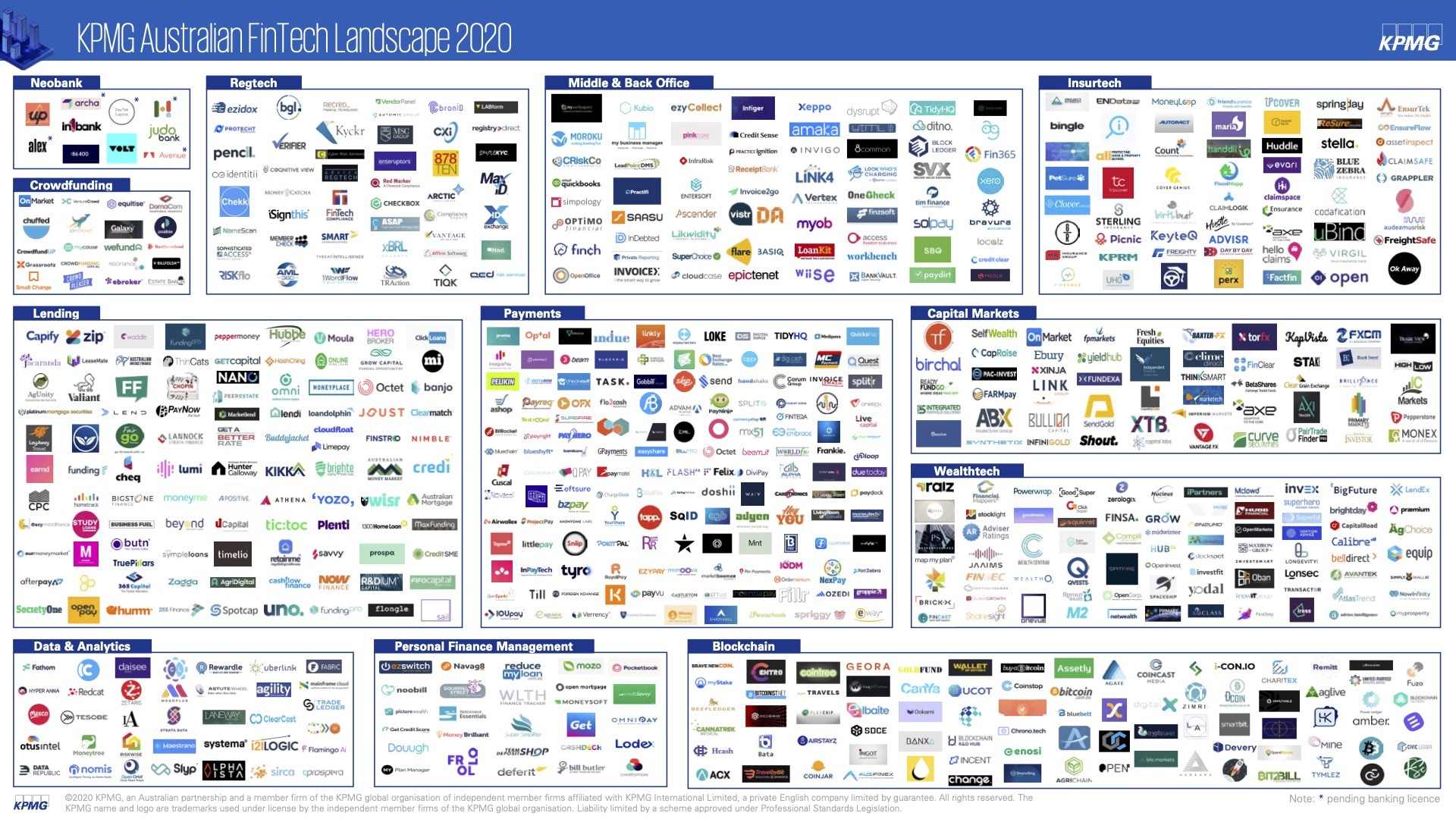

Australia is home to 733 active fintech companies, up from 629 in September 2019, reveals KPMG’s Fintech Landscape 2020 map. This represents an increase of 104 companies that joined the sector between September 2019 and December 2020.

The infographic, released on December 21, 2020, provides a snapshot of the Australian fintech ecosystem, revealing several major trends that have emerged over the past year.

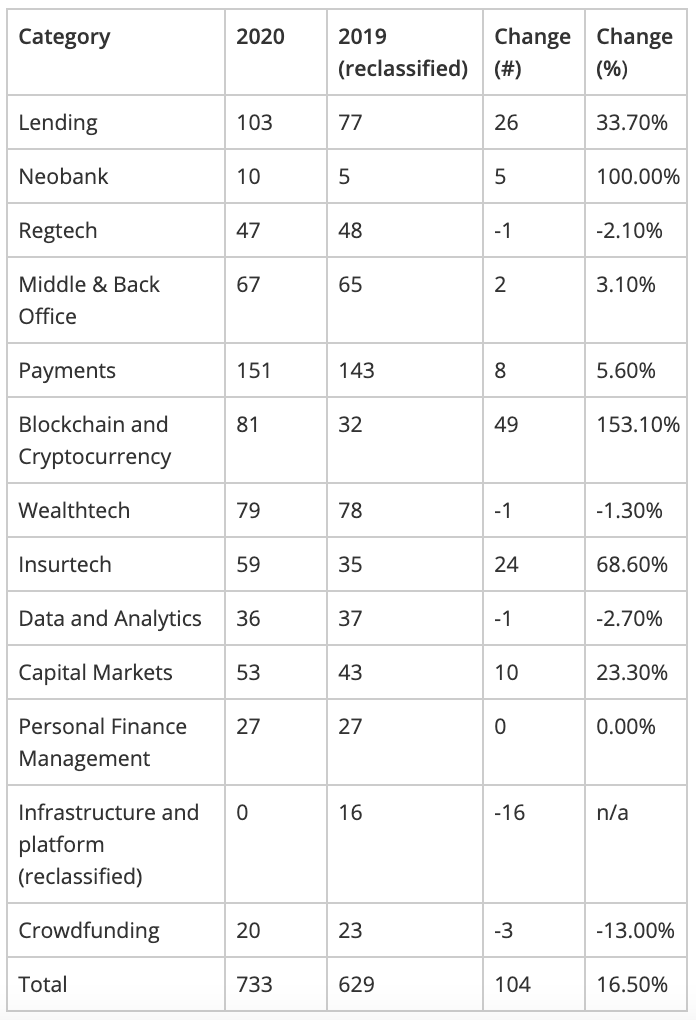

In particular, the blockchain and cryptocurrency segment saw the strongest growth with 49 new companies being established. It’s followed by lending with the addition to 26 companies (some reclassified from the payments category since KPMG’s Fintech Landscape 2019 edition), and insurtech with 24 new companies established.

In 2020, payment maintained its dominance in the Australian fintech industry with 151 companies, up from 143 in 2019. Capital markets saw the addition to ten companies, bringing the total to 53, and neobanking, while remaining small, added five new companies for a total to 10.

Fintech segments that lost players in 2020 include regtech, wealthtech, data and analytics, and crowdfunding.

KPMG Australian fintech landscape changes 2019-2020, via KPMG

Daniel Teper, national fintech lead at KPMG Australia, said in a statement that the Australian fintech industry continued to evolve in 2020 with several companies going through repurposing and recategorization as they changed monetization strategies and business models.

Some categories also saw rationalization and consolidation, a trend that’s expected to continue as the market matures and category winners and losers begin to emerge, he added.

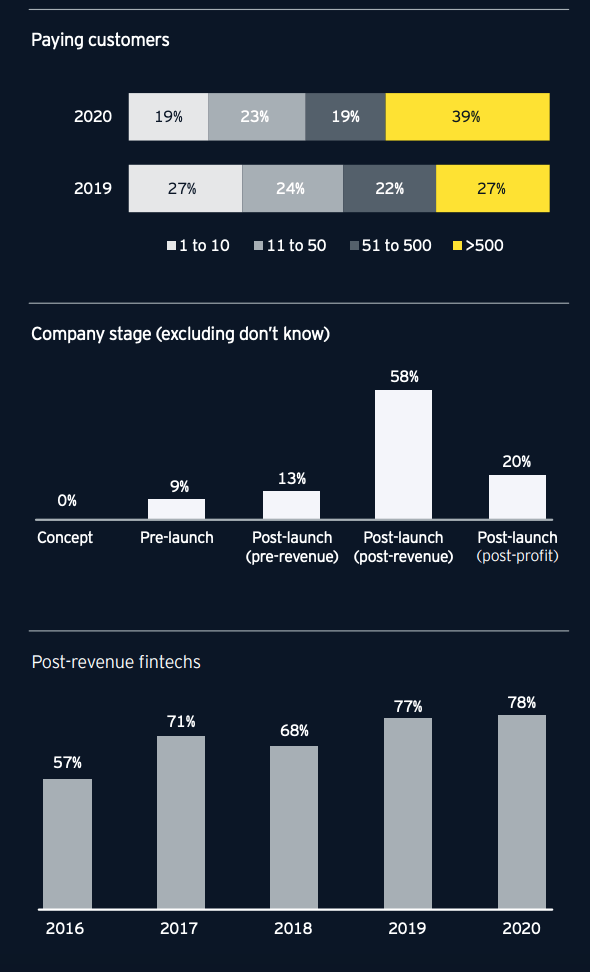

The maturing of Australia’s fintech industry is also evidenced by the rising number of post revenue fintechs. The 2020 EY Fintech Australia Census, released in October 2020, found that out of more than 100 local fintech companies surveyed, 78% were post revenue and 98% had been in operation for two or more years.

The study also found that Australian fintech startups continued to see strong growth in paying customers, with 39% of local fintechs surveyed now having more than 500 paying customers, up from just 27% in 2019.

The Australian fintech industry, Graphs via 2020 EY Fintech Australia Census, EY, Oct 2020

When it comes to overseas expansion, the EY survey found that Australian fintechs have broadened their outlook to include new markets including Ireland (22%), Germany (17%), Indonesia (17%) and the United Arab Emirates (UAE) (17%). Australian fintechs cited the US (56%), New Zealand (54%) and the US (50%) as the top three markets for global expansion.

Fintech investment trends

Investment in Australia’s fintech sector reached US$376.5 million in H1 2020 with the biggest transactions going towards challenger bank Judo Bank and cross-border payment startup Airwallex.

Judo Bank, which provides banking services to small and medium-sized enterprises (SMEs), closed a A$284 million Series D funding round in December 2020 that valued it at about A$1.6 billion. Airwallex, which is originally from Australian but which has since moved its headquartered to Hong Kong, raised a total of A$307 million in its Series D funding round last year.

2020 also saw several fintech exits including non-bank lender Plenti Group, which went public in an initial public offering (IPO) in September 2020.

One major investment trend outlined in KPMG’s annual Pulse of Fintech report is investors’ rising interest in the ‘buy now, and pay later’ (BNPL) or instalment finance sector. This comes at a time when the COVID-19 pandemic is forcing merchants to ramp up their digital capabilities and enhance e-commerce options.

The trend has been evidenced, for example, by China’s bigtech Tencent buying shares in Afterpay, Australia’s leading BNPL firm, as well as the acquisition of US-based BNPL player QuadPay by Australia’s fintech firm Zip.

The growth of the Australian fintech sector over the past year came on the back of policy enhancements and government support. The Federal Budget announcements in early October 2020 unveiled the Digital Business Plan, which includes investment in a Digital ID system, Consumer Data Right (CDR) enhancements, support for fintechs to export financial services, and funding of regtech pilot projects that use blockchain to reduce compliance costs.

Another key development last year was the launch of the first phase of open banking. Open banking is expected to be fully implemented by 2022.

KPMG Australian Fintech Landscape 2020:

The post Australia Saw Over 100 New Fintechs in 2020 as The Sector Matures appeared first on Fintech Singapore.

Checkout PrimeXBT

Source: https://fintechnews.sg/49125/australia/australia-saw-over-100-new-fintechs-in-2020-as-the-sector-matures/