of Bitcoin (BTC) moved to $23,444 at the time of composition. And, according to the crypto market tracker published by CoinGape, this results in a growth of 0.33% over the past 24 hours, in contrast to a jump of 2% over the last seven days.

Also Read: Top Whales Are Buying This Crypto Even After Massive 200% Rally

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://coingape.com/bitcoin-btc-price-on-the-brink-of-massive-breakout-to-40k/